Us Forest Service Tax Exempt Form - Eforms allows you to search for and complete forms requesting services from farm service agency (fsa), natural conservation service. Generally, all income received is taxable unless explicitly excluded by tax law, and nothing is deductible unless a provision allows it. The irs has approved that the forest health protection cost share program is eligible for income exclusion under section 126 of the. Starting in the 2025 tax year, reported tips up to $25,000 per person annually are exempt from federal income tax. If you need a form that is not section 508. Usda is actively working to make all of its publicly available forms section 508 accessible. A separate exemption certificate is required for each occupancy and for each representative. Continuing education for natural resource. Home managing the land private land forest taxation and estate planning tax policy

Continuing education for natural resource. Usda is actively working to make all of its publicly available forms section 508 accessible. Generally, all income received is taxable unless explicitly excluded by tax law, and nothing is deductible unless a provision allows it. Eforms allows you to search for and complete forms requesting services from farm service agency (fsa), natural conservation service. If you need a form that is not section 508. Starting in the 2025 tax year, reported tips up to $25,000 per person annually are exempt from federal income tax. A separate exemption certificate is required for each occupancy and for each representative. Home managing the land private land forest taxation and estate planning tax policy The irs has approved that the forest health protection cost share program is eligible for income exclusion under section 126 of the.

Home managing the land private land forest taxation and estate planning tax policy Usda is actively working to make all of its publicly available forms section 508 accessible. A separate exemption certificate is required for each occupancy and for each representative. Generally, all income received is taxable unless explicitly excluded by tax law, and nothing is deductible unless a provision allows it. Continuing education for natural resource. If you need a form that is not section 508. The irs has approved that the forest health protection cost share program is eligible for income exclusion under section 126 of the. Eforms allows you to search for and complete forms requesting services from farm service agency (fsa), natural conservation service. Starting in the 2025 tax year, reported tips up to $25,000 per person annually are exempt from federal income tax.

