Leave Donation Program Irs Rules - Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific. With its latest guidance, the irs has now made clear that under leave donation programs, employees who elect to forgo. The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other.

Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific. With its latest guidance, the irs has now made clear that under leave donation programs, employees who elect to forgo. The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other.

Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific. With its latest guidance, the irs has now made clear that under leave donation programs, employees who elect to forgo. The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other.

IRS Extends LeaveBased Donation Programs through 2021

Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific. The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other. With its latest guidance, the irs has now made clear that under leave donation programs, employees who elect to forgo.

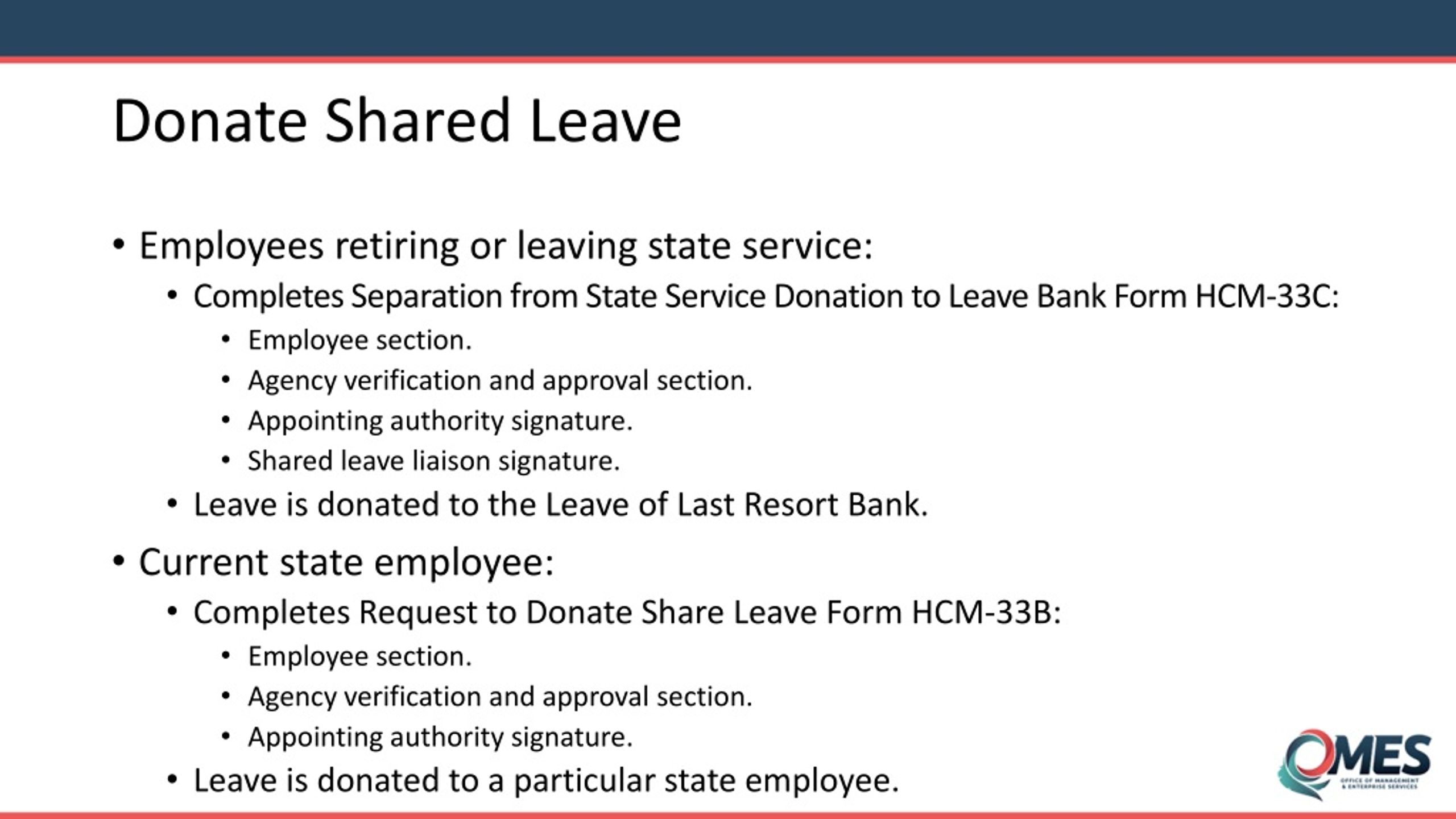

PPT State Leave Sharing Program PowerPoint Presentation, free

The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other. Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific. With its latest guidance, the irs has now made clear that under leave donation programs, employees who elect to forgo.

