Vat Number In Uae - Uae vat rate is 5%. Trn and vat number connection in the uae, the tax registration number (trn) serves as the vat identification number. Federal tax authorities give tax. However, there are two more categories: Tax registration number or trn is a special number assigned to every company that registers for vat in uae. Value added tax (vat) was introduced in the. Learn how to register for vat (value added tax) and how to file vat returns in the uae.

Tax registration number or trn is a special number assigned to every company that registers for vat in uae. Value added tax (vat) was introduced in the. Learn how to register for vat (value added tax) and how to file vat returns in the uae. Trn and vat number connection in the uae, the tax registration number (trn) serves as the vat identification number. Federal tax authorities give tax. However, there are two more categories: Uae vat rate is 5%.

Value added tax (vat) was introduced in the. Tax registration number or trn is a special number assigned to every company that registers for vat in uae. However, there are two more categories: Federal tax authorities give tax. Uae vat rate is 5%. Trn and vat number connection in the uae, the tax registration number (trn) serves as the vat identification number. Learn how to register for vat (value added tax) and how to file vat returns in the uae.

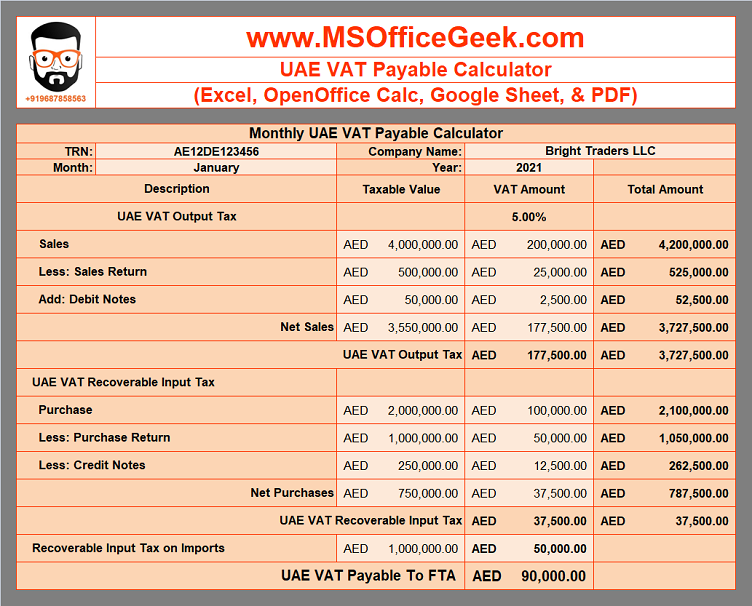

ReadyToUse UAE VAT Payable Calculator Template MSOfficeGeek

However, there are two more categories: Federal tax authorities give tax. Tax registration number or trn is a special number assigned to every company that registers for vat in uae. Value added tax (vat) was introduced in the. Uae vat rate is 5%.

