Npv Vs Discounted Cash Flow - When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment. The main difference between discounted cash flow vs. What is the difference between npv and discounted cash flow?

Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. The main difference between discounted cash flow vs. What is the difference between npv and discounted cash flow?

When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. The main difference between discounted cash flow vs. Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment. What is the difference between npv and discounted cash flow?

PPT Discounted Cash Flow applications PowerPoint Presentation, free

The main difference between discounted cash flow vs. What is the difference between npv and discounted cash flow? When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment.

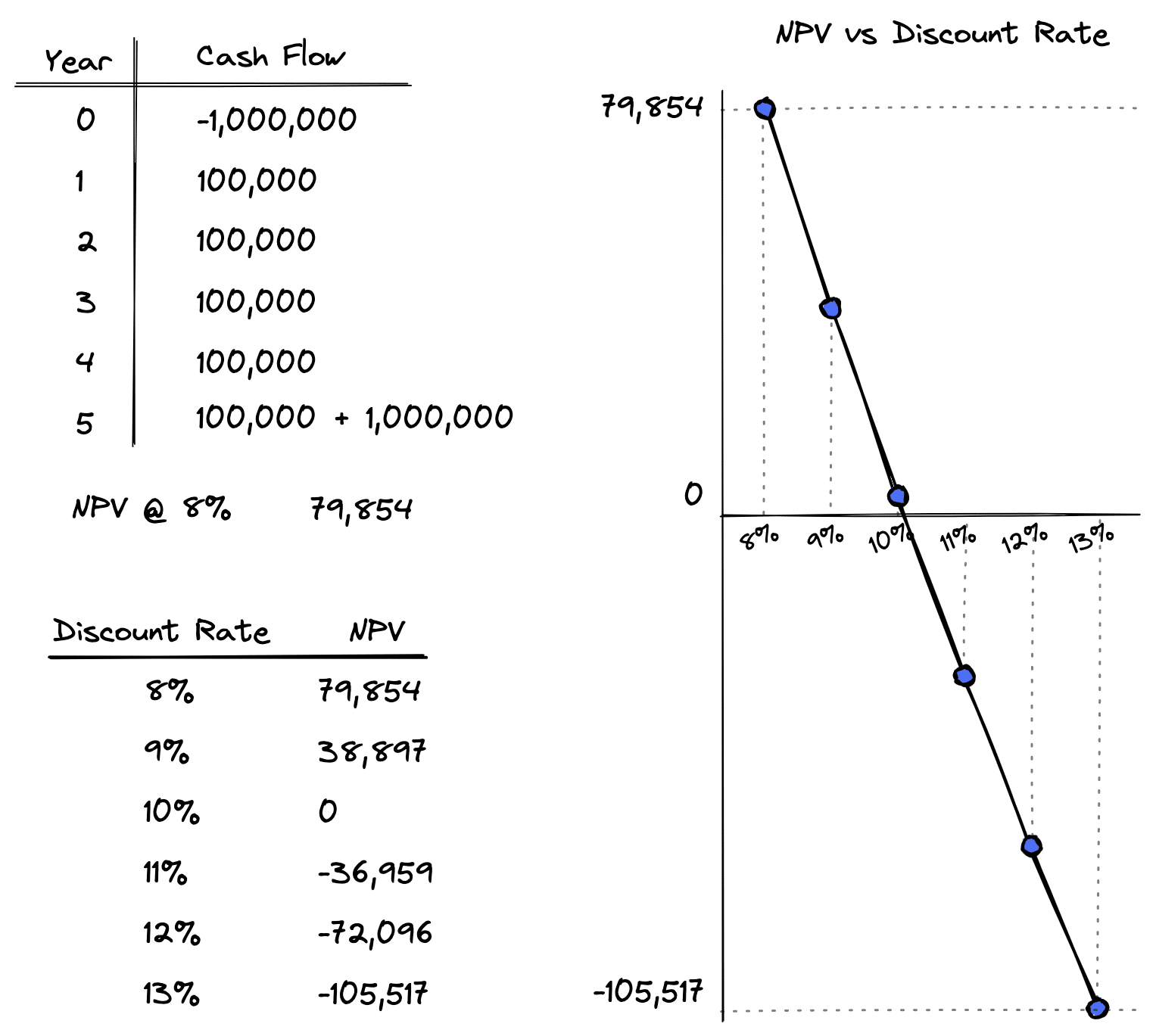

Graphic of Net Present Value and Present Value Vs. Discount rate

What is the difference between npv and discounted cash flow? When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment. The main difference between discounted cash flow vs.

