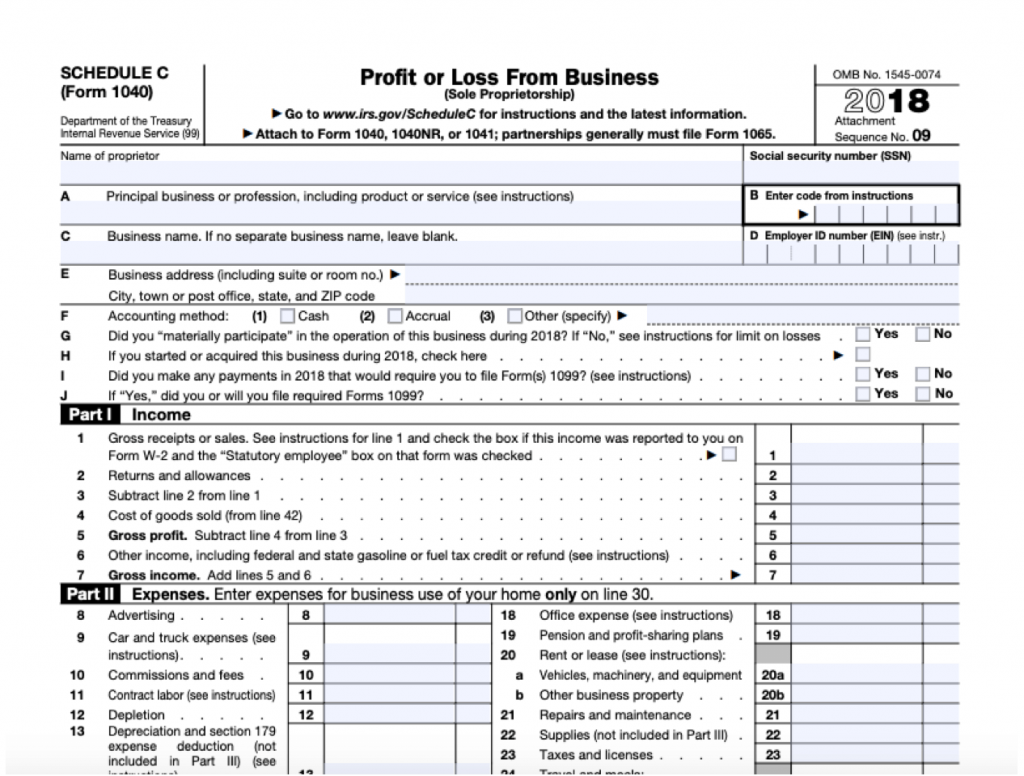

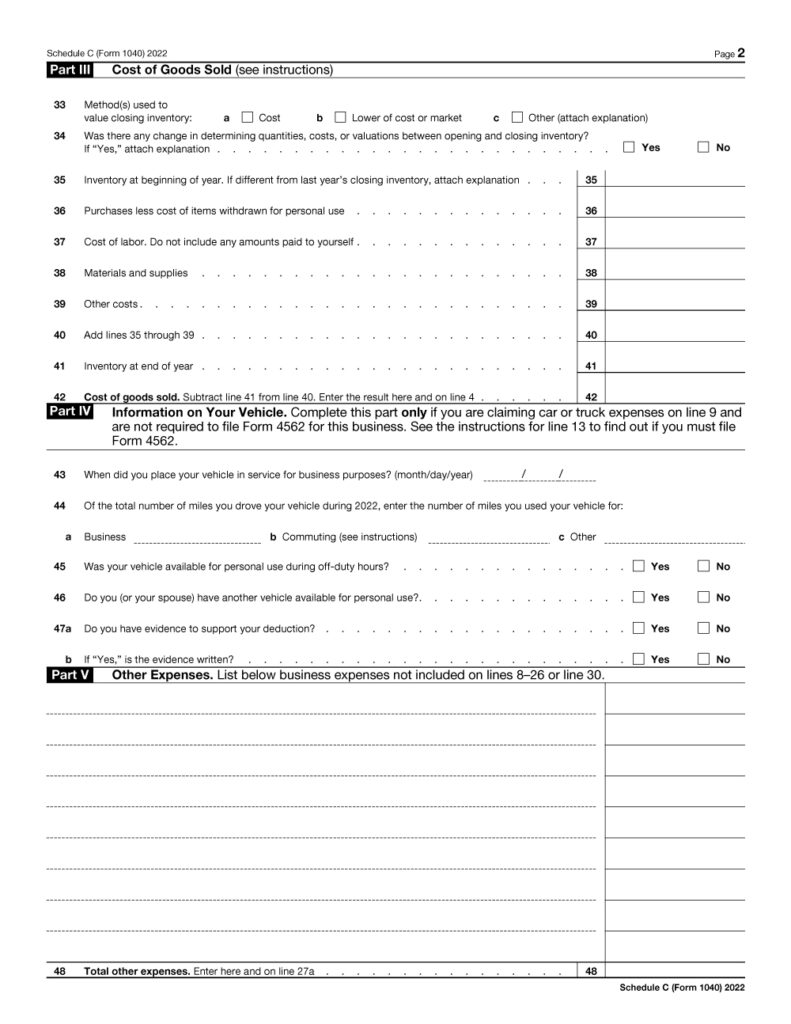

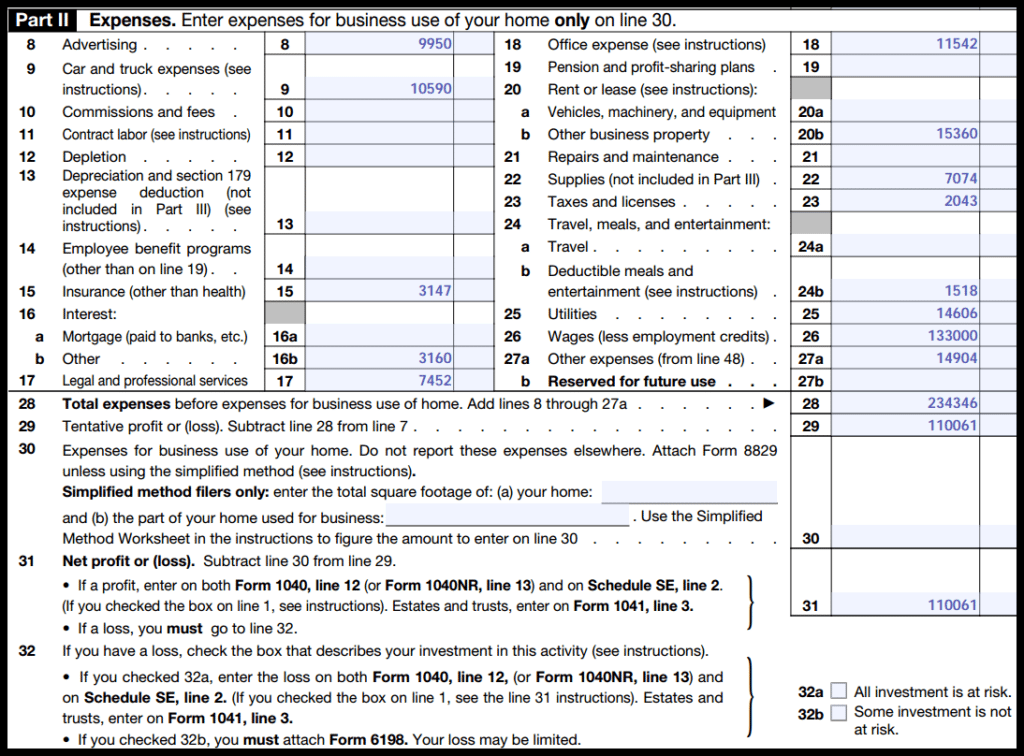

Schedule C 2023 Instructions Pdf - And, you can fill out & download a schedule c form. Three changes have been made to the 2023 instructions for schedule c (form 1040). See the instructions for the schedules for more. Learn how to report income or loss from a business or a profession as a sole proprietor on schedule c (form 1040). Below is a general guide to which schedule(s) you will need to le based on your circumstances. Check out our guide for a detailed filing instructions. Schedule dcg for defined contribution group (dcg) reporting arrangements. Filing a schedule c with your 2023 taxes? Section 202 of the secure act (pub. These changes pertain to the standard mileage.

