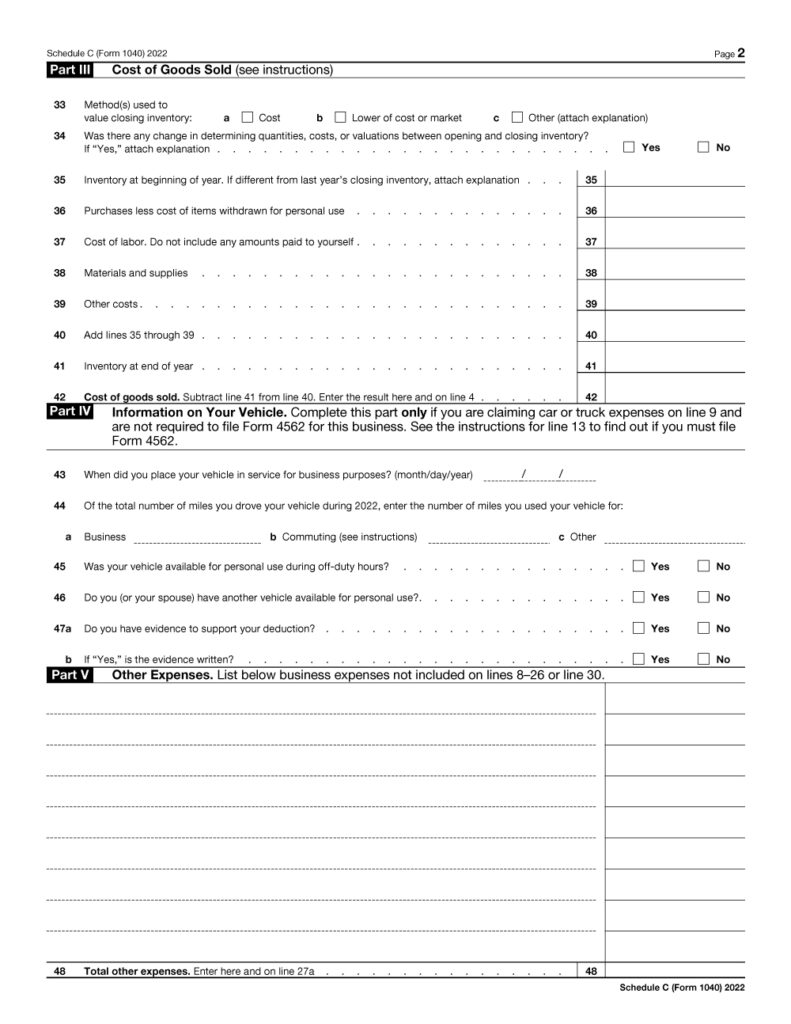

Schedule C 2023 Download - Accurate asset valuationconvenient for clients Accurate completion of this schedule. And, you can fill out & download a schedule c form. If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Check out our guide for a detailed filing instructions. Filing a schedule c with your 2023 taxes? Go to www.irs.gov/schedulec for instructions and the latest information. Sign, print, and download this pdf at printfriendly. View the schedule c form 1040 for sole proprietors 2023 in our collection of pdfs.

Filing a schedule c with your 2023 taxes? Accurate asset valuationconvenient for clients If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Check out our guide for a detailed filing instructions. View the schedule c form 1040 for sole proprietors 2023 in our collection of pdfs. Sign, print, and download this pdf at printfriendly. Accurate completion of this schedule. Go to www.irs.gov/schedulec for instructions and the latest information. And, you can fill out & download a schedule c form.

If no separate business name, leave blank. Check out our guide for a detailed filing instructions. Go to www.irs.gov/schedulec for instructions and the latest information. View the schedule c form 1040 for sole proprietors 2023 in our collection of pdfs. Accurate asset valuationconvenient for clients Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Accurate completion of this schedule. And, you can fill out & download a schedule c form. Filing a schedule c with your 2023 taxes? Sign, print, and download this pdf at printfriendly.