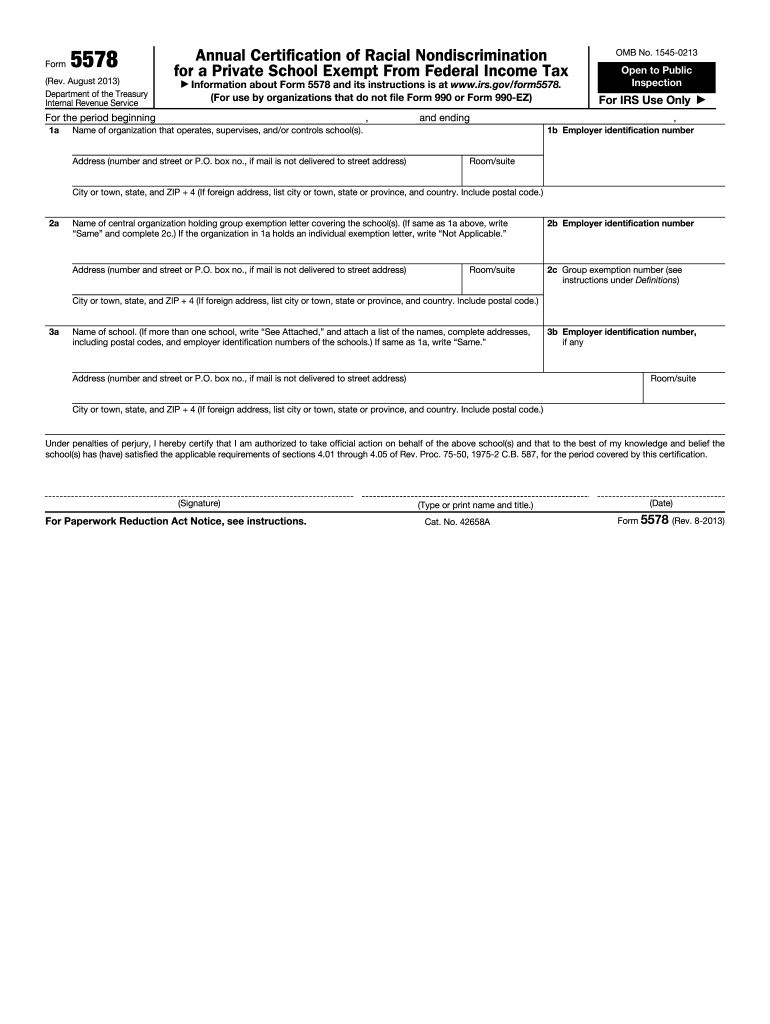

Are You Ready Big Changes To The 2020 Federal W 4 Withholding Form

If you need a form that is not section 508. Home managing the land private land forest taxation and estate planning tax policy Generally, all income received is taxable unless explicitly excluded by tax law, and nothing is deductible unless a provision allows it. Usda is actively working to make all of its publicly available forms section 508 accessible. Eforms.

