Vat Introduced In Uae - The uae government implemented vat to generate revenue for public services such as healthcare,. Understand how vat in uae works — 5% tax rate, who must register (aed 375,000+ turnover), vat exemptions for. Learn how to register for vat (value added tax) and how to file vat returns in the uae. Value added tax (vat) was introduced in the. Understanding the vat framework is. Why was vat introduced in the uae? The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018.

Understanding the vat framework is. Understand how vat in uae works — 5% tax rate, who must register (aed 375,000+ turnover), vat exemptions for. The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. Value added tax (vat) was introduced in the. Learn how to register for vat (value added tax) and how to file vat returns in the uae. Why was vat introduced in the uae? The uae government implemented vat to generate revenue for public services such as healthcare,.

Value added tax (vat) was introduced in the. Learn how to register for vat (value added tax) and how to file vat returns in the uae. The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. The uae government implemented vat to generate revenue for public services such as healthcare,. Understanding the vat framework is. Why was vat introduced in the uae? Understand how vat in uae works — 5% tax rate, who must register (aed 375,000+ turnover), vat exemptions for.

New UAE VAT rules Exemptions for businesses and registration for the 5

Why was vat introduced in the uae? The uae government implemented vat to generate revenue for public services such as healthcare,. Understand how vat in uae works — 5% tax rate, who must register (aed 375,000+ turnover), vat exemptions for. Value added tax (vat) was introduced in the. Learn how to register for vat (value added tax) and how to.

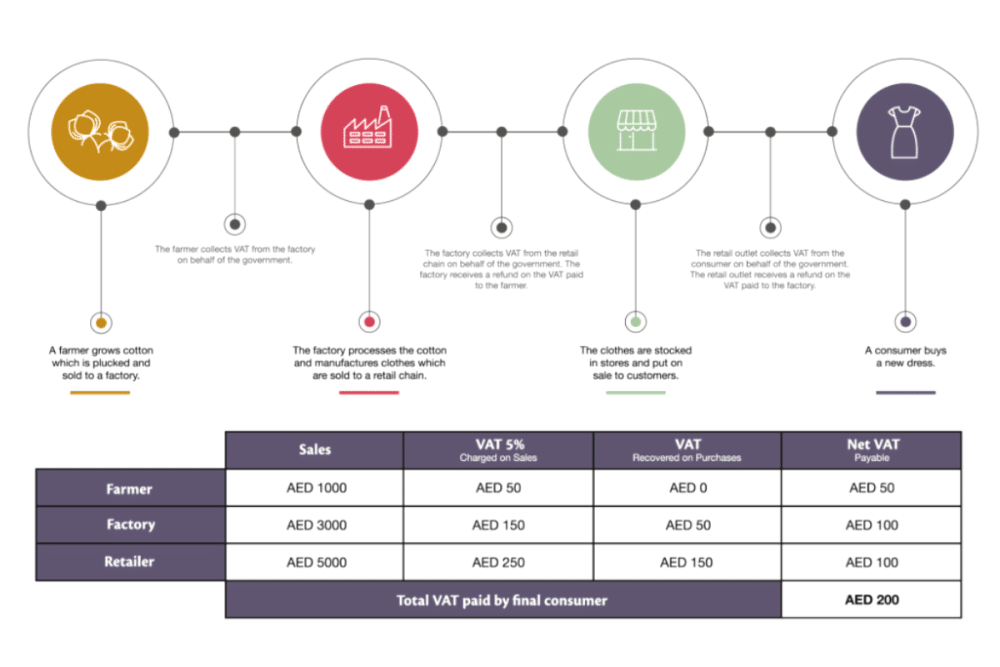

The Basics of VAT As Introduced In the UAE

Learn how to register for vat (value added tax) and how to file vat returns in the uae. The uae government implemented vat to generate revenue for public services such as healthcare,. Understand how vat in uae works — 5% tax rate, who must register (aed 375,000+ turnover), vat exemptions for. Why was vat introduced in the uae? Value added.

VAT in UAE 2024 Federal Tax Authority Everything You Need about

Understanding the vat framework is. Understand how vat in uae works — 5% tax rate, who must register (aed 375,000+ turnover), vat exemptions for. Why was vat introduced in the uae? Value added tax (vat) was introduced in the. Learn how to register for vat (value added tax) and how to file vat returns in the uae.