Three changes have been made to the 2023 instructions for schedule c (form 1040). Schedule dcg for defined contribution group (dcg) reporting arrangements. See the instructions for the schedules for more. Filing a schedule c with your 2023 taxes? Learn how to report income or loss from a business or a profession as a sole proprietor on schedule c (form 1040). And, you can fill out & download a schedule c form. Section 202 of the secure act (pub. These changes pertain to the standard mileage. Below is a general guide to which schedule(s) you will need to le based on your circumstances. Check out our guide for a detailed filing instructions.

Check out our guide for a detailed filing instructions. Learn how to report income or loss from a business or a profession as a sole proprietor on schedule c (form 1040). And, you can fill out & download a schedule c form. Schedule dcg for defined contribution group (dcg) reporting arrangements. These changes pertain to the standard mileage. Filing a schedule c with your 2023 taxes? Below is a general guide to which schedule(s) you will need to le based on your circumstances. Three changes have been made to the 2023 instructions for schedule c (form 1040). Section 202 of the secure act (pub. See the instructions for the schedules for more.

Schedule C Tax Calculator

Below is a general guide to which schedule(s) you will need to le based on your circumstances. Learn how to report income or loss from a business or a profession as a sole proprietor on schedule c (form 1040). These changes pertain to the standard mileage. Three changes have been made to the 2023 instructions for schedule c (form 1040)..