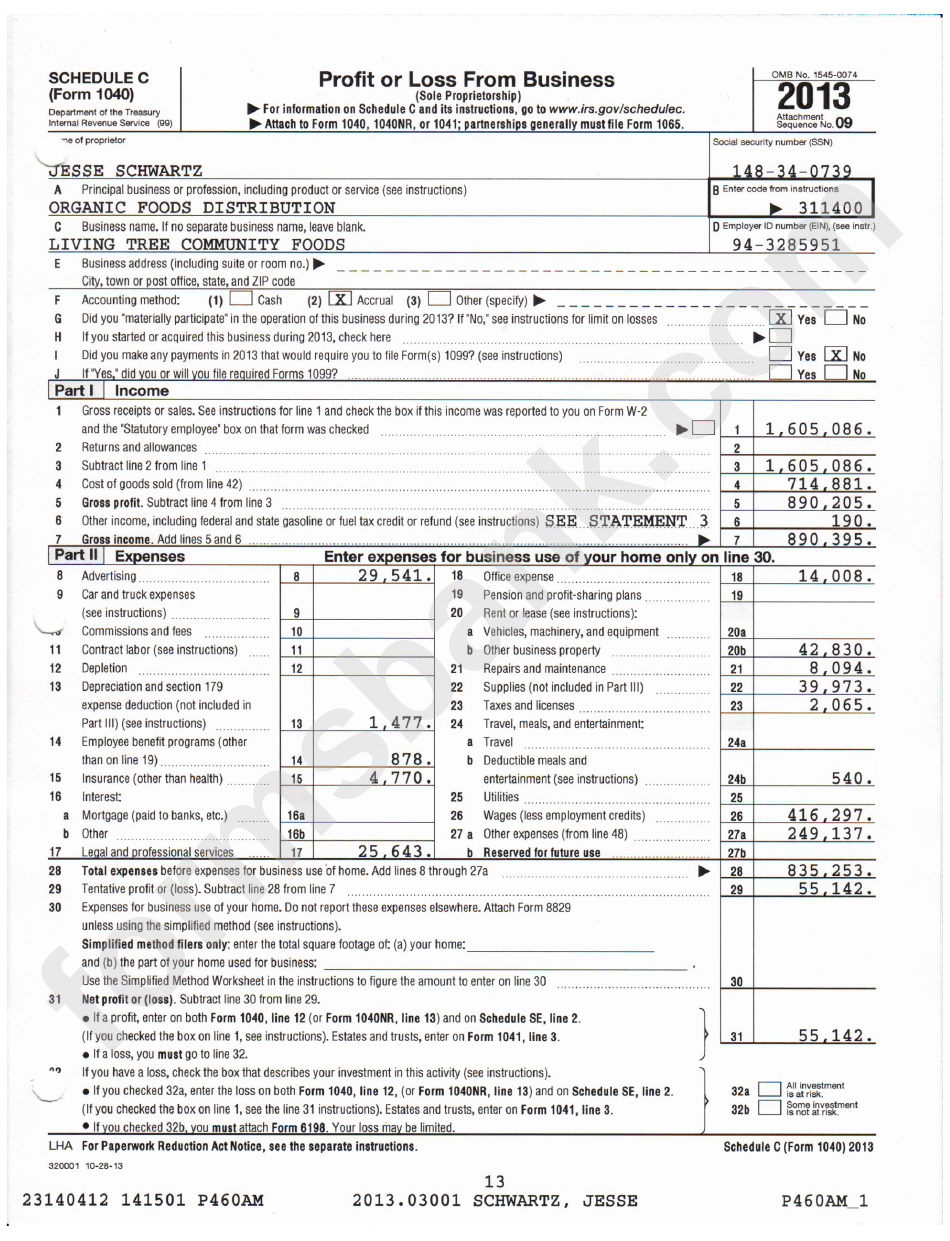

2023 fillable schedule c Fill out & sign online DocHub

Filing a schedule c with your 2023 taxes? Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.irs.gov/schedulec for instructions and the latest information. Accurate asset valuationconvenient for clients Accurate completion of this schedule.