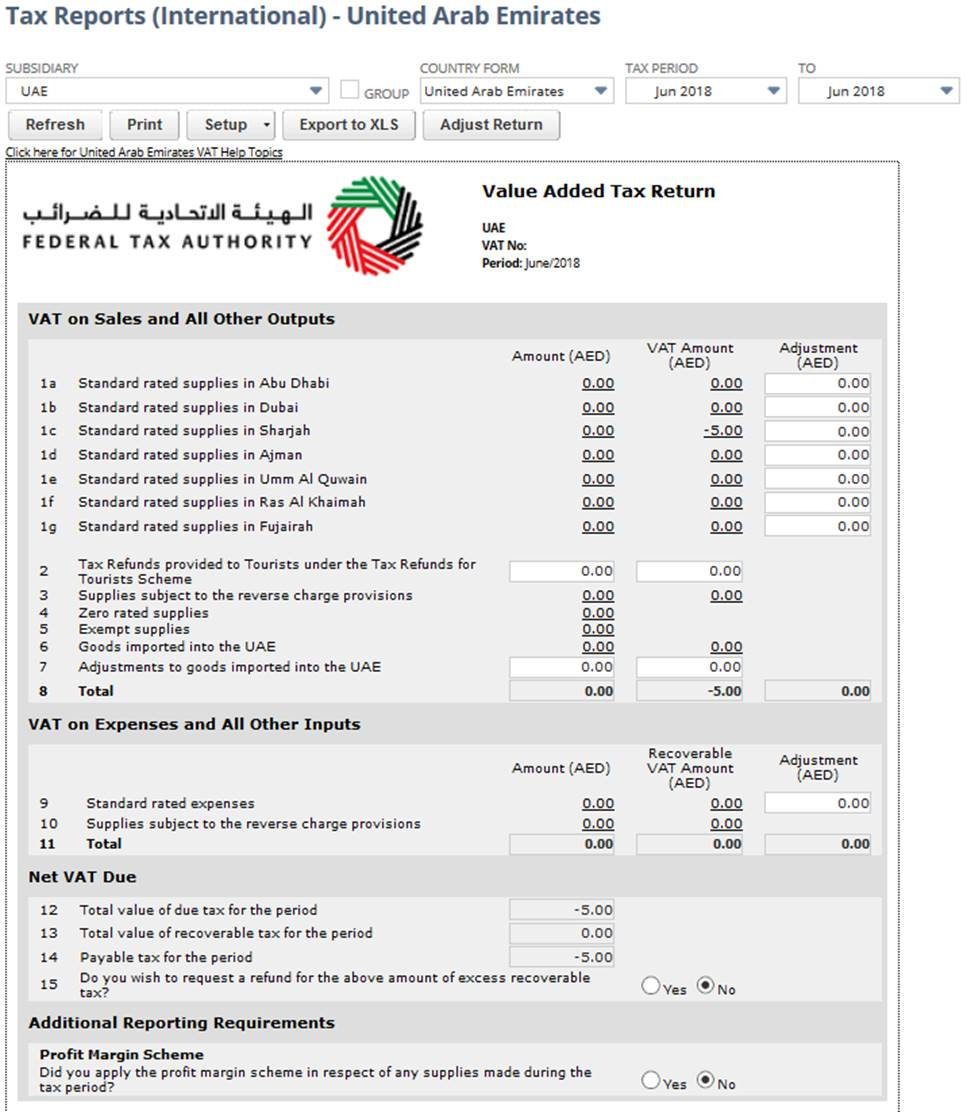

NetSuite Applications Suite United Arab Emirates VAT Report

Trn and vat number connection in the uae, the tax registration number (trn) serves as the vat identification number. Value added tax (vat) was introduced in the. Learn how to register for vat (value added tax) and how to file vat returns in the uae. Tax registration number or trn is a special number assigned to every company that registers.

