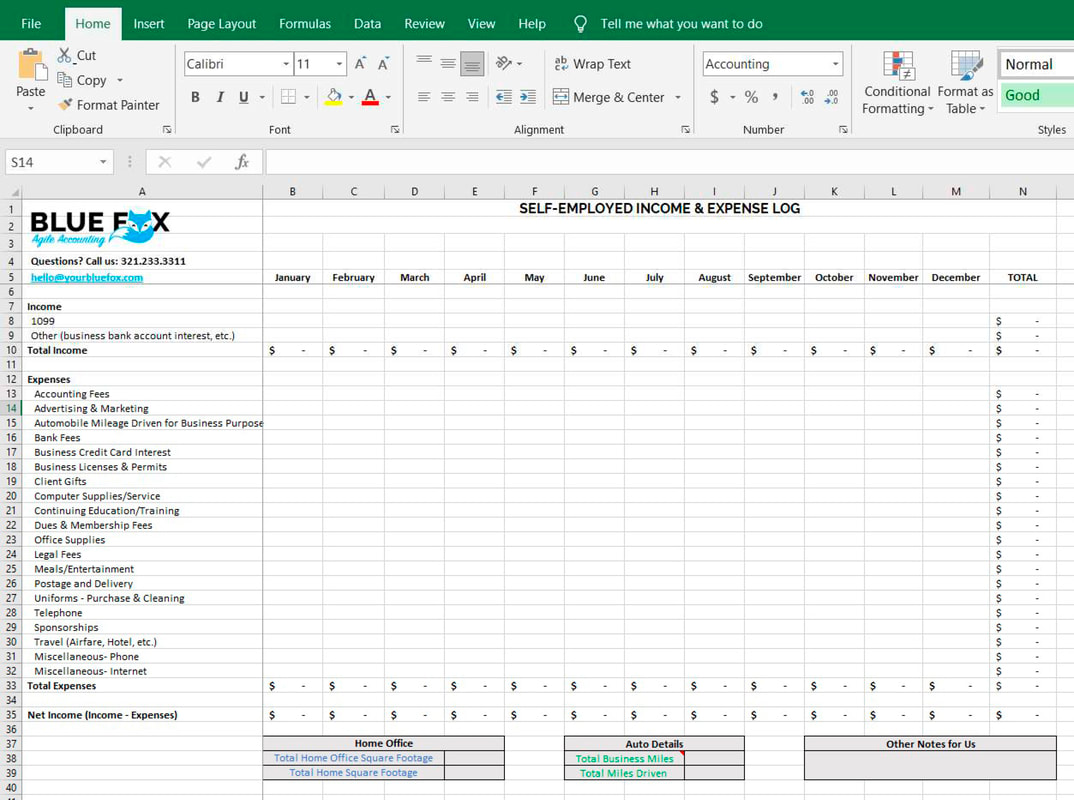

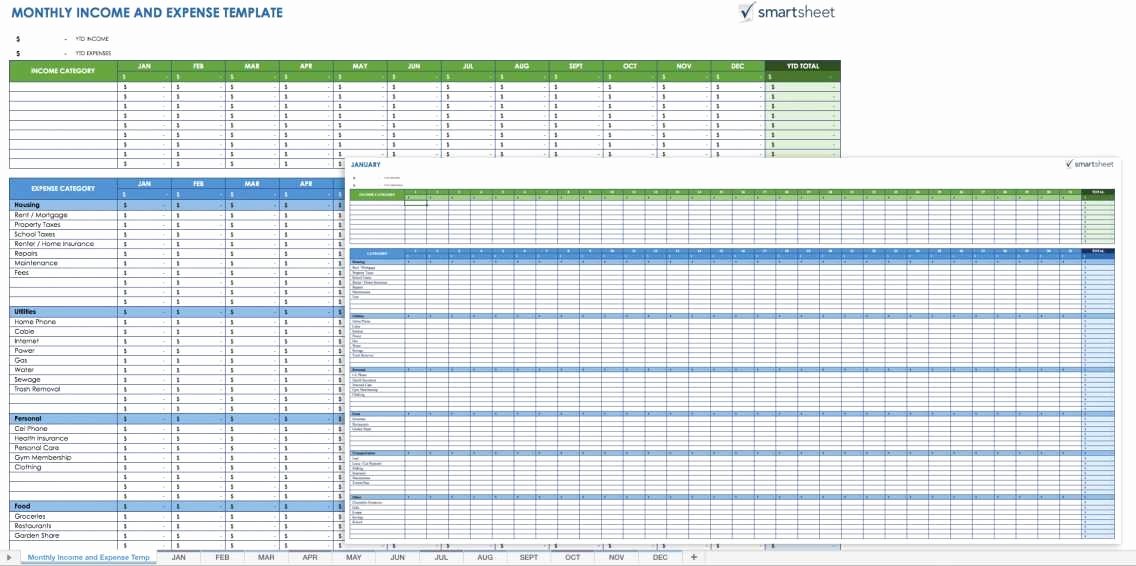

Schedule C Excel Template 2023 - Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. The document is a schedule c business income & expense worksheet for the 2023 tax year, designed for taxpayers to report their business. Get the 1040_2023_sch_c_template.xlsm or 1040_2023_sch_e_template.xlsm file from the file download page and download the template. The green tabs are if you want to track.

The green tabs are if you want to track. The document is a schedule c business income & expense worksheet for the 2023 tax year, designed for taxpayers to report their business. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Get the 1040_2023_sch_c_template.xlsm or 1040_2023_sch_e_template.xlsm file from the file download page and download the template.