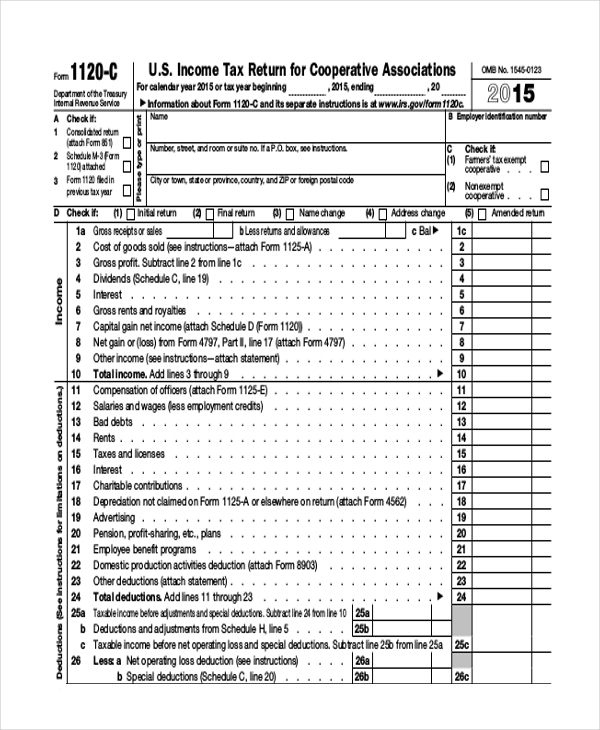

FREE 9+ Sample Schedule C Forms in PDF MS Word

View the schedule c form 1040 for sole proprietors 2023 in our collection of pdfs. Check out our guide for a detailed filing instructions. And, you can fill out & download a schedule c form. Accurate completion of this schedule. Filing a schedule c with your 2023 taxes?

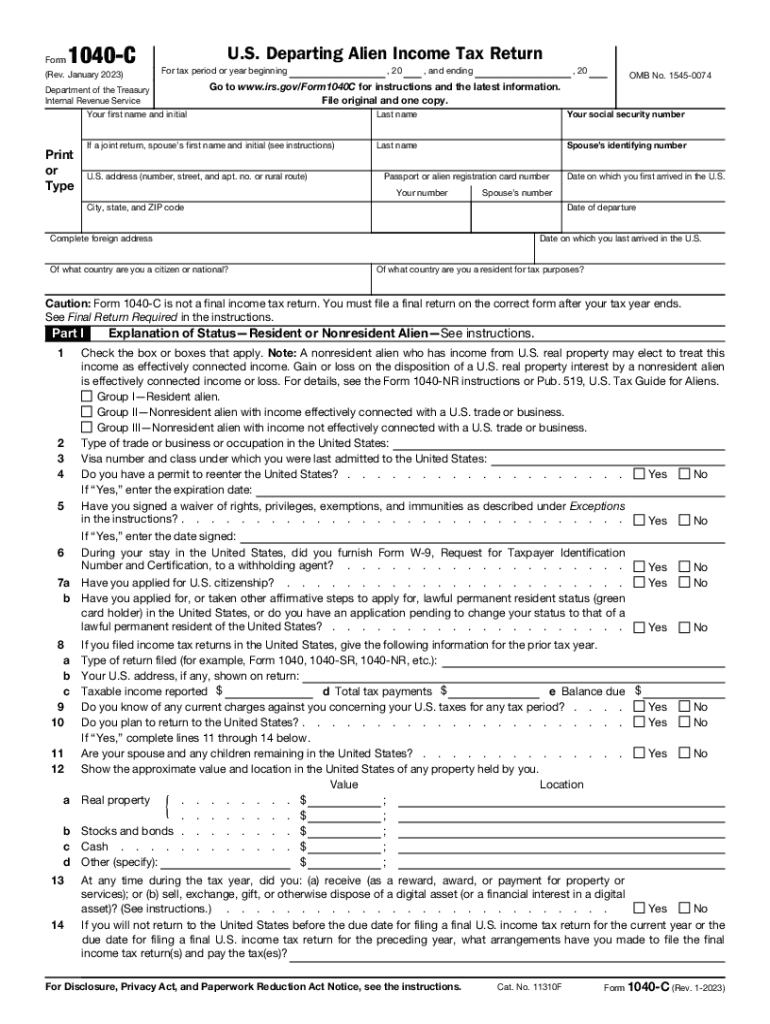

Schedule C (Form 1040) 2023 Instructions

If no separate business name, leave blank. Check out our guide for a detailed filing instructions. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Accurate completion of this schedule. Go to www.irs.gov/schedulec for instructions and the latest information.

Download Fillable Schedule C Form

If no separate business name, leave blank. Accurate completion of this schedule. Accurate asset valuationconvenient for clients View the schedule c form 1040 for sole proprietors 2023 in our collection of pdfs. Check out our guide for a detailed filing instructions.

1040 Schedule C 20232025 Form Fill Out and Sign Printable PDF

Check out our guide for a detailed filing instructions. View the schedule c form 1040 for sole proprietors 2023 in our collection of pdfs. Filing a schedule c with your 2023 taxes? Accurate completion of this schedule. If no separate business name, leave blank.

Schedule C (Form 1040) 2023 Instructions

Filing a schedule c with your 2023 taxes? Check out our guide for a detailed filing instructions. And, you can fill out & download a schedule c form. If no separate business name, leave blank. Sign, print, and download this pdf at printfriendly.

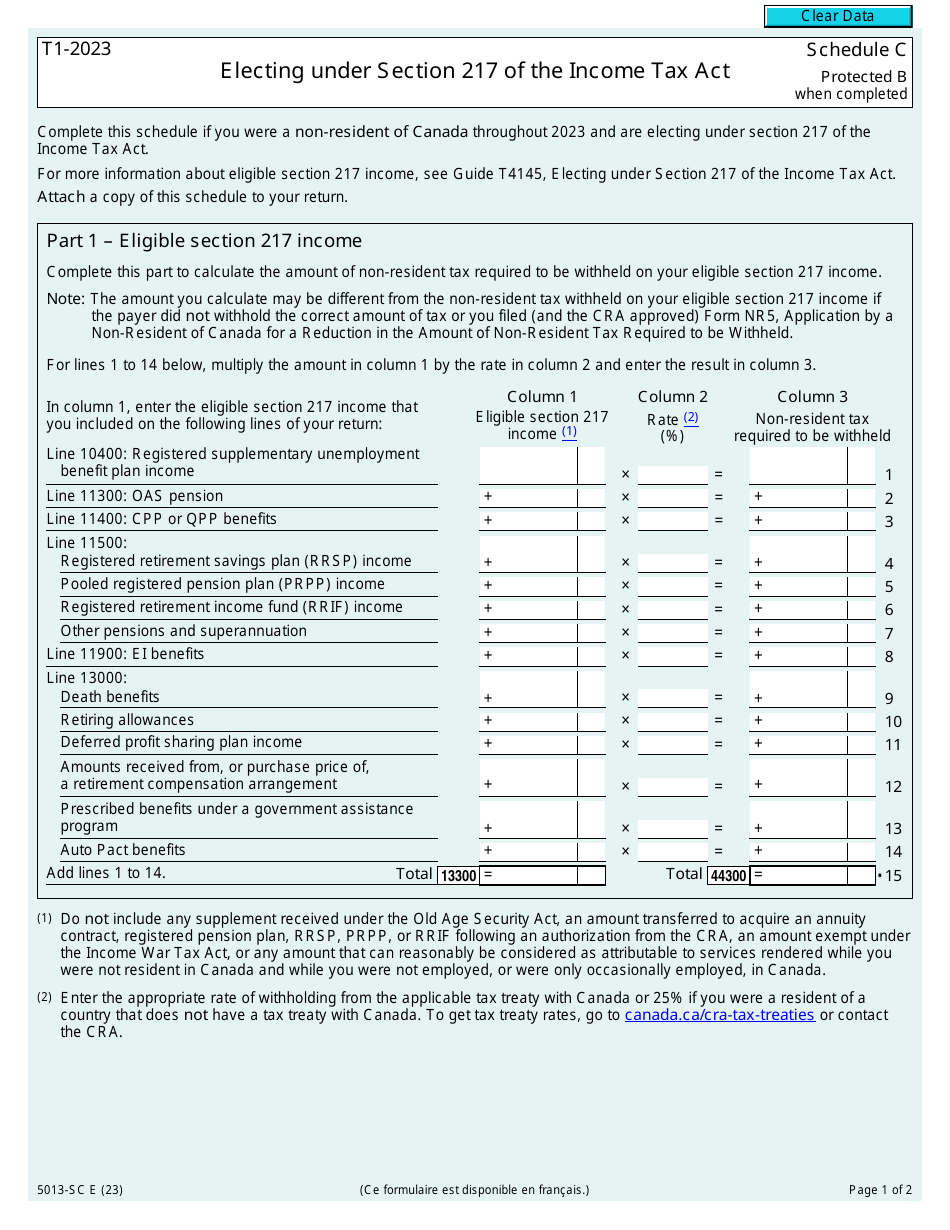

Form 5013SC Schedule C 2023 Fill Out, Sign Online and Download

Accurate completion of this schedule. Filing a schedule c with your 2023 taxes? Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.irs.gov/schedulec for instructions and the latest information. Check out our guide for a detailed filing instructions.

Printable Schedule C 2023

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. Accurate completion of this schedule. And, you can fill out & download a schedule c form.

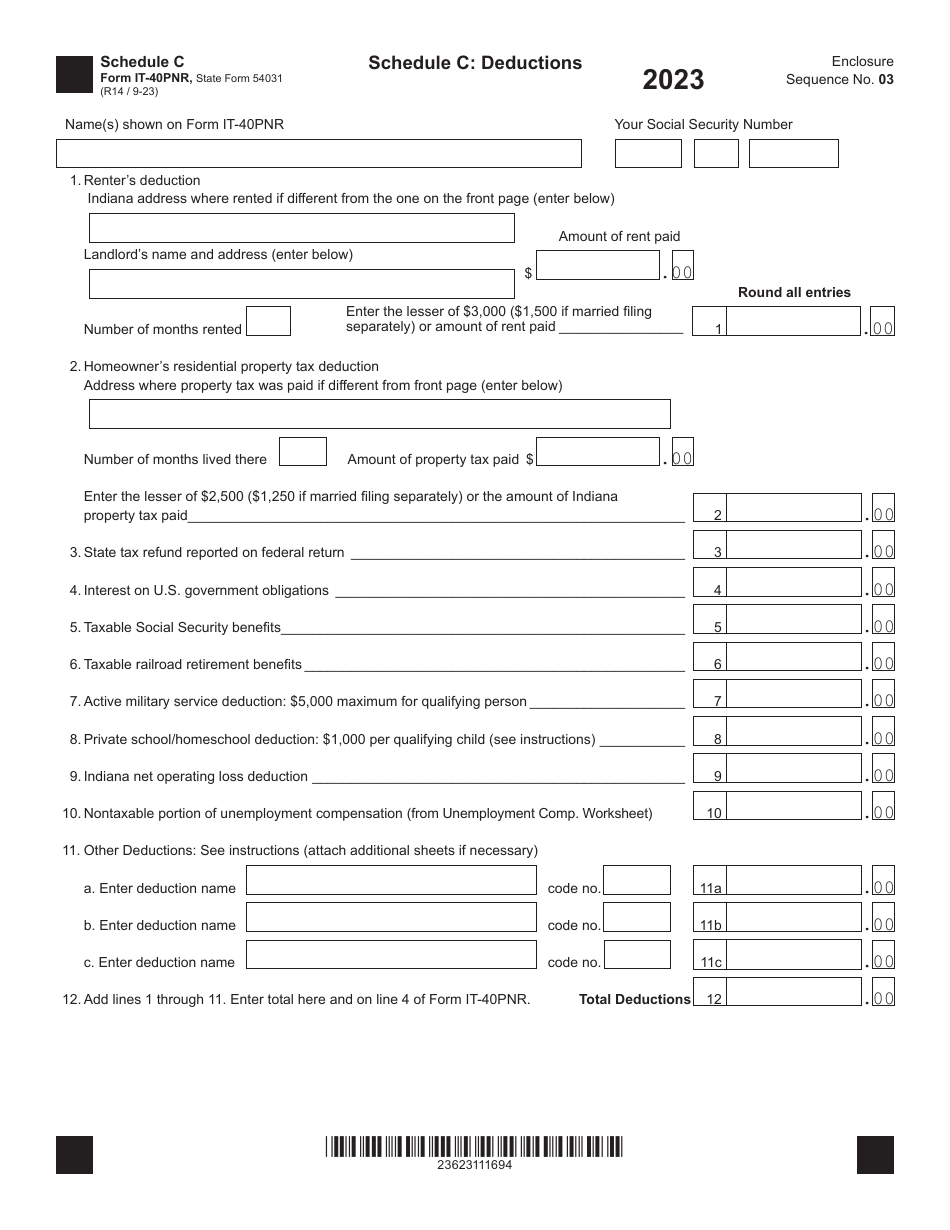

Form IT40PNR (State Form 54031) Schedule C 2023 Fill Out, Sign

View the schedule c form 1040 for sole proprietors 2023 in our collection of pdfs. If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Sign, print, and download this pdf at printfriendly. Accurate asset valuationconvenient for clients

Download Fillable Schedule C Form

Sign, print, and download this pdf at printfriendly. Filing a schedule c with your 2023 taxes? Go to www.irs.gov/schedulec for instructions and the latest information. Accurate asset valuationconvenient for clients Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

Check Out Our Guide For A Detailed Filing Instructions.

Sign, print, and download this pdf at printfriendly. Accurate asset valuationconvenient for clients Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. View the schedule c form 1040 for sole proprietors 2023 in our collection of pdfs.

Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

Filing a schedule c with your 2023 taxes? If no separate business name, leave blank. And, you can fill out & download a schedule c form. Accurate completion of this schedule.

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)