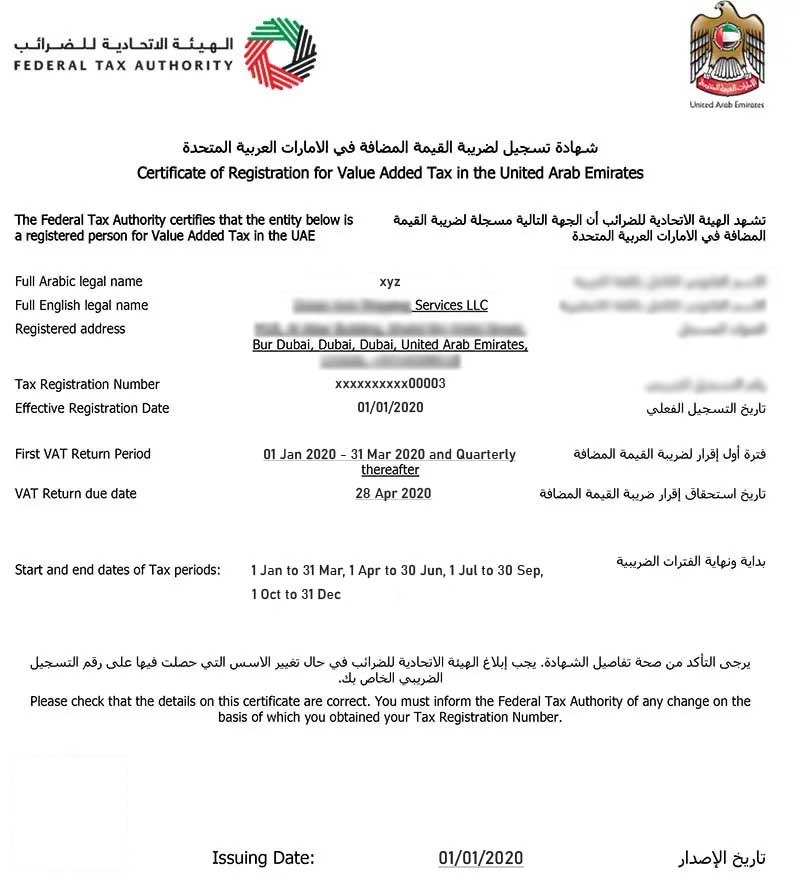

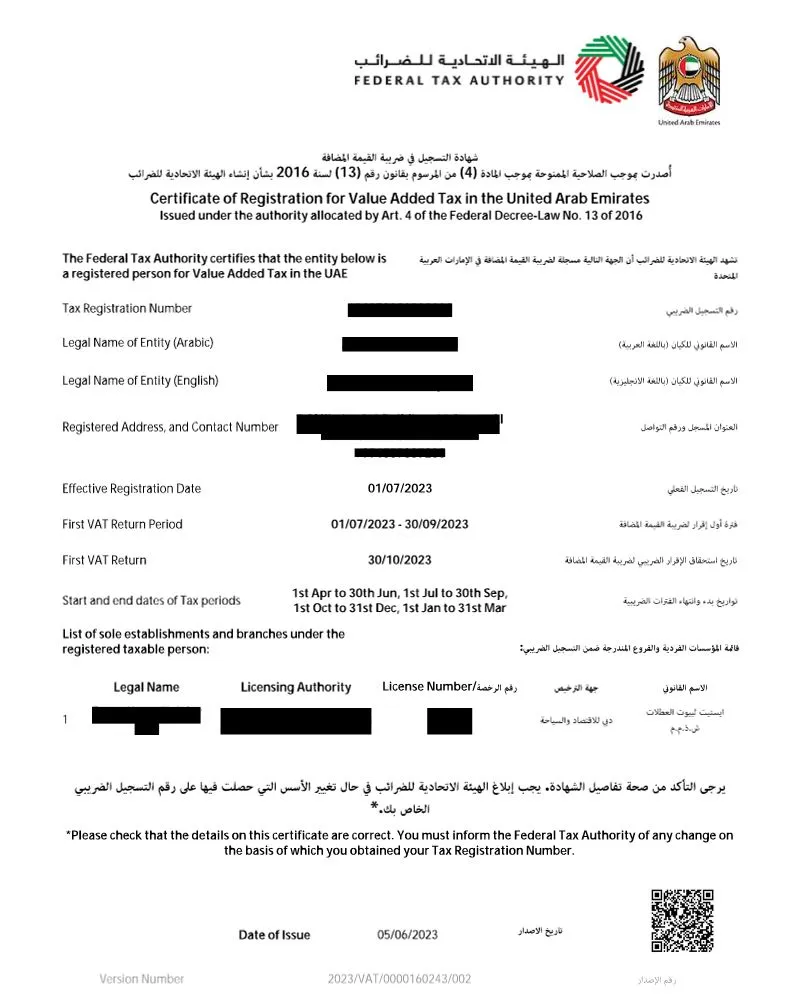

Vat Registration Certificate What Is It And Why Is It

Learn how to register for vat (value added tax) and how to file vat returns in the uae. Value added tax (vat) was introduced in the. Uae vat rate is 5%. However, there are two more categories: Tax registration number or trn is a special number assigned to every company that registers for vat in uae.

How to check vat registration number (trn) in uae

However, there are two more categories: Trn and vat number connection in the uae, the tax registration number (trn) serves as the vat identification number. Learn how to register for vat (value added tax) and how to file vat returns in the uae. Federal tax authorities give tax. Uae vat rate is 5%.

What is the VAT number in the UAE

Learn how to register for vat (value added tax) and how to file vat returns in the uae. However, there are two more categories: Uae vat rate is 5%. Trn and vat number connection in the uae, the tax registration number (trn) serves as the vat identification number. Value added tax (vat) was introduced in the.

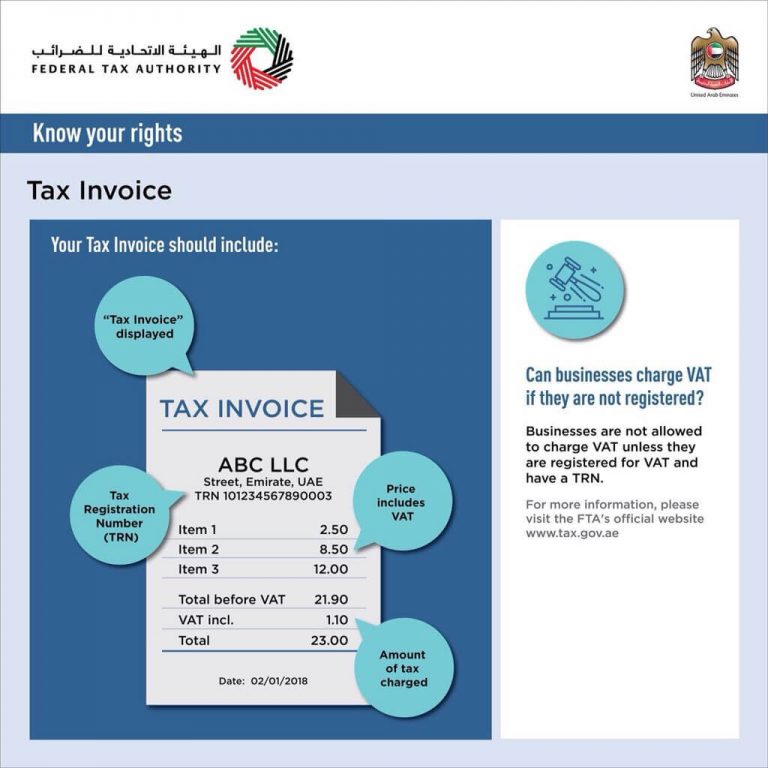

VAT Invoice Format in UAE FTA Tax Invoice Format UAE

Value added tax (vat) was introduced in the. Trn and vat number connection in the uae, the tax registration number (trn) serves as the vat identification number. Learn how to register for vat (value added tax) and how to file vat returns in the uae. Tax registration number or trn is a special number assigned to every company that registers.

