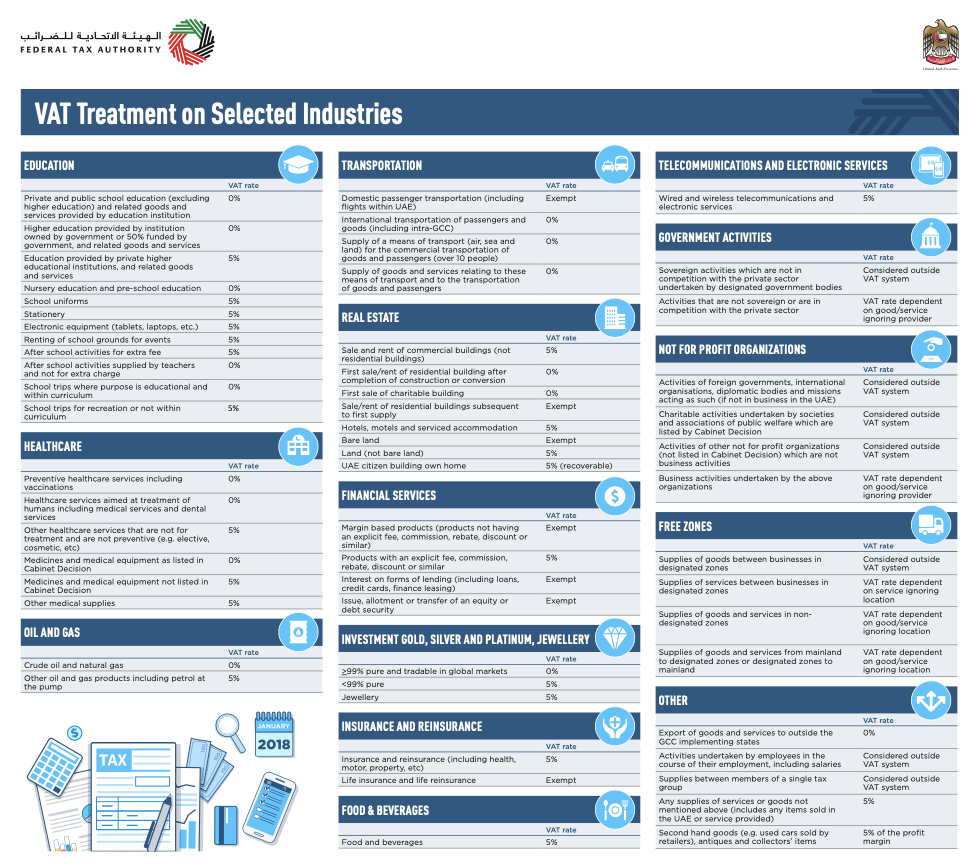

Uae Vat Guide Pdf - This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. Overview of vat what is vat? Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger.

Overview of vat what is vat? (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger.

Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. Overview of vat what is vat? This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter.

A COMPREHENSIVE GUIDE ON UAE VALUE ADDED TAX UAE VAT SIMPLIFIED by CA

Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it.

Guide to UAE VAT Registration & Eligibility

If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. Overview of vat what is vat? (uae) vat on imports is payable on reverse.

