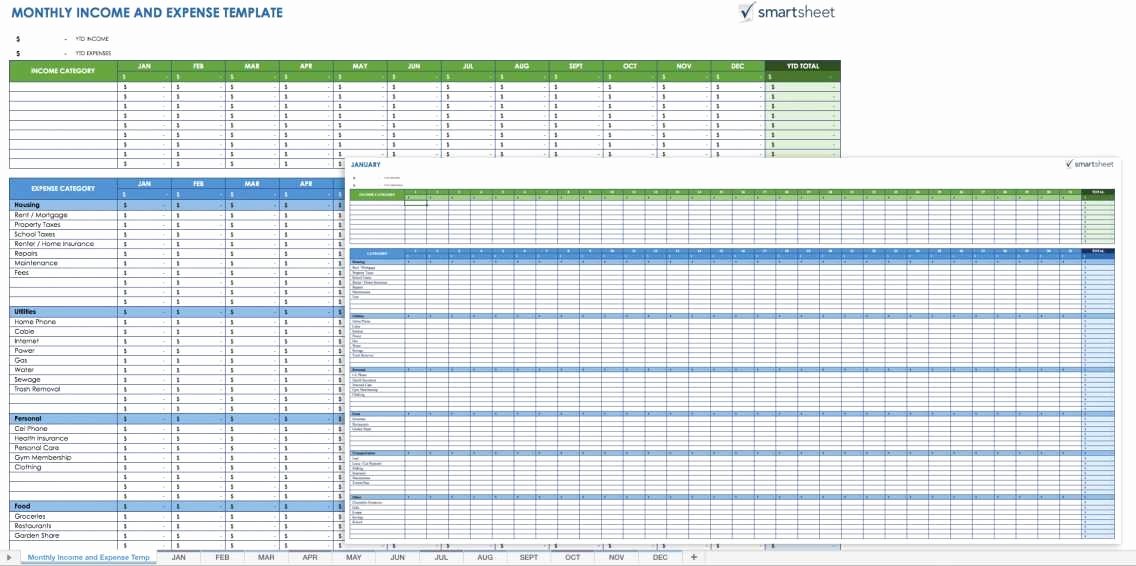

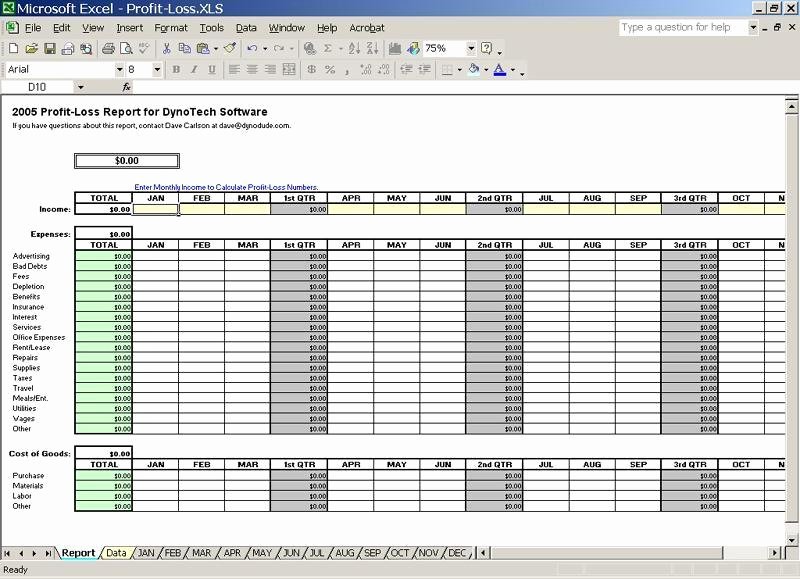

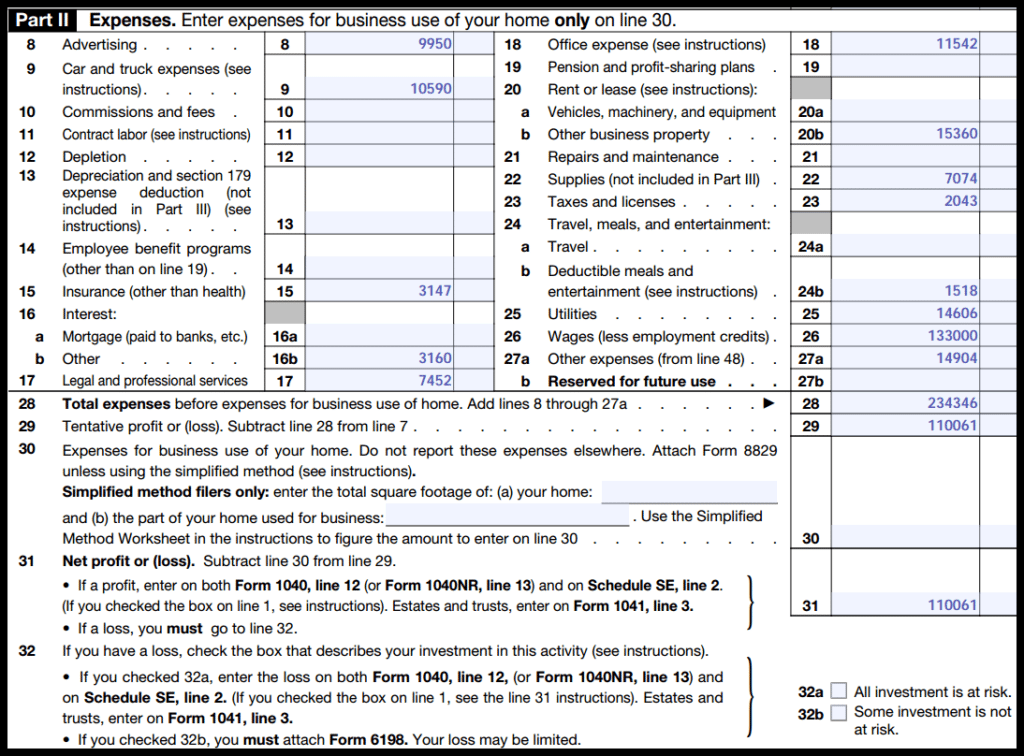

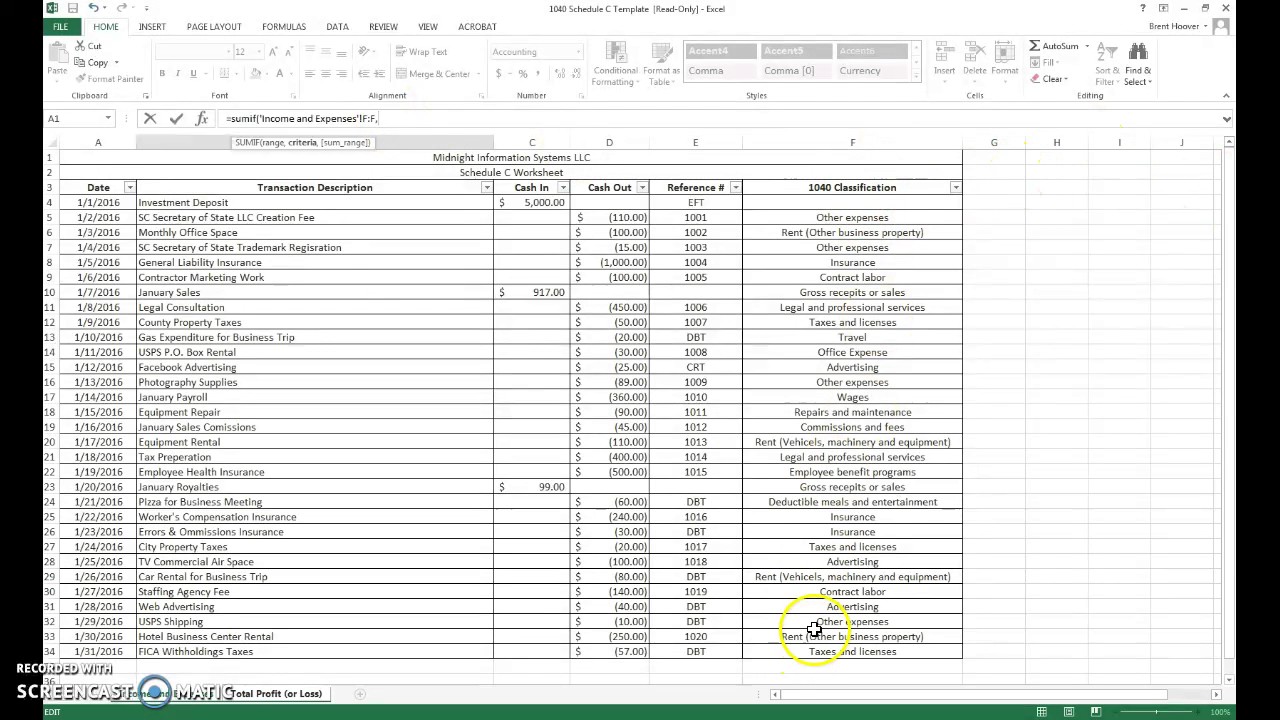

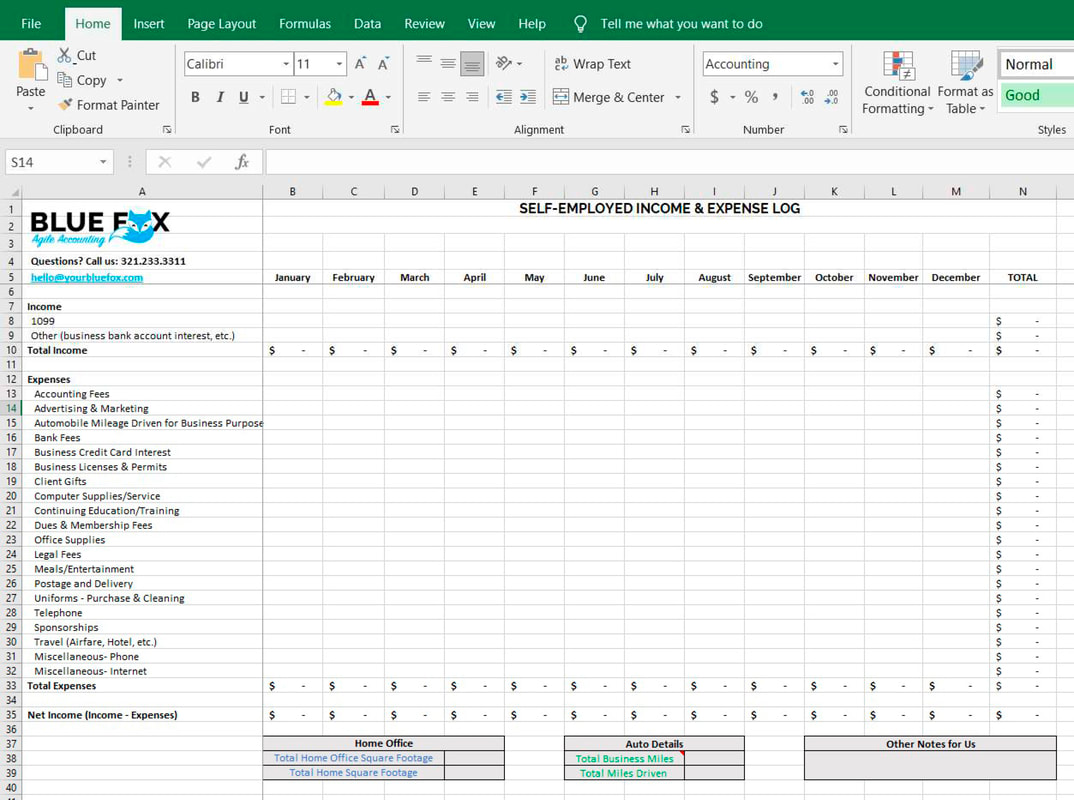

Schedule C Excel Template 2024 - I put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. 11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. For paperwork reduction act notice, see the separate instructions. I also put together a.

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. 11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. I also put together a. I put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. For paperwork reduction act notice, see the separate instructions.

11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. For paperwork reduction act notice, see the separate instructions. I also put together a. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c.

Schedule C Worksheet Fillable

I put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. For paperwork reduction act notice, see the separate instructions. 11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. I also put together a. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have.

Schedule C In Excel Format

