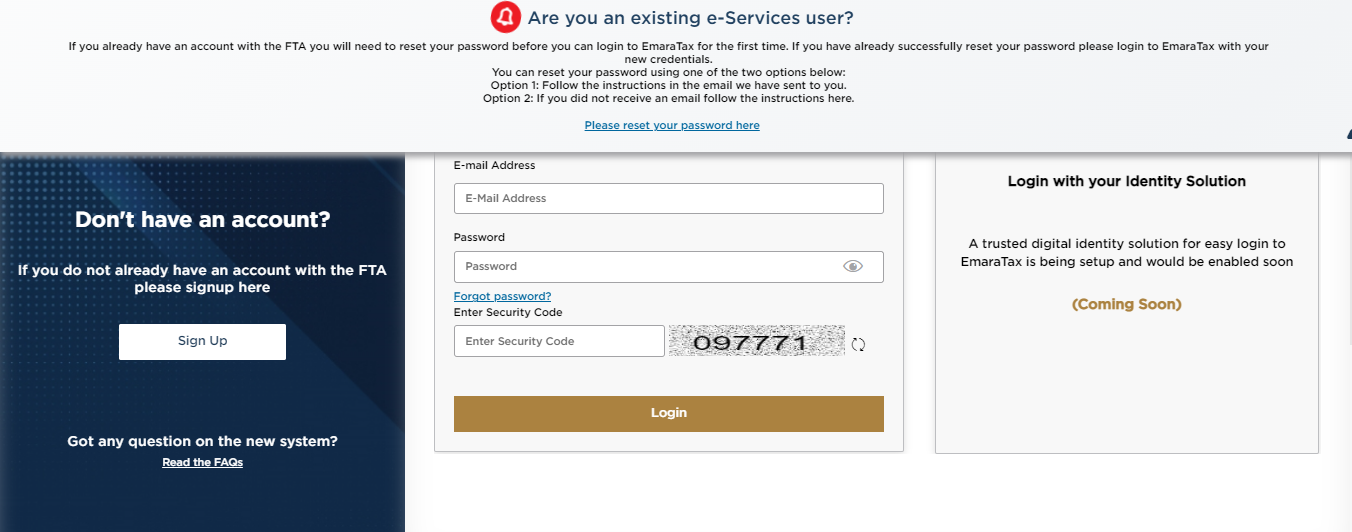

Vat Filing Uae Login - You must file for tax return electronically through the fta portal: Administering, collecting and enforcing federal taxes, applying tax procedures efficiently and effectively, and. How to file vat return? Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. If you are an existing user, please create your account on emarattax using. Please use your emaratax's credentials to login to the trc portal. Maskan smart application for vat refund on newly built residences by uae nationals read more

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Please use your emaratax's credentials to login to the trc portal. How to file vat return? Administering, collecting and enforcing federal taxes, applying tax procedures efficiently and effectively, and. You must file for tax return electronically through the fta portal: If you are an existing user, please create your account on emarattax using. Maskan smart application for vat refund on newly built residences by uae nationals read more

Maskan smart application for vat refund on newly built residences by uae nationals read more If you are an existing user, please create your account on emarattax using. Administering, collecting and enforcing federal taxes, applying tax procedures efficiently and effectively, and. How to file vat return? Please use your emaratax's credentials to login to the trc portal. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must file for tax return electronically through the fta portal:

Filing Vat Return in UAE Vat Return UAE How to file VAT Return in

Administering, collecting and enforcing federal taxes, applying tax procedures efficiently and effectively, and. If you are an existing user, please create your account on emarattax using. Maskan smart application for vat refund on newly built residences by uae nationals read more Please use your emaratax's credentials to login to the trc portal. You must file for tax return electronically through.

How to File VAT Returns in UAE? A stepbystep VAT Returns User Guide

If you are an existing user, please create your account on emarattax using. Maskan smart application for vat refund on newly built residences by uae nationals read more How to file vat return? Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must.

UAE VAT Return Filing Process Explained

How to file vat return? Administering, collecting and enforcing federal taxes, applying tax procedures efficiently and effectively, and. Maskan smart application for vat refund on newly built residences by uae nationals read more Please use your emaratax's credentials to login to the trc portal. If you are an existing user, please create your account on emarattax using.

StepbyStep Guide to Filing VAT Return in UAE

Administering, collecting and enforcing federal taxes, applying tax procedures efficiently and effectively, and. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. If you are an existing user, please create your account on emarattax using. Maskan smart application for vat refund on newly built.

File vat return in UAE 2024

How to file vat return? You must file for tax return electronically through the fta portal: If you are an existing user, please create your account on emarattax using. Maskan smart application for vat refund on newly built residences by uae nationals read more Please use your emaratax's credentials to login to the trc portal.

How to File VAT Return in UAE New EMARA TAX PORTAL YouTube

Maskan smart application for vat refund on newly built residences by uae nationals read more How to file vat return? Administering, collecting and enforcing federal taxes, applying tax procedures efficiently and effectively, and. Please use your emaratax's credentials to login to the trc portal. If you are an existing user, please create your account on emarattax using.

VAT Return Filing in UAE A Detailed Guide Audit Firm in Dubai

If you are an existing user, please create your account on emarattax using. Maskan smart application for vat refund on newly built residences by uae nationals read more Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Administering, collecting and enforcing federal taxes, applying.

How to File VAT Returns in UAE? A stepbystep VAT Returns User Guide

Maskan smart application for vat refund on newly built residences by uae nationals read more If you are an existing user, please create your account on emarattax using. How to file vat return? Administering, collecting and enforcing federal taxes, applying tax procedures efficiently and effectively, and. Once you have registered for vat in the uae, you are required to file.

EmaraTax 2024 A Complete Guide to UAE VAT Registration

Administering, collecting and enforcing federal taxes, applying tax procedures efficiently and effectively, and. Maskan smart application for vat refund on newly built residences by uae nationals read more Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. How to file vat return? Please use.

UAE VAT Return Filing Tips NOKAAF Auditors

Please use your emaratax's credentials to login to the trc portal. Administering, collecting and enforcing federal taxes, applying tax procedures efficiently and effectively, and. You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days..

You Must File For Tax Return Electronically Through The Fta Portal:

Administering, collecting and enforcing federal taxes, applying tax procedures efficiently and effectively, and. Maskan smart application for vat refund on newly built residences by uae nationals read more Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Please use your emaratax's credentials to login to the trc portal.

How To File Vat Return?

If you are an existing user, please create your account on emarattax using.