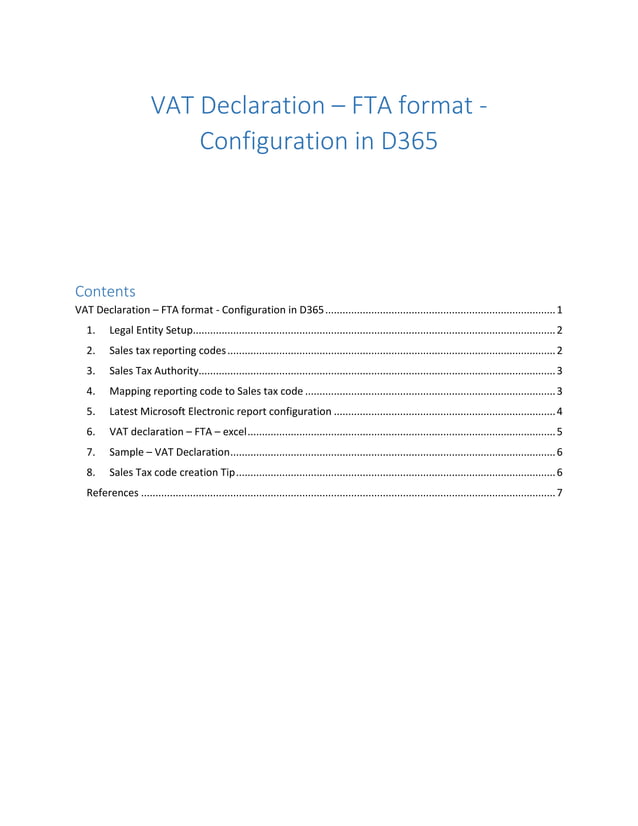

UAE FTA Vat declaration config guide PDF

Overview of vat what is vat? Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. All countries that enjoy full membership of the cooperation council for.

UAE Comprehensive VAT Guide PDF Value Added Tax Taxes

Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during..