I also put together a. 11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. For paperwork reduction act notice, see the separate instructions. I put together an excel spreadsheet with columns for all the information you need to.

Schedule C In Excel Format

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. 11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. For paperwork reduction act notice, see the separate.

Schedule C In Excel Format

11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. For paperwork reduction act notice, see the separate instructions. I also put together a. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I put together an excel spreadsheet with columns for all the information you need to.

Schedule C Worksheet Excel

11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. I also put together a. For paperwork reduction.

Schedule C Excel Template

I put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. I also put together a. For paperwork reduction act notice, see the separate instructions. 11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have.

Excel Schedule C Template Modern Resume Template Word

I also put together a. For paperwork reduction act notice, see the separate instructions. 11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I put together an excel spreadsheet with columns for all the information you need to.

Schedule C Excel Template

I also put together a. 11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. I put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. For paperwork reduction act notice, see the separate instructions. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have.

Irs Fillable Forms 2024 Schedule C Penny Blondell

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. 11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. I also put together a. For paperwork reduction act notice, see the separate instructions. I put together an excel spreadsheet with columns for all the information you need to.

2024 Schedule C Form Orel Tracey

I put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. I also put together a. 11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. For paperwork reduction act notice, see the separate instructions. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have.

Schedule C Worksheet For Self Employed Businesses And/Or Independent Contractors Irs Requires We Have On File To Support All Schedule.

For paperwork reduction act notice, see the separate instructions. I also put together a. 11334p schedule c (form 1040) 2024 schedule c (form 1040) 2024. I put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c.