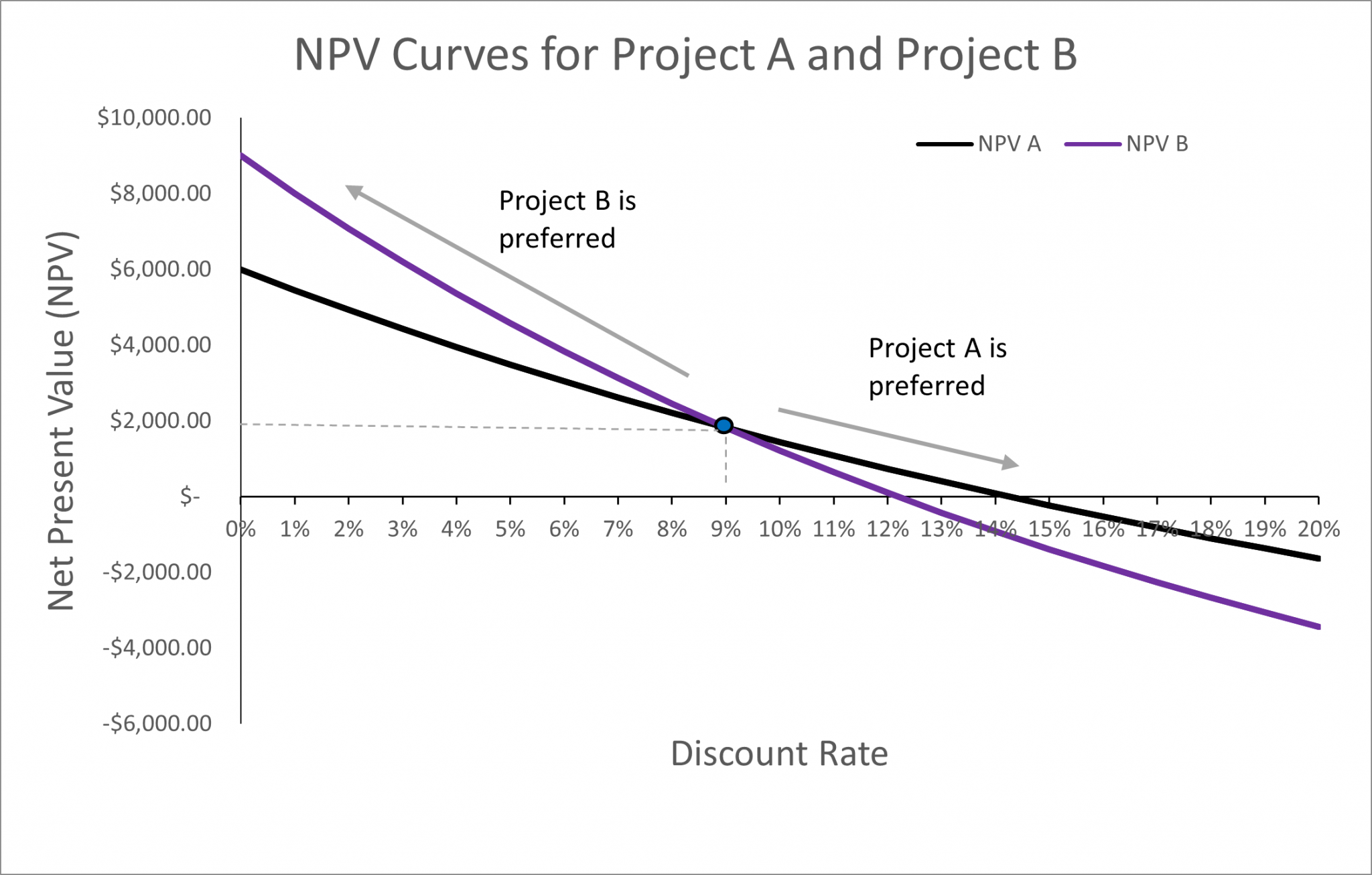

What You Should Know About the Discount Rate PropertyMetrics

Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment. What is the difference between npv and discounted cash flow? The main difference between discounted cash flow vs. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash.

Chapter 9 Capital Budgeting Decision Models Shortterm versus Longterm

What is the difference between npv and discounted cash flow? Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. The main difference between discounted cash flow vs.

Understanding Net Present Value and The Basics of Discounted Cash Flow

When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. What is the difference between npv and discounted cash flow? Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment. The main difference between discounted cash flow vs.

What You Should Know About the Discount Rate PropertyMetrics

What is the difference between npv and discounted cash flow? Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. The main difference between discounted cash flow vs.

PPT Investment Appraisal (Discounted Cash Flow and NPV) by Binam

When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. The main difference between discounted cash flow vs. Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment. What is the difference between npv and discounted cash flow?

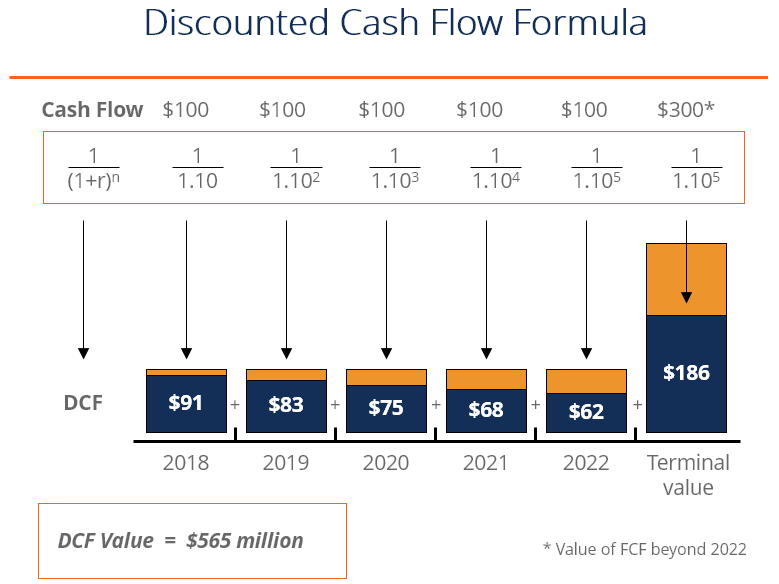

Discounted Cash Flow DCF Formula

What is the difference between npv and discounted cash flow? When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment. The main difference between discounted cash flow vs.

Chapter 2 Decisions, Decisions, Decisions. Social Cost Benefit

The main difference between discounted cash flow vs. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment. What is the difference between npv and discounted cash flow?

Excel Discounted Cash Flow (DCF) Analysis Model With IRR And NPV

What is the difference between npv and discounted cash flow? Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. The main difference between discounted cash flow vs.

What Is The Difference Between Npv And Discounted Cash Flow?

When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. The main difference between discounted cash flow vs. Discounted cash flow (dcf) and net present value (npv) are critical tools in determining the feasibility of an investment.