Software Expense In Accounting - Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed.

Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed.

Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity.

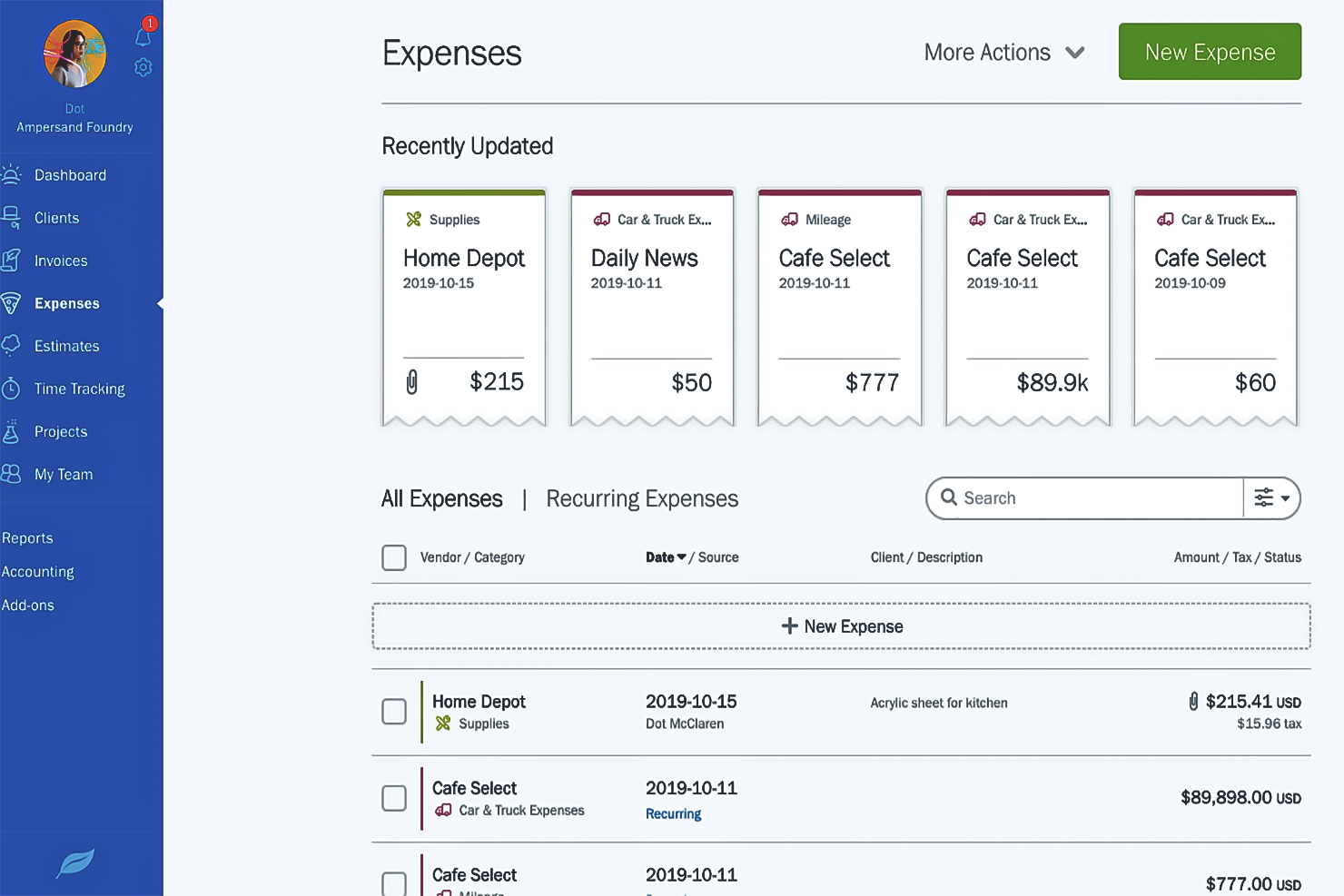

20 Best Expense Reporting Software of 2023 Reviewed & Compared

Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize.