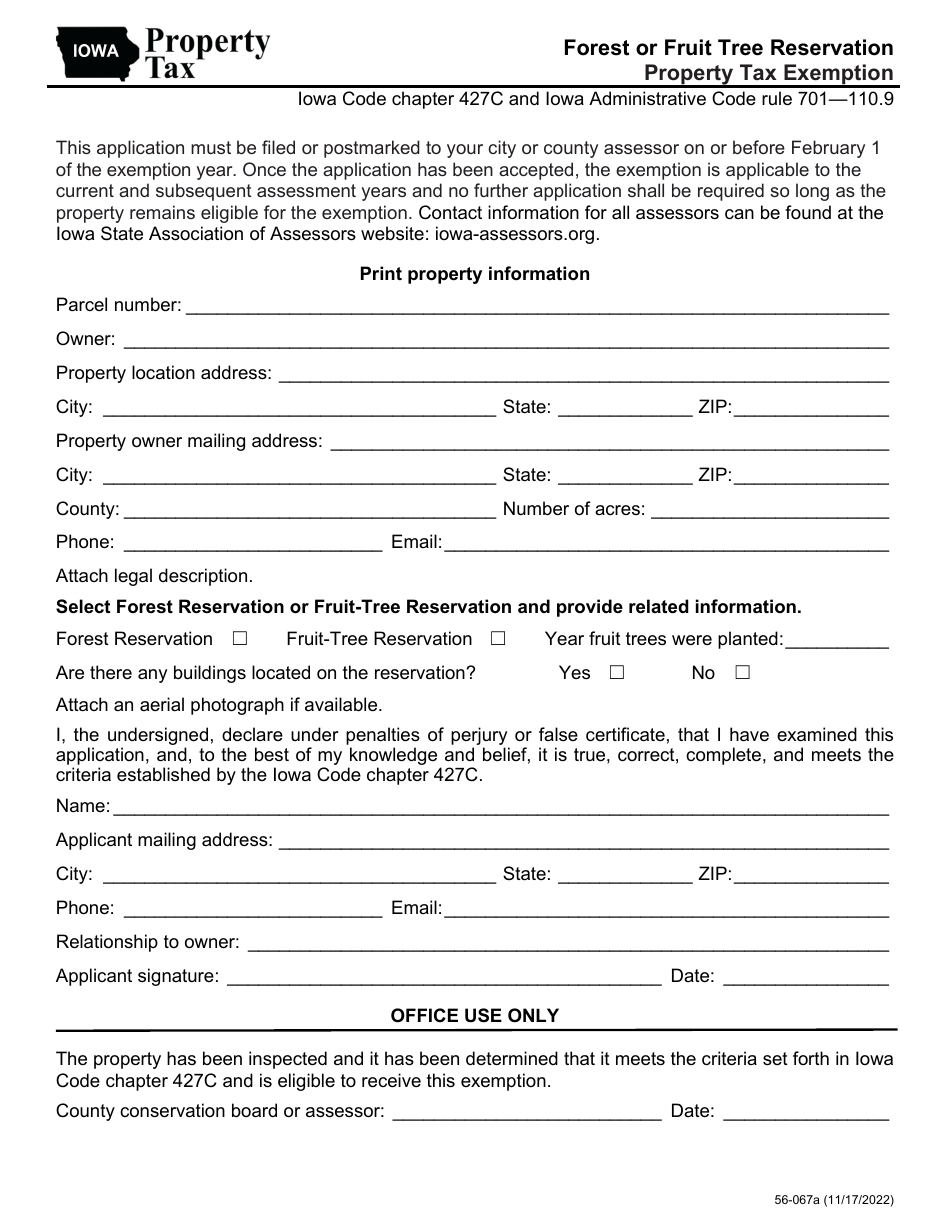

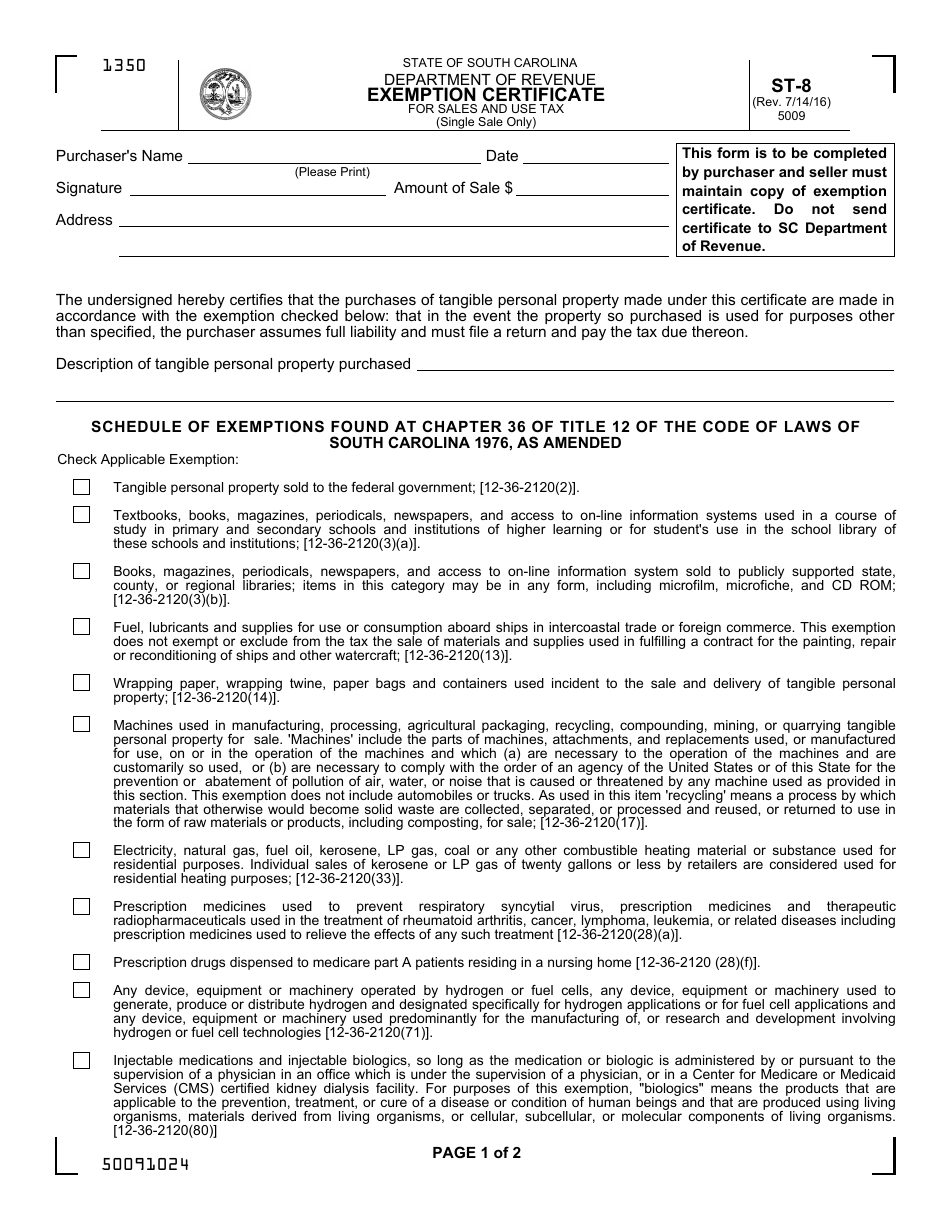

Form 56067 Download Fillable PDF or Fill Online Forest or Fruit Tree

Starting in the 2025 tax year, reported tips up to $25,000 per person annually are exempt from federal income tax. Eforms allows you to search for and complete forms requesting services from farm service agency (fsa), natural conservation service. Home managing the land private land forest taxation and estate planning tax policy A separate exemption certificate is required for each.