Get the 1040_2023_sch_c_template.xlsm or 1040_2023_sch_e_template.xlsm file from the file download page and download the template. The document is a schedule c business income & expense worksheet for the 2023 tax year, designed for taxpayers to report their business. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. The green tabs are if you want to track.

Schedule C IRS Form 1040 Spreadsheet Excel Google Sheets Etsy

Get the 1040_2023_sch_c_template.xlsm or 1040_2023_sch_e_template.xlsm file from the file download page and download the template. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. The green tabs are if you want to track. The document is a schedule c business income & expense worksheet for the 2023 tax year,.

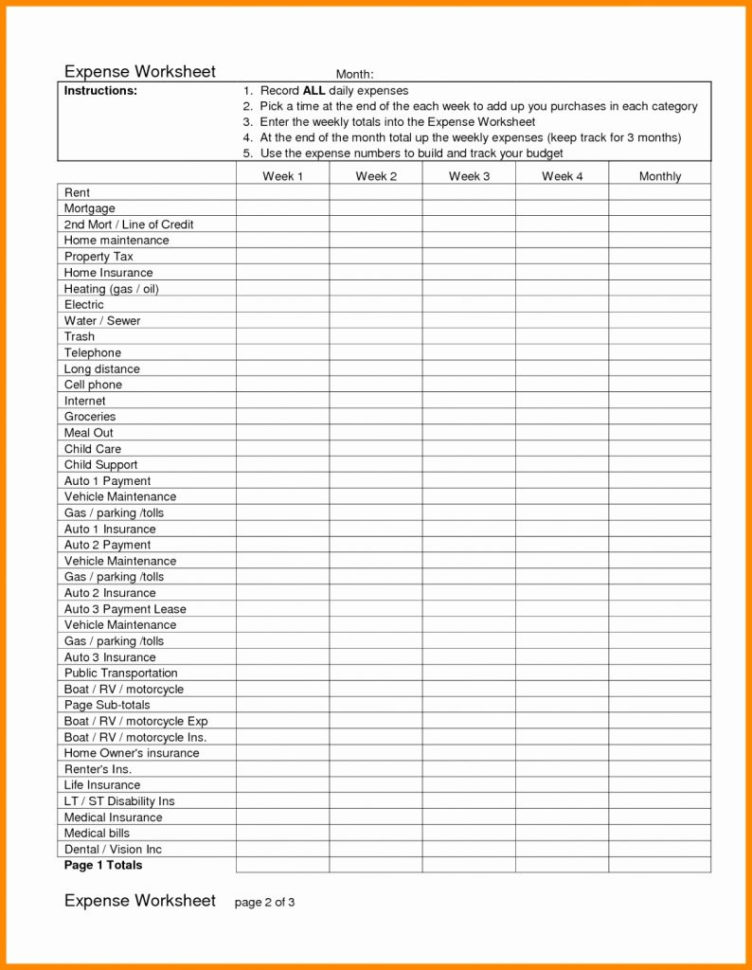

Schedule C Expenses Worksheet 2023

Get the 1040_2023_sch_c_template.xlsm or 1040_2023_sch_e_template.xlsm file from the file download page and download the template. The green tabs are if you want to track. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. The document is a schedule c business income & expense worksheet for the 2023 tax year,.