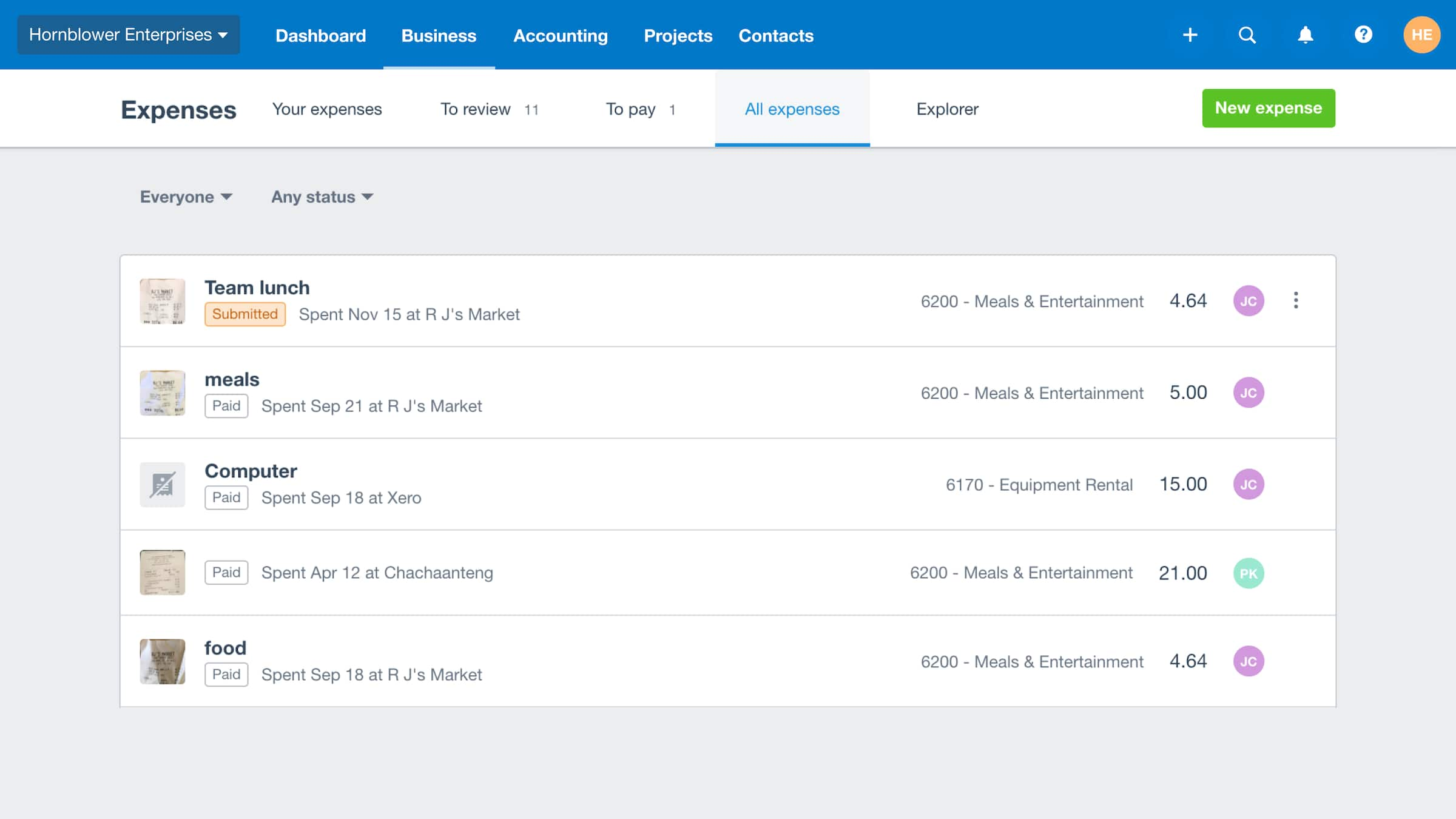

Track and Manage Expense Claims Expenses App Xero PH

Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize.

Best Expense Management Software in 2024

Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize.

Ledgers Accounting Software Free Download 📒📲

Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed.

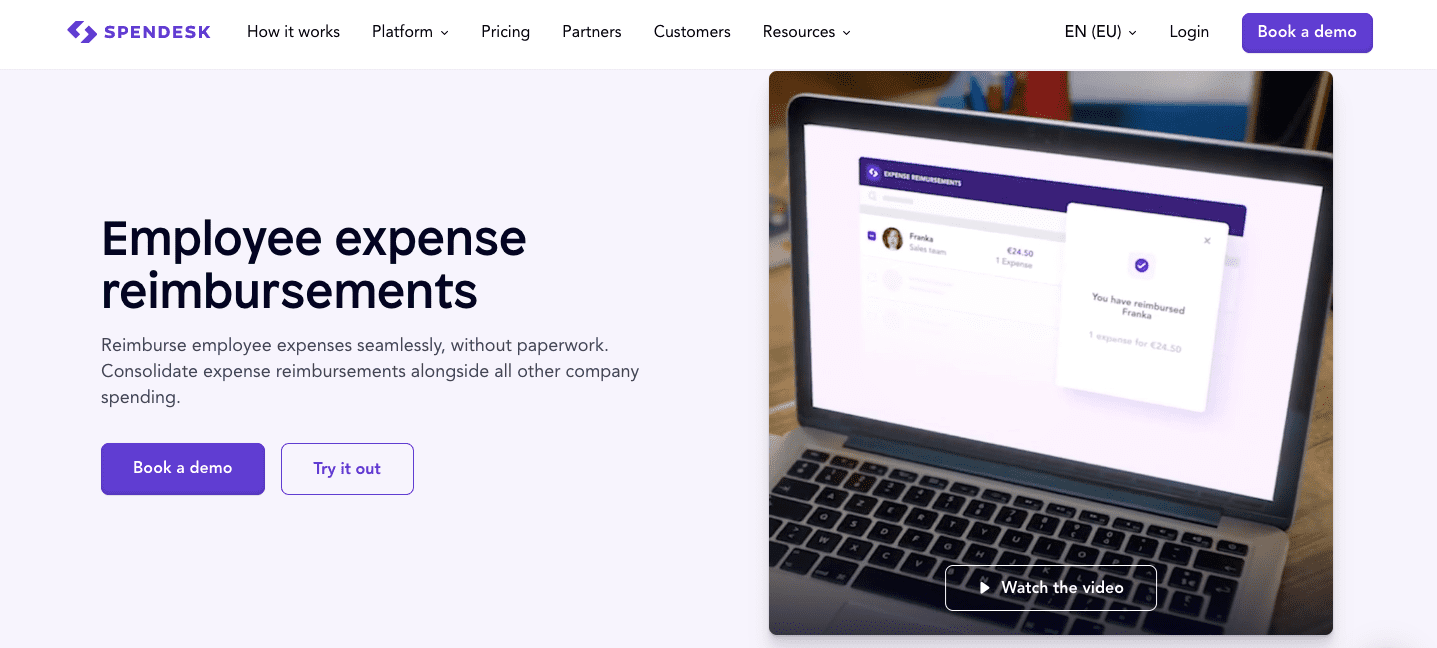

10 Best Expense Reimbursement Software & Systems 2023 2024

Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity.

What is Expense Tracking? How Will it Help Your Business?

Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed.

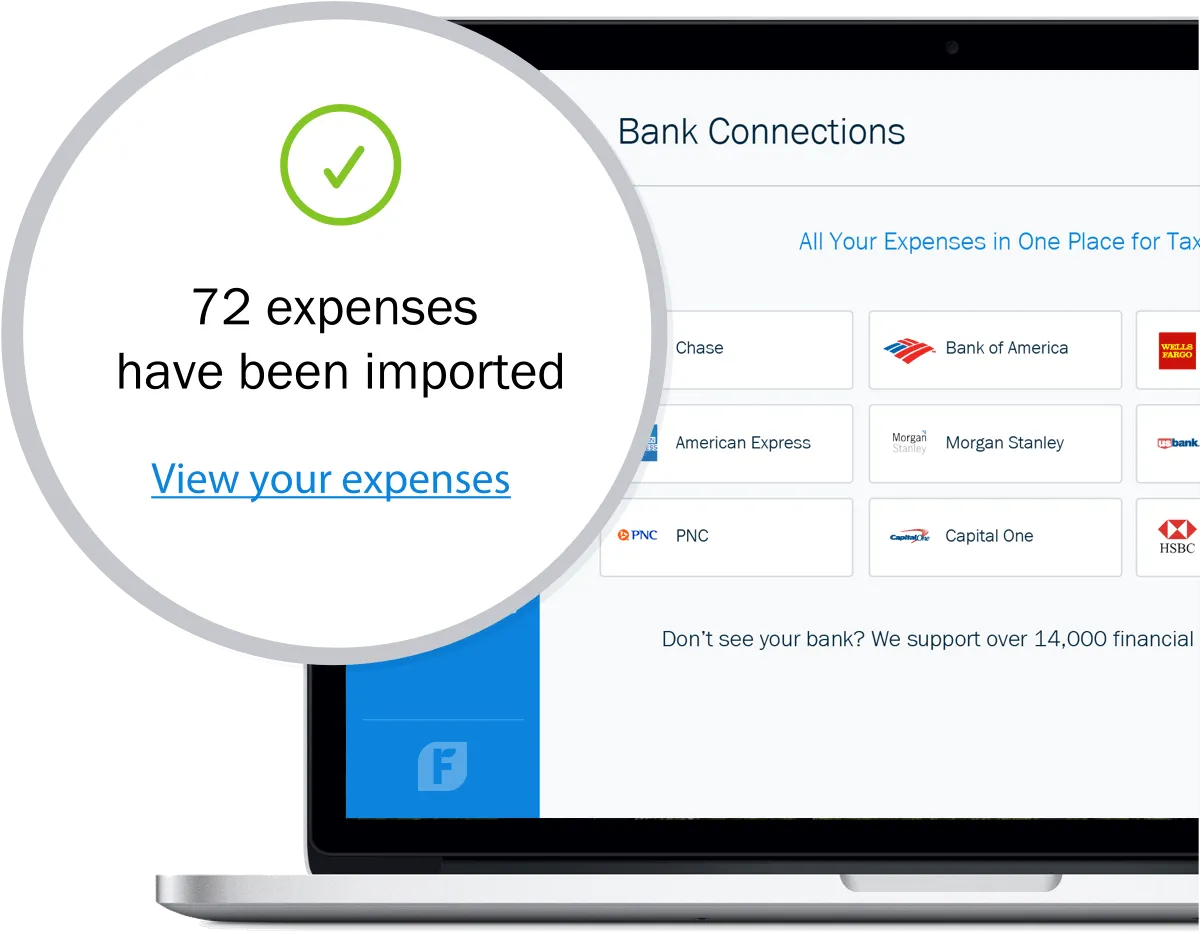

Best expense tracking software for 1099 nicevast

Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed.

Time & Expense Management Software Sage Intacct

Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize.