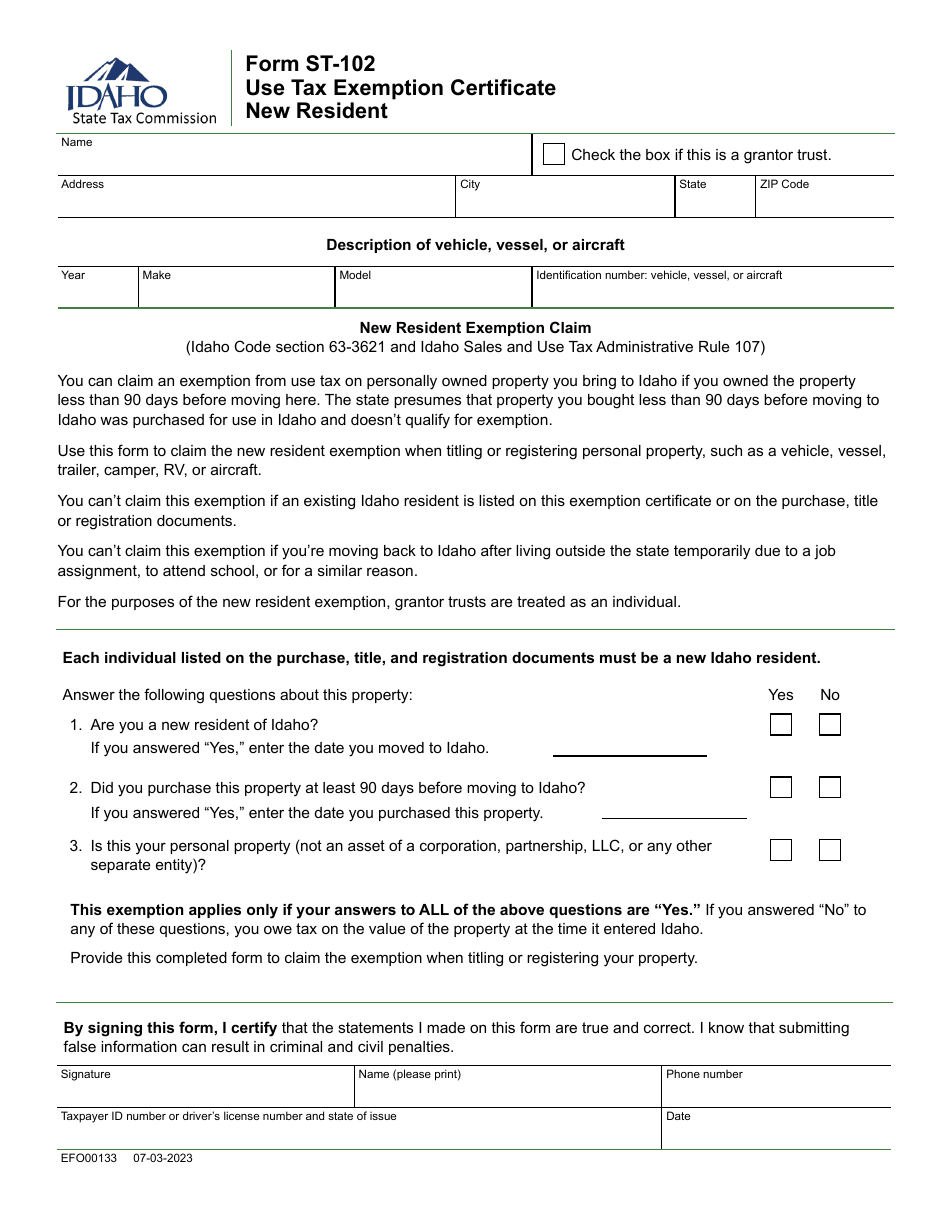

Form ST102 (EFO00133) Fill Out, Sign Online and Download Fillable

Home managing the land private land forest taxation and estate planning tax policy Continuing education for natural resource. Eforms allows you to search for and complete forms requesting services from farm service agency (fsa), natural conservation service. A separate exemption certificate is required for each occupancy and for each representative. If you need a form that is not section 508.

ATF eForm 1 FINAL RULE Tax Exempt Approved "Tax Stamp" Example

If you need a form that is not section 508. Starting in the 2025 tax year, reported tips up to $25,000 per person annually are exempt from federal income tax. A separate exemption certificate is required for each occupancy and for each representative. Home managing the land private land forest taxation and estate planning tax policy Continuing education for natural.

Printable Tax Exempt Form

Continuing education for natural resource. A separate exemption certificate is required for each occupancy and for each representative. Home managing the land private land forest taxation and estate planning tax policy Usda is actively working to make all of its publicly available forms section 508 accessible. Starting in the 2025 tax year, reported tips up to $25,000 per person annually.

Forms Texas Crushed Stone Co.

Starting in the 2025 tax year, reported tips up to $25,000 per person annually are exempt from federal income tax. Eforms allows you to search for and complete forms requesting services from farm service agency (fsa), natural conservation service. Usda is actively working to make all of its publicly available forms section 508 accessible. Generally, all income received is taxable.