Uaevatexpert.ae You. Process of Registering VAT Return Filing

The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. The uae government implemented vat to generate revenue for public services such as healthcare,. Why was vat introduced in the uae? Value added tax (vat) was introduced in the. Understand how vat in uae works — 5% tax rate, who must register (aed 375,000+.

VAT In UAE A Comprehensive Guide For 2025

Value added tax (vat) was introduced in the. Understand how vat in uae works — 5% tax rate, who must register (aed 375,000+ turnover), vat exemptions for. Understanding the vat framework is. The uae government implemented vat to generate revenue for public services such as healthcare,. Why was vat introduced in the uae?

Vat Uae 2025 Viola S Vance

The uae government implemented vat to generate revenue for public services such as healthcare,. Value added tax (vat) was introduced in the. The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. Learn how to register for vat (value added tax) and how to file vat returns in the uae. Understand how vat in.

PPT Vat review in UAE PowerPoint Presentation, free download ID

Learn how to register for vat (value added tax) and how to file vat returns in the uae. The uae government implemented vat to generate revenue for public services such as healthcare,. Value added tax (vat) was introduced in the. Understanding the vat framework is. Understand how vat in uae works — 5% tax rate, who must register (aed 375,000+.

Key Points of VAT in UAE for Businesses

Understand how vat in uae works — 5% tax rate, who must register (aed 375,000+ turnover), vat exemptions for. Why was vat introduced in the uae? Value added tax (vat) was introduced in the. The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. Learn how to register for vat (value added tax) and.

A COMPREHENSIVE GUIDE ON UAE VALUE ADDED TAX UAE VAT SIMPLIFIED by CA

The uae government implemented vat to generate revenue for public services such as healthcare,. Understanding the vat framework is. Why was vat introduced in the uae? The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. Value added tax (vat) was introduced in the.

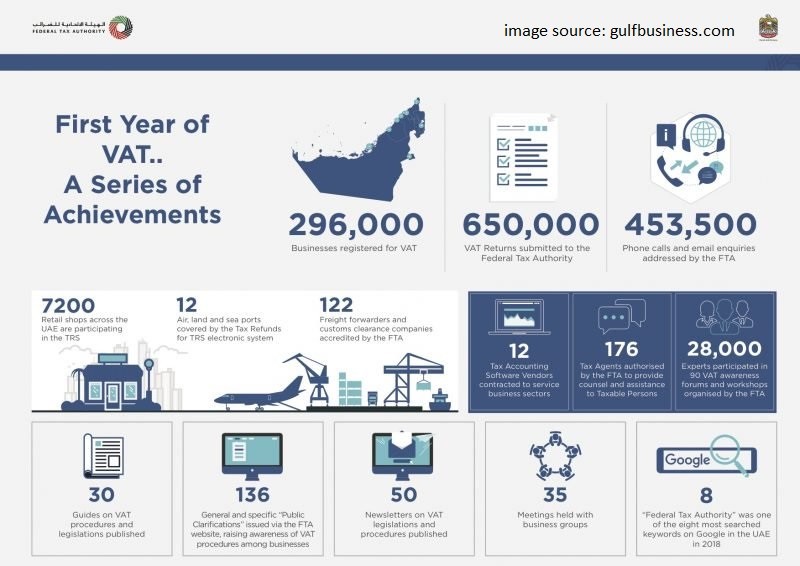

An overview of one year of UAE VAT and its compliance. Acute Consultants

Understanding the vat framework is. Learn how to register for vat (value added tax) and how to file vat returns in the uae. Understand how vat in uae works — 5% tax rate, who must register (aed 375,000+ turnover), vat exemptions for. Value added tax (vat) was introduced in the. The uae government implemented vat to generate revenue for public.

Value Added Tax (Vat) Was Introduced In The.

Understanding the vat framework is. Learn how to register for vat (value added tax) and how to file vat returns in the uae. Understand how vat in uae works — 5% tax rate, who must register (aed 375,000+ turnover), vat exemptions for. Why was vat introduced in the uae?

The Members Of The Gulf Corporation Council (Gcc) Introduced Vat Across The Uae In January 2018.

The uae government implemented vat to generate revenue for public services such as healthcare,.