Pto Donation IRS Guidelines Essential Information for HR Compliance

With its latest guidance, the irs has now made clear that under leave donation programs, employees who elect to forgo. The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other. Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific.

Leave Donation Programs for COVID19 Groom Law Group

Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific. The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other. With its latest guidance, the irs has now made clear that under leave donation programs, employees who elect to forgo.

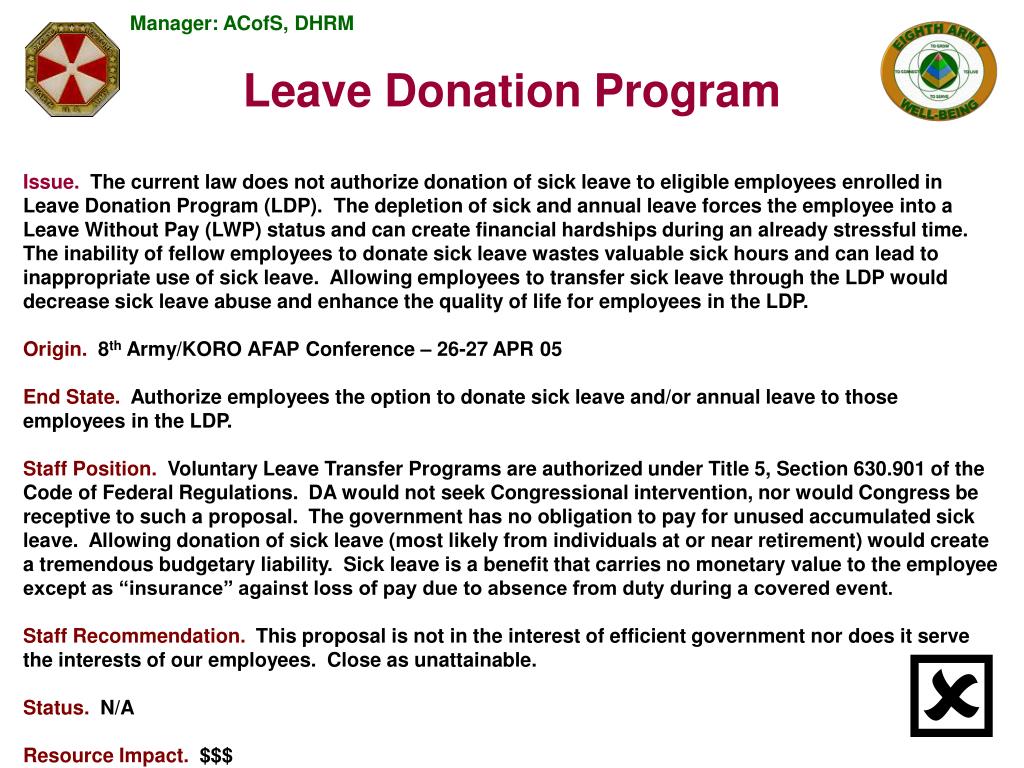

PPT VAN FLEET ROOM PowerPoint Presentation, free download ID4267648

The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other. With its latest guidance, the irs has now made clear that under leave donation programs, employees who elect to forgo. Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific.

TOP TIP Leave Donation Programs Complying with IRS Requirements

The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other. With its latest guidance, the irs has now made clear that under leave donation programs, employees who elect to forgo. Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific.

IRS approves leave donation programs for coronavirus

Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific. The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other. With its latest guidance, the irs has now made clear that under leave donation programs, employees who elect to forgo.

IRS Offers Guidance On EmployerSponsored Leave Donation Programs

Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific. With its latest guidance, the irs has now made clear that under leave donation programs, employees who elect to forgo. The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other.

IRS extends tax relief for employer leavebased donation programs that

With its latest guidance, the irs has now made clear that under leave donation programs, employees who elect to forgo. Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific. The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other.

IRS Extends Tax Treatment for LeaveBased Donation Programs for COVID

Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific. With its latest guidance, the irs has now made clear that under leave donation programs, employees who elect to forgo. The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other.

With Its Latest Guidance, The Irs Has Now Made Clear That Under Leave Donation Programs, Employees Who Elect To Forgo.

Pto donation programs allow employees to share accrued leave for medical emergencies or charitable causes, with specific. The internal revenue service (“irs”) has set forth guidance, stating that employees will not be taxed upon donating leave to other.