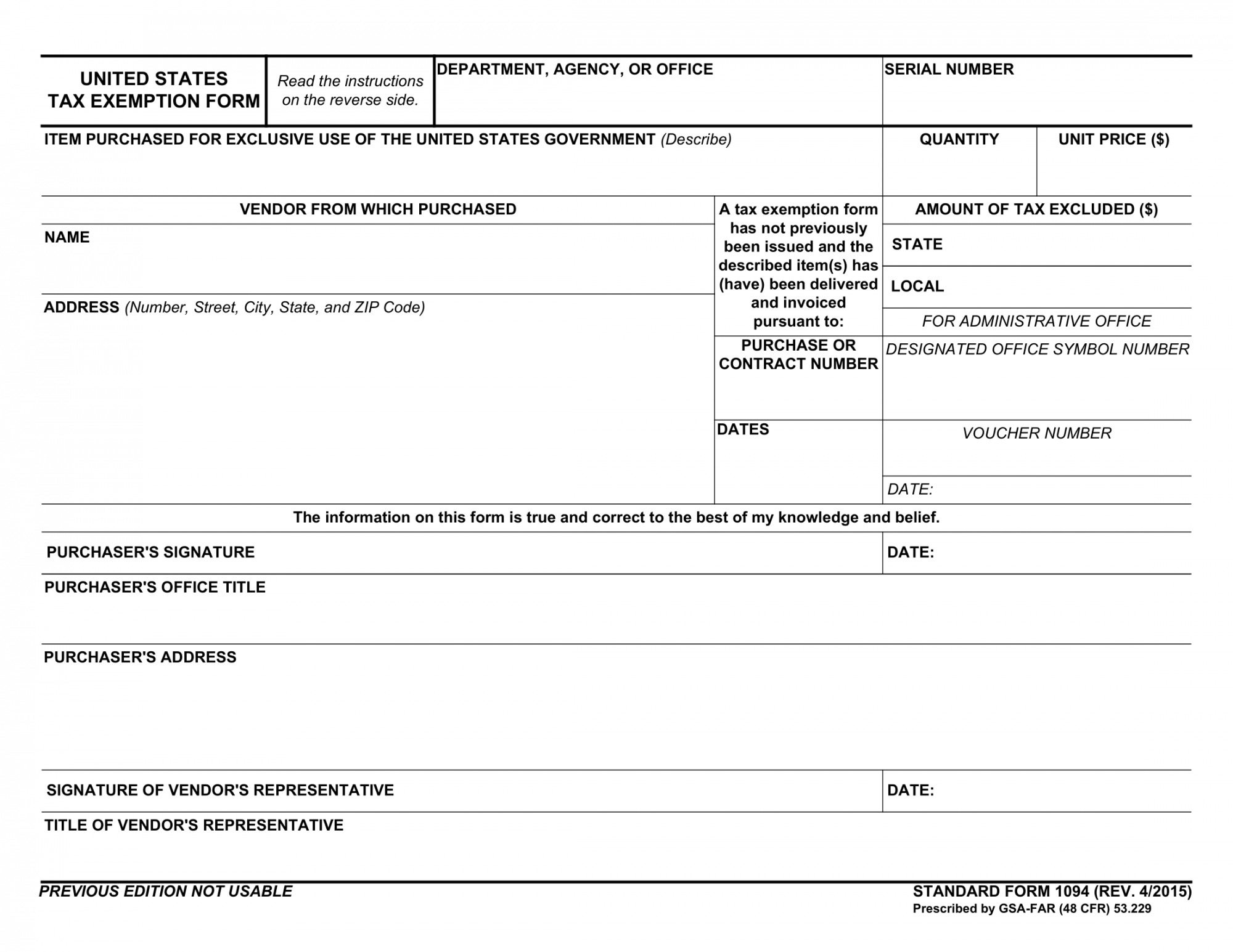

SF 1094. The United States Tax Exemption Form Forms Docs 2023

Home managing the land private land forest taxation and estate planning tax policy Continuing education for natural resource. Usda is actively working to make all of its publicly available forms section 508 accessible. Eforms allows you to search for and complete forms requesting services from farm service agency (fsa), natural conservation service. A separate exemption certificate is required for each.