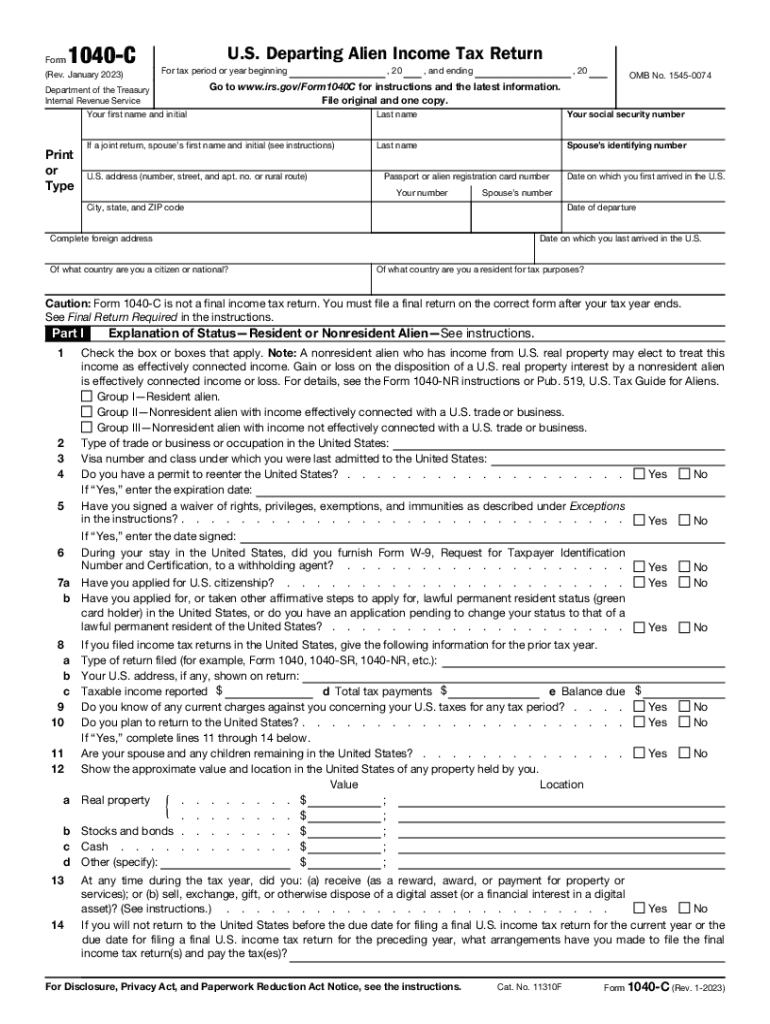

2023 Form IRS Instructions 1040 Schedule C Fill Online, Printable

Schedule dcg for defined contribution group (dcg) reporting arrangements. Filing a schedule c with your 2023 taxes? Below is a general guide to which schedule(s) you will need to le based on your circumstances. And, you can fill out & download a schedule c form. These changes pertain to the standard mileage.

Printable Schedule C 2023

Filing a schedule c with your 2023 taxes? These changes pertain to the standard mileage. Section 202 of the secure act (pub. Check out our guide for a detailed filing instructions. Three changes have been made to the 2023 instructions for schedule c (form 1040).

Schedule C 2023 Form Printable Forms Free Online

And, you can fill out & download a schedule c form. Three changes have been made to the 2023 instructions for schedule c (form 1040). Filing a schedule c with your 2023 taxes? These changes pertain to the standard mileage. Section 202 of the secure act (pub.

1040 Schedule C 20232025 Form Fill Out and Sign Printable PDF

Filing a schedule c with your 2023 taxes? These changes pertain to the standard mileage. And, you can fill out & download a schedule c form. Below is a general guide to which schedule(s) you will need to le based on your circumstances. Three changes have been made to the 2023 instructions for schedule c (form 1040).

Schedule C Instructions How to Fill Out Form 1040 Excel Capital

See the instructions for the schedules for more. And, you can fill out & download a schedule c form. Schedule dcg for defined contribution group (dcg) reporting arrangements. Filing a schedule c with your 2023 taxes? Three changes have been made to the 2023 instructions for schedule c (form 1040).

Schedule C (Form 1040) 2023 Instructions

Below is a general guide to which schedule(s) you will need to le based on your circumstances. These changes pertain to the standard mileage. Schedule dcg for defined contribution group (dcg) reporting arrangements. Check out our guide for a detailed filing instructions. Three changes have been made to the 2023 instructions for schedule c (form 1040).

Printable Schedule C Form

See the instructions for the schedules for more. Check out our guide for a detailed filing instructions. Schedule dcg for defined contribution group (dcg) reporting arrangements. And, you can fill out & download a schedule c form. These changes pertain to the standard mileage.

2025 Instructions For Schedule C Alexis W Nuttall

Below is a general guide to which schedule(s) you will need to le based on your circumstances. These changes pertain to the standard mileage. See the instructions for the schedules for more. Learn how to report income or loss from a business or a profession as a sole proprietor on schedule c (form 1040). Section 202 of the secure act.

Schedule C (Form 1040) 2023 Instructions

Check out our guide for a detailed filing instructions. Learn how to report income or loss from a business or a profession as a sole proprietor on schedule c (form 1040). Filing a schedule c with your 2023 taxes? And, you can fill out & download a schedule c form. These changes pertain to the standard mileage.

Below Is A General Guide To Which Schedule(S) You Will Need To Le Based On Your Circumstances.

Schedule dcg for defined contribution group (dcg) reporting arrangements. See the instructions for the schedules for more. Section 202 of the secure act (pub. These changes pertain to the standard mileage.

Check Out Our Guide For A Detailed Filing Instructions.

Filing a schedule c with your 2023 taxes? Learn how to report income or loss from a business or a profession as a sole proprietor on schedule c (form 1040). And, you can fill out & download a schedule c form. Three changes have been made to the 2023 instructions for schedule c (form 1040).

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)