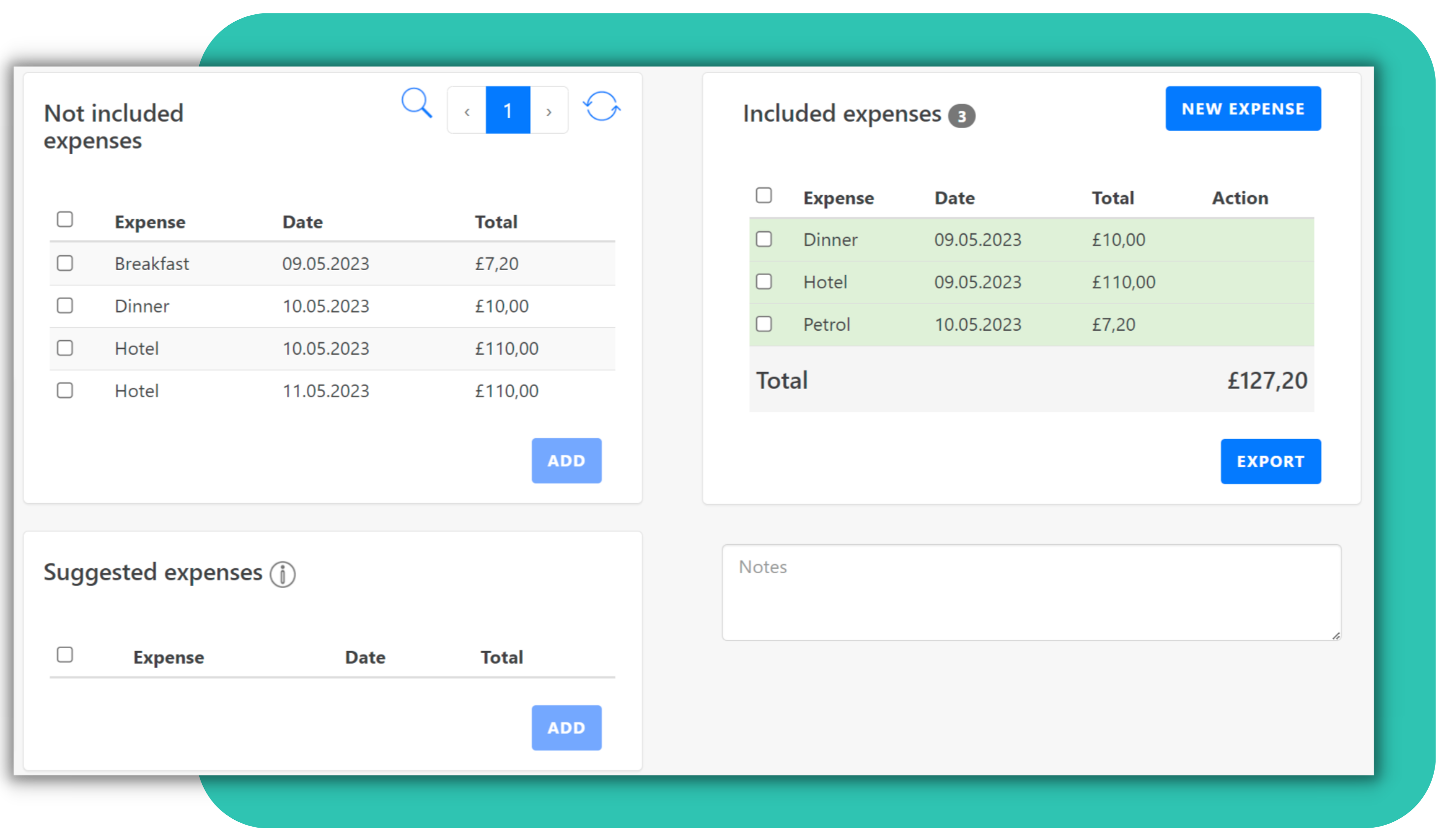

Expense Management System Easy and Digital Expense Tracking

Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize.

10 Best Ways to Track Expenses in 2025 Financfy

Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize. Software and website development costs (not research costs) may be recognised as internally generated intangibles if, and only if, an entity. Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed.

Software And Website Development Costs (Not Research Costs) May Be Recognised As Internally Generated Intangibles If, And Only If, An Entity.

Capitalized software development costs related to software to be sold, leased, or otherwise marketed, whether acquired or developed. Explore the nuances of accounting for software costs, including capitalization, amortization, and tax implications, to optimize.