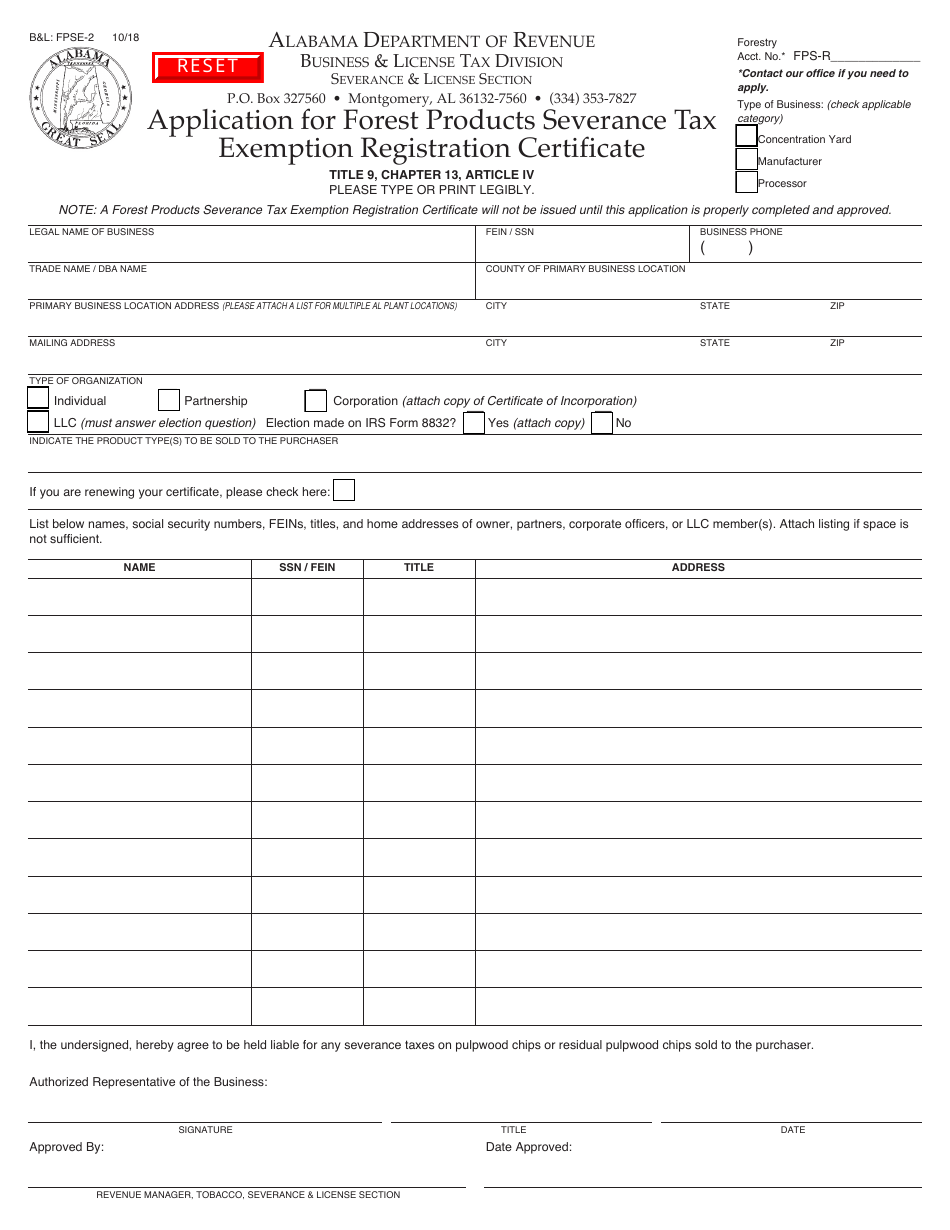

Form B&L FPSE2 Fill Out, Sign Online and Download Fillable PDF

Usda is actively working to make all of its publicly available forms section 508 accessible. The irs has approved that the forest health protection cost share program is eligible for income exclusion under section 126 of the. Starting in the 2025 tax year, reported tips up to $25,000 per person annually are exempt from federal income tax. Eforms allows you.

Printable Tax Exempt Form

A separate exemption certificate is required for each occupancy and for each representative. Home managing the land private land forest taxation and estate planning tax policy Eforms allows you to search for and complete forms requesting services from farm service agency (fsa), natural conservation service. Usda is actively working to make all of its publicly available forms section 508 accessible..

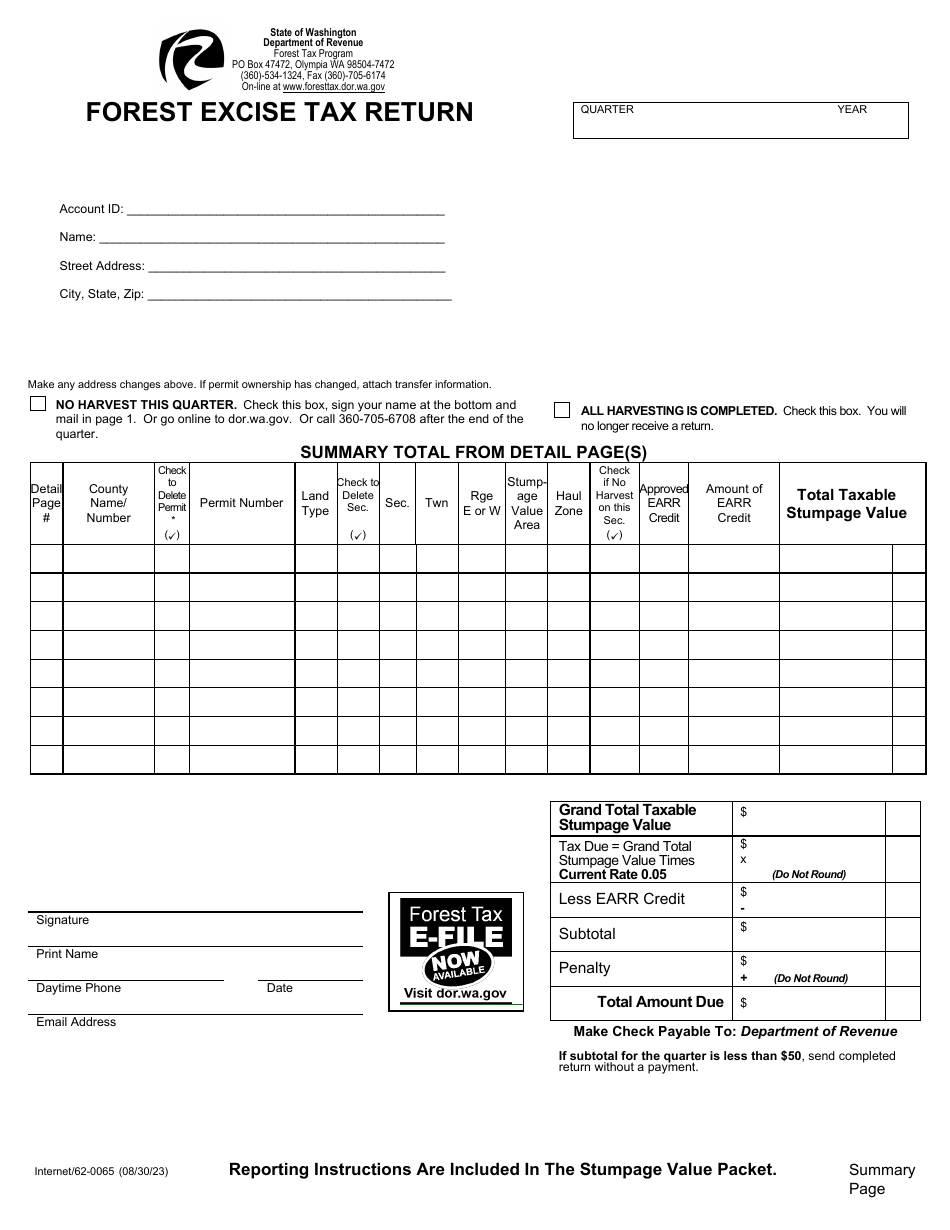

Washington Public Harvester Forest Excise Tax Return Download Printable

Continuing education for natural resource. Eforms allows you to search for and complete forms requesting services from farm service agency (fsa), natural conservation service. A separate exemption certificate is required for each occupancy and for each representative. Generally, all income received is taxable unless explicitly excluded by tax law, and nothing is deductible unless a provision allows it. Usda is.

Usda Is Actively Working To Make All Of Its Publicly Available Forms Section 508 Accessible.

The irs has approved that the forest health protection cost share program is eligible for income exclusion under section 126 of the. A separate exemption certificate is required for each occupancy and for each representative. Starting in the 2025 tax year, reported tips up to $25,000 per person annually are exempt from federal income tax. Home managing the land private land forest taxation and estate planning tax policy

Eforms Allows You To Search For And Complete Forms Requesting Services From Farm Service Agency (Fsa), Natural Conservation Service.

Generally, all income received is taxable unless explicitly excluded by tax law, and nothing is deductible unless a provision allows it. Continuing education for natural resource. If you need a form that is not section 508.