Printable Schedule C 2023

Get the 1040_2023_sch_c_template.xlsm or 1040_2023_sch_e_template.xlsm file from the file download page and download the template. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. The document is a schedule c business income & expense worksheet for the 2023 tax year, designed for taxpayers to report their business. The green.

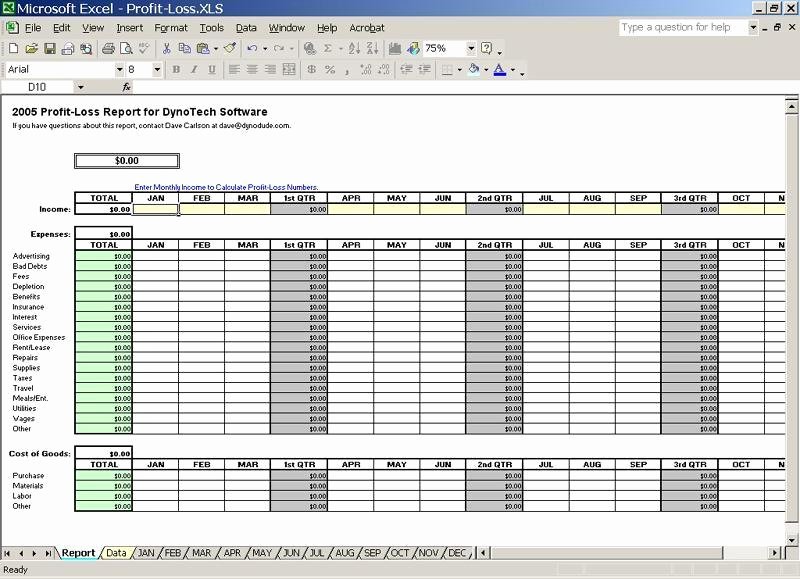

Schedule C In Excel Format

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. The document is a schedule c business income & expense worksheet for the 2023 tax year, designed for taxpayers to report their business. Get the 1040_2023_sch_c_template.xlsm or 1040_2023_sch_e_template.xlsm file from the file download page and download the template. The green.

Schedule C Excel Template

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Get the 1040_2023_sch_c_template.xlsm or 1040_2023_sch_e_template.xlsm file from the file download page and download the template. The document is a schedule c business income & expense worksheet for the 2023 tax year, designed for taxpayers to report their business. The green.

Schedule C In Excel Format

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. The document is a schedule c business income & expense worksheet for the 2023 tax year, designed for taxpayers to report their business. Get the 1040_2023_sch_c_template.xlsm or 1040_2023_sch_e_template.xlsm file from the file download page and download the template. The green.

Schedule C Worksheet Fillable

The green tabs are if you want to track. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. The document is a schedule c business income & expense worksheet for the 2023 tax year, designed for taxpayers to report their business. Get the 1040_2023_sch_c_template.xlsm or 1040_2023_sch_e_template.xlsm file from the.

Schedule C Worksheet Fillable

The green tabs are if you want to track. Get the 1040_2023_sch_c_template.xlsm or 1040_2023_sch_e_template.xlsm file from the file download page and download the template. The document is a schedule c business income & expense worksheet for the 2023 tax year, designed for taxpayers to report their business. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we.

Printable Schedule C Form

The green tabs are if you want to track. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. The document is a schedule c business income & expense worksheet for the 2023 tax year, designed for taxpayers to report their business. Get the 1040_2023_sch_c_template.xlsm or 1040_2023_sch_e_template.xlsm file from the.

Printable Schedule C 2023

Get the 1040_2023_sch_c_template.xlsm or 1040_2023_sch_e_template.xlsm file from the file download page and download the template. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. The document is a schedule c business income & expense worksheet for the 2023 tax year, designed for taxpayers to report their business. The green.

Get The 1040_2023_Sch_C_Template.xlsm Or 1040_2023_Sch_E_Template.xlsm File From The File Download Page And Download The Template.

The document is a schedule c business income & expense worksheet for the 2023 tax year, designed for taxpayers to report their business. The green tabs are if you want to track. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule.