Vat Filing Process In Uae - You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat. To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. How to file vat return?

Once you have registered for vat in the uae, you are required to file your vat return and make related vat. To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. You must file for tax return electronically through the fta portal: How to file vat return?

Once you have registered for vat in the uae, you are required to file your vat return and make related vat. To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. You must file for tax return electronically through the fta portal: How to file vat return?

A StepByStep Guide On VAT Filing in UAE Tulpar Global Taxation

You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat. To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. How to file vat return?

Vat Filing in UAE 2024, its process and importance

Once you have registered for vat in the uae, you are required to file your vat return and make related vat. You must file for tax return electronically through the fta portal: To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. How to file vat return?

Vat return filing in uae PPT

How to file vat return? To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat.

Expert Finance Management Bookkeeping & Tax Services in UAE

To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. How to file vat return? You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat.

How To Submit VAT Return In UAE Using FTA Portal [2025]

To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. Once you have registered for vat in the uae, you are required to file your vat return and make related vat. How to file vat return? You must file for tax return electronically through the fta portal:

UAE VAT Return Filing Process Explained

To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. Once you have registered for vat in the uae, you are required to file your vat return and make related vat. You must file for tax return electronically through the fta portal: How to file vat return?

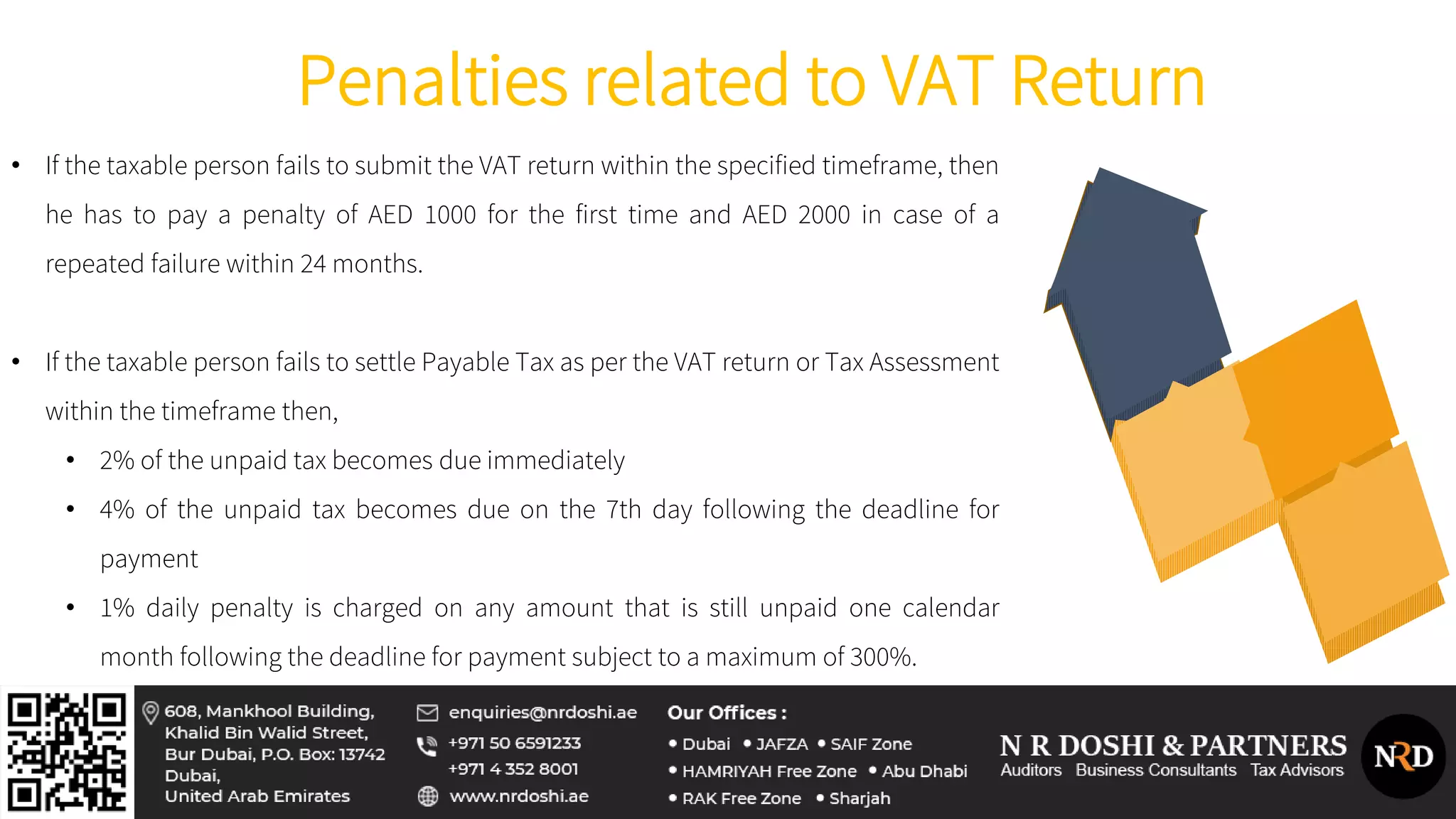

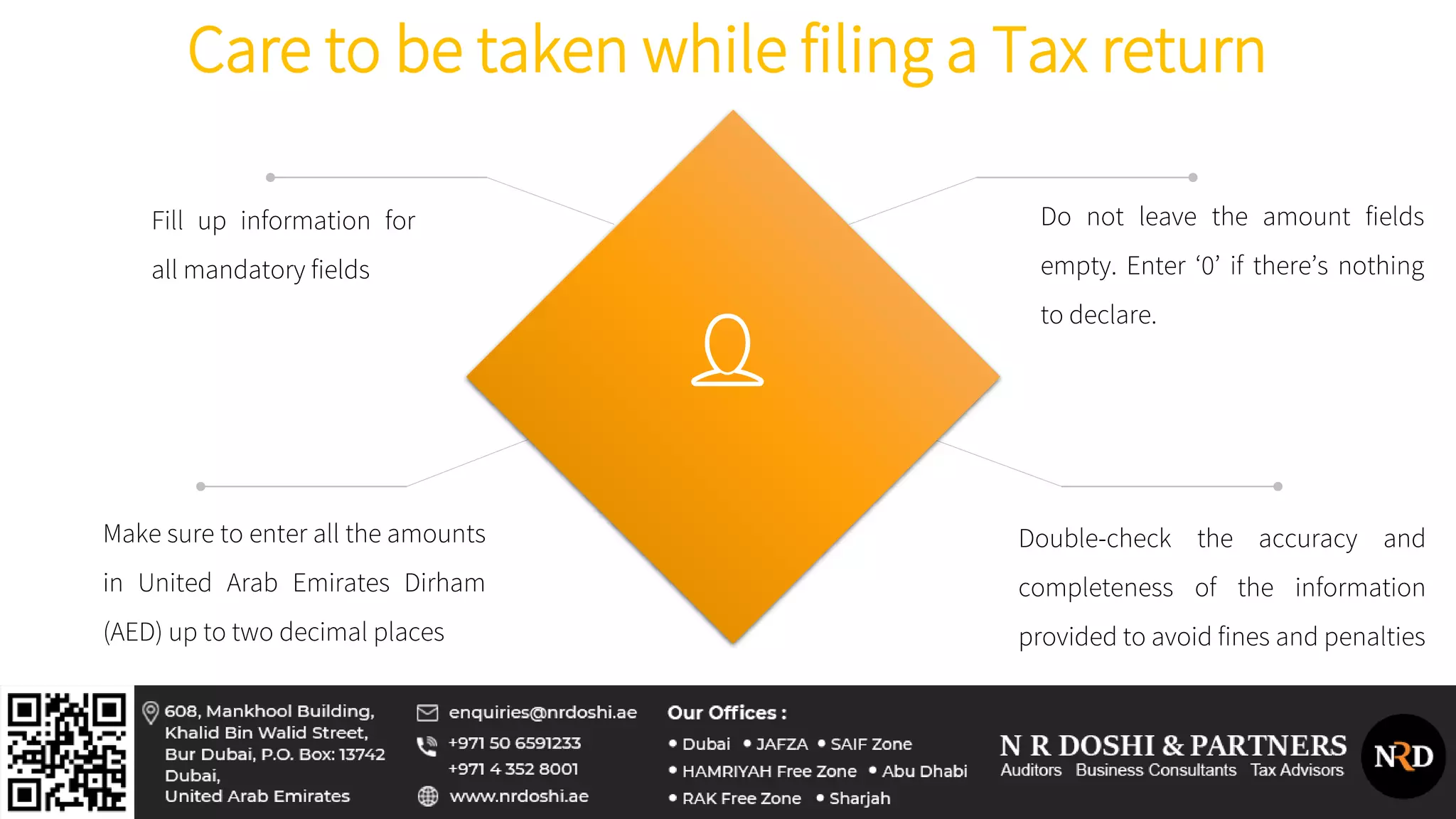

VAT Return Filing Process In The UAE N R Doshi and Partners

You must file for tax return electronically through the fta portal: How to file vat return? To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. Once you have registered for vat in the uae, you are required to file your vat return and make related vat.

StepbyStep Guide to Filing VAT Return in UAE

To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. You must file for tax return electronically through the fta portal: How to file vat return? Once you have registered for vat in the uae, you are required to file your vat return and make related vat.

Vat return filing in uae PPT

How to file vat return? You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat. To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes.

How to File a VAT Return in the UAE

To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. How to file vat return? Once you have registered for vat in the uae, you are required to file your vat return and make related vat. You must file for tax return electronically through the fta portal:

You Must File For Tax Return Electronically Through The Fta Portal:

How to file vat return? Once you have registered for vat in the uae, you are required to file your vat return and make related vat. To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes.

![How To Submit VAT Return In UAE Using FTA Portal [2025]](https://nowconsultant.com/wp-content/uploads/2023/11/VAT-Return-Filing-Process-_1_.webp)