Fully Automated UAE VAT Invoice Template MSOfficeGeek

Value added tax (vat) was introduced in the. Federal tax authorities give tax. Trn and vat number connection in the uae, the tax registration number (trn) serves as the vat identification number. Uae vat rate is 5%. However, there are two more categories:

Vat Uae 2025 Viola S Vance

Tax registration number or trn is a special number assigned to every company that registers for vat in uae. Uae vat rate is 5%. Federal tax authorities give tax. Value added tax (vat) was introduced in the. Learn how to register for vat (value added tax) and how to file vat returns in the uae.

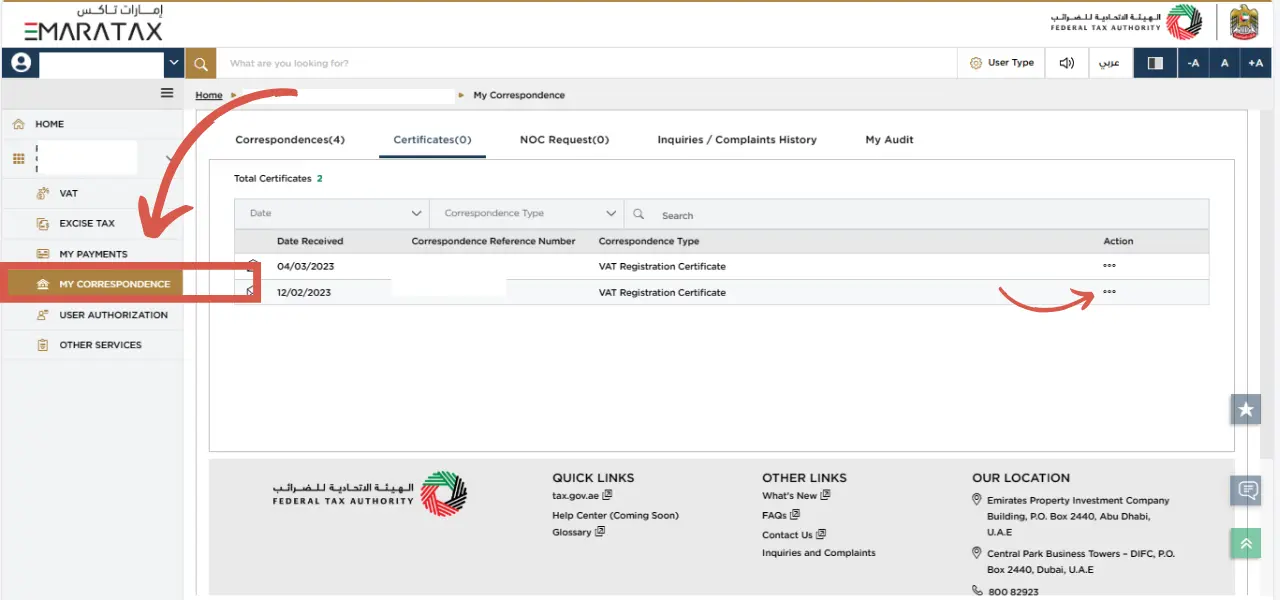

How To Check VAT Certificate Online In UAE

Trn and vat number connection in the uae, the tax registration number (trn) serves as the vat identification number. Value added tax (vat) was introduced in the. Federal tax authorities give tax. Uae vat rate is 5%. However, there are two more categories:

How To Check VAT Certificate Online In UAE

Tax registration number or trn is a special number assigned to every company that registers for vat in uae. However, there are two more categories: Uae vat rate is 5%. Trn and vat number connection in the uae, the tax registration number (trn) serves as the vat identification number. Federal tax authorities give tax.

Tax Registration Number Or Trn Is A Special Number Assigned To Every Company That Registers For Vat In Uae.

Uae vat rate is 5%. Value added tax (vat) was introduced in the. Federal tax authorities give tax. However, there are two more categories:

Trn And Vat Number Connection In The Uae, The Tax Registration Number (Trn) Serves As The Vat Identification Number.

Learn how to register for vat (value added tax) and how to file vat returns in the uae.