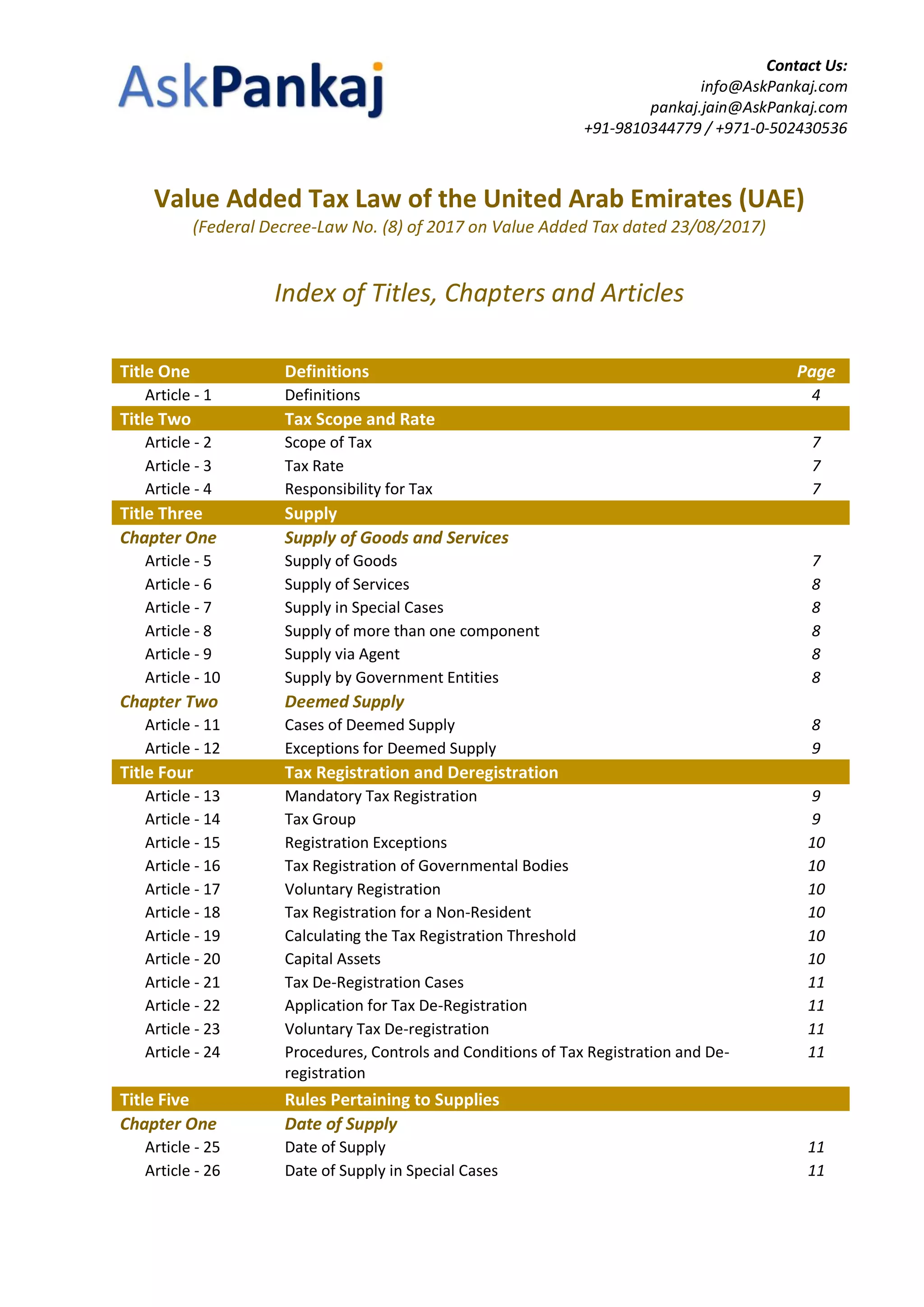

AskPankaj Value Added Tax (VAT) law of the United Arab Emirates (UAE

All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with.

UAE VAT and VAT Reports A Complete Guide

Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1..

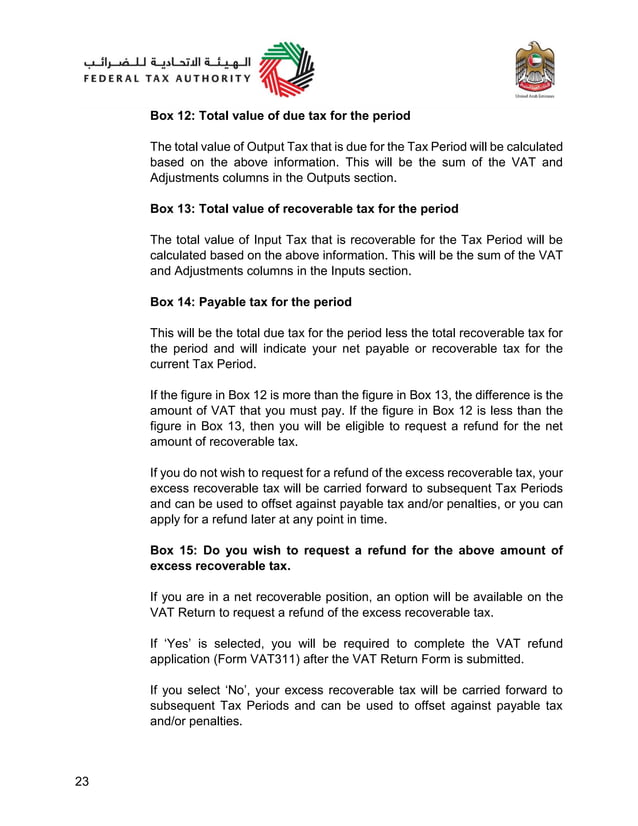

UAE VAT Returns Guide in English PDF

This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. All countries that enjoy full membership of the cooperation council for the arab states of the gulf.

Uae Vat Return Hoe To File? PDF Value Added Tax Customs

This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. Overview of vat what is vat? (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. Broadly, vat exemptions in uae are given for certain financial services, residential building, and.

UAE VAT Returns Guide in English PDF

(uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with.

uaevatguide PDF Value Added Tax Goods

All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. If you are registered for vat and any circumstances occur that will impact your tax records.

This Guide Is An Overview Of The Uae’s Value Added Tax (“Vat”) System, Focused On How It Affects Foreign Businesses Trading With Uae.

(uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. Overview of vat what is vat? Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger.