King County Property Tax Reduction Form - State law provides 2 tax benefit programs for senior citizens and persons with disabilities. Please be sure to pay your property tax bill on time even if you’ve already applied. If you are approved, you will receive a refund for any. They include property tax exemptions and property. We recommend applying online for faster. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Click here to apply online, or apply by mail, download 2025 paper application and instructions. In washington, individuals who meet certain eligibility requirements may receive a reduction of property taxes.

They include property tax exemptions and property. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. Please be sure to pay your property tax bill on time even if you’ve already applied. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Click here to apply online, or apply by mail, download 2025 paper application and instructions. We recommend applying online for faster. If you are approved, you will receive a refund for any. In washington, individuals who meet certain eligibility requirements may receive a reduction of property taxes.

Click here to apply online, or apply by mail, download 2025 paper application and instructions. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. If you are approved, you will receive a refund for any. They include property tax exemptions and property. We recommend applying online for faster. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. In washington, individuals who meet certain eligibility requirements may receive a reduction of property taxes. Please be sure to pay your property tax bill on time even if you’ve already applied.

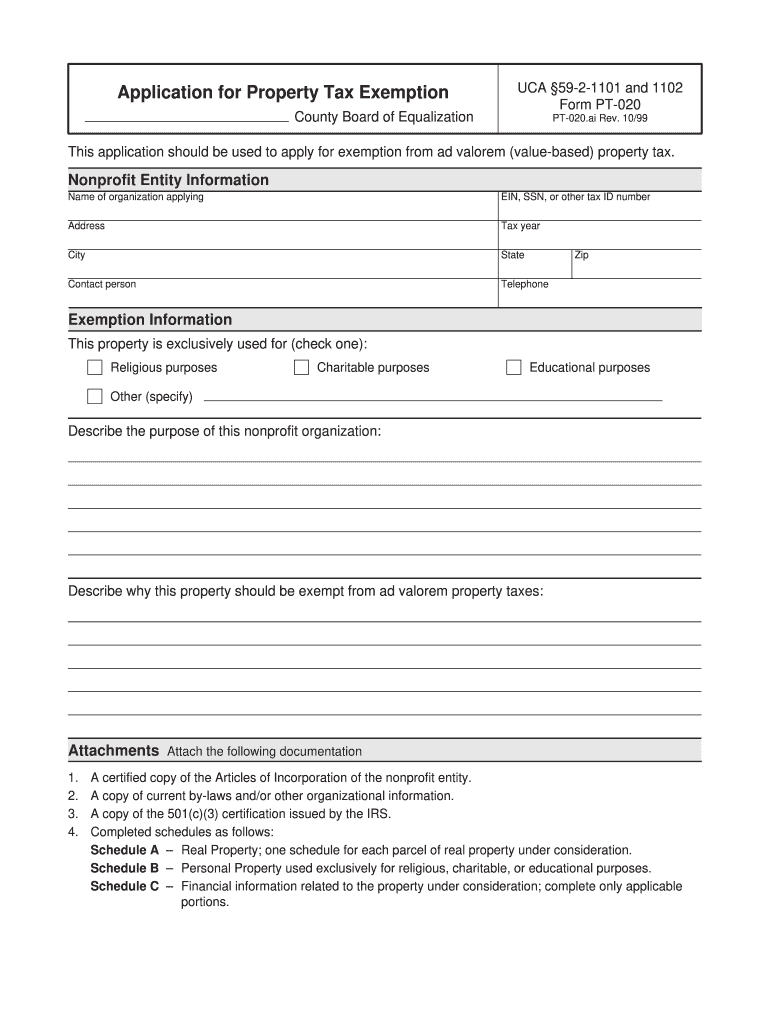

King County Property Tax Exemption 2025 Stephen E. Stanley

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. They include property tax exemptions and property. If you are approved, you will receive a refund for any. We recommend applying online for faster.

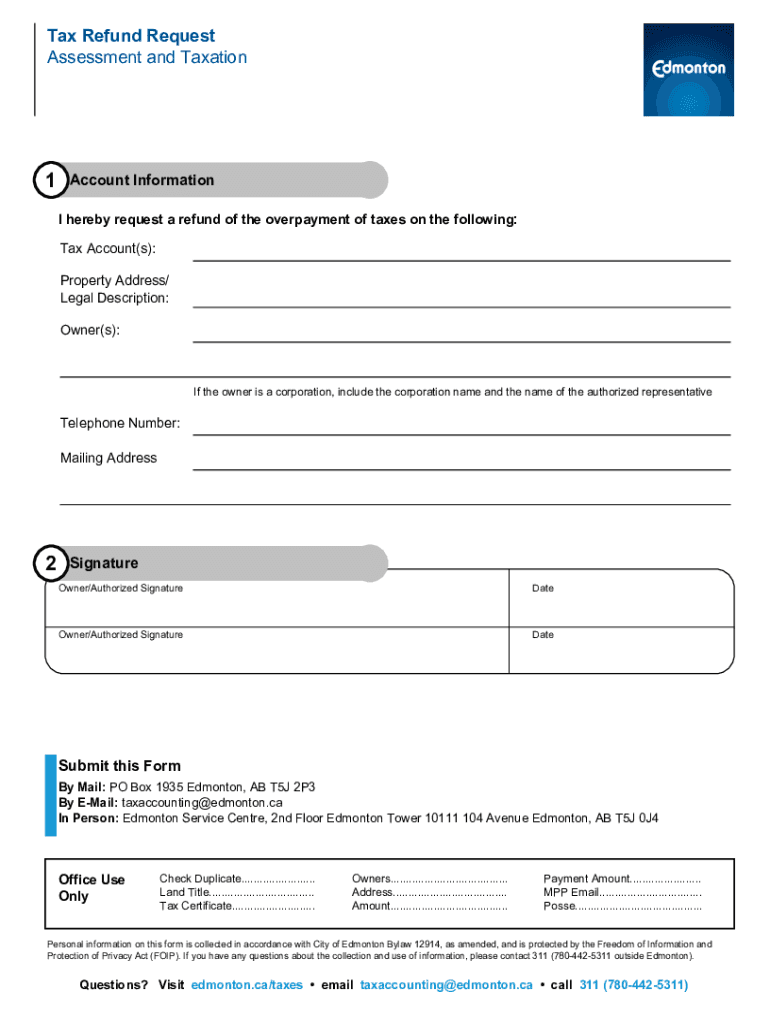

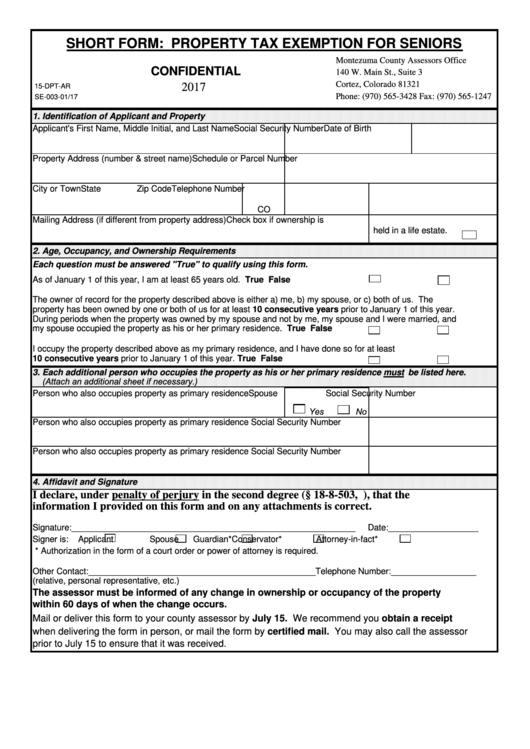

Fillable Online Property Tax Refund Request Form. Property Tax Refund

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. If you are approved, you will receive a refund for any. Please be sure to pay your property tax bill on time even if you’ve already applied. Click here to apply online, or apply by mail, download 2025.

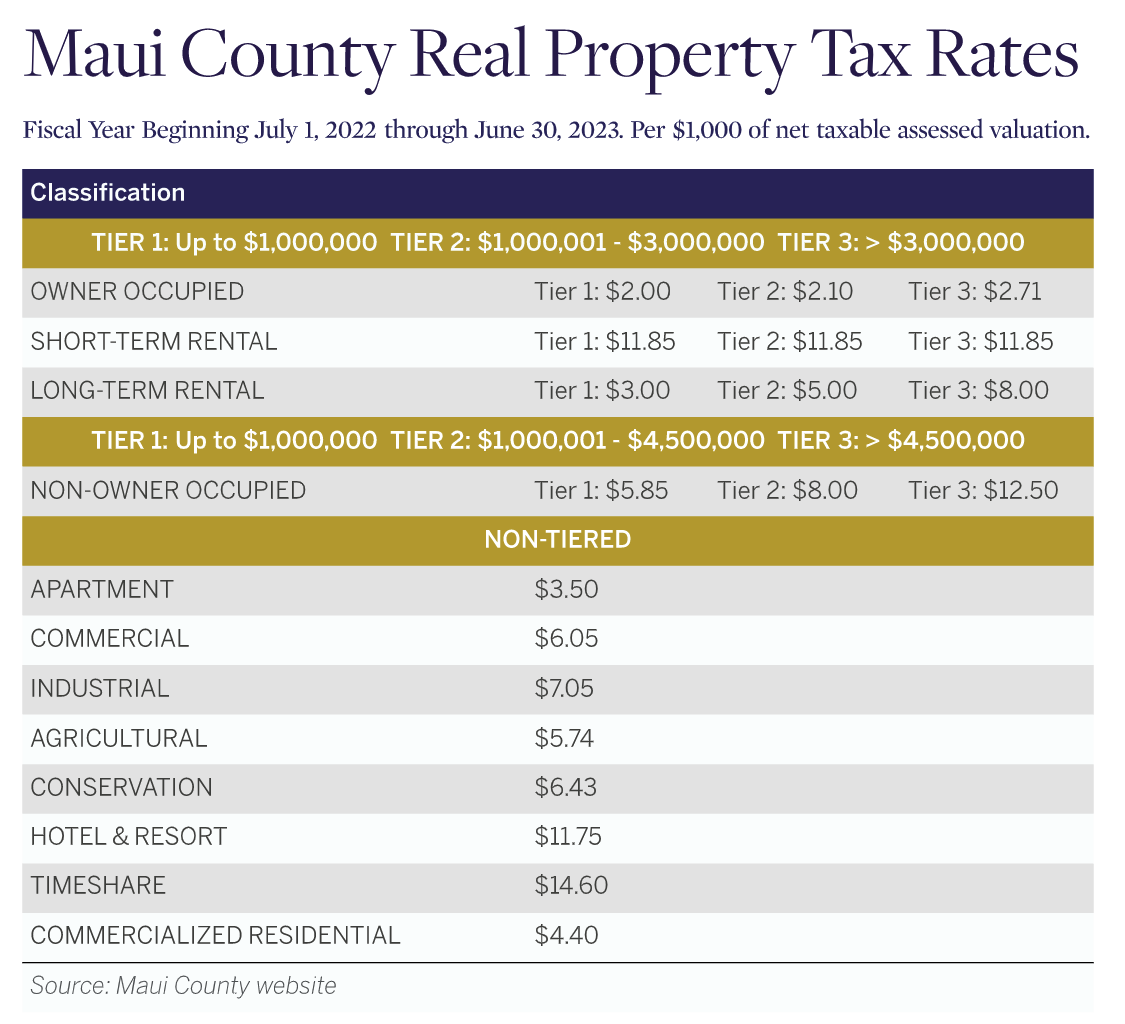

Senior & Disability Property Tax Discounts Qualification & Deadline

Please be sure to pay your property tax bill on time even if you’ve already applied. If you are approved, you will receive a refund for any. They include property tax exemptions and property. Click here to apply online, or apply by mail, download 2025 paper application and instructions. State law provides 2 tax benefit programs for senior citizens and.

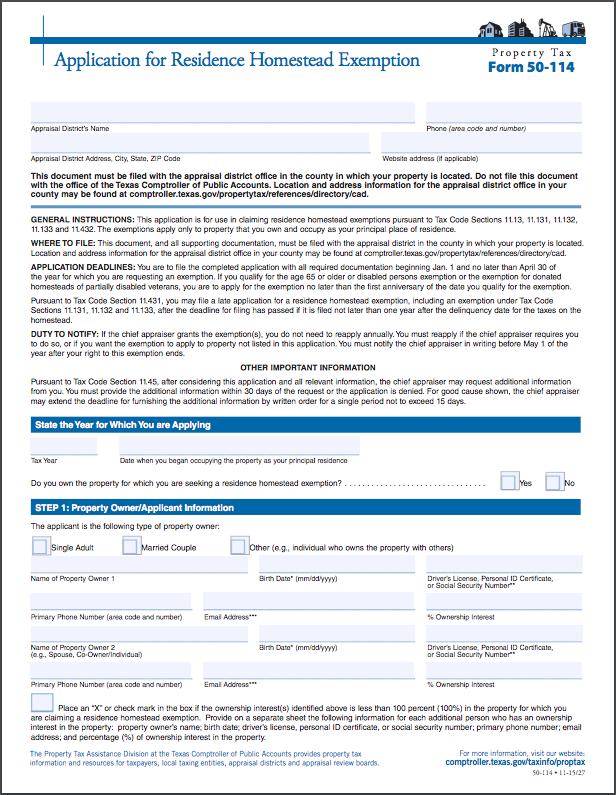

Tax relief form Fill out & sign online DocHub

If you are approved, you will receive a refund for any. Click here to apply online, or apply by mail, download 2025 paper application and instructions. We recommend applying online for faster. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. In washington, individuals who meet certain eligibility requirements may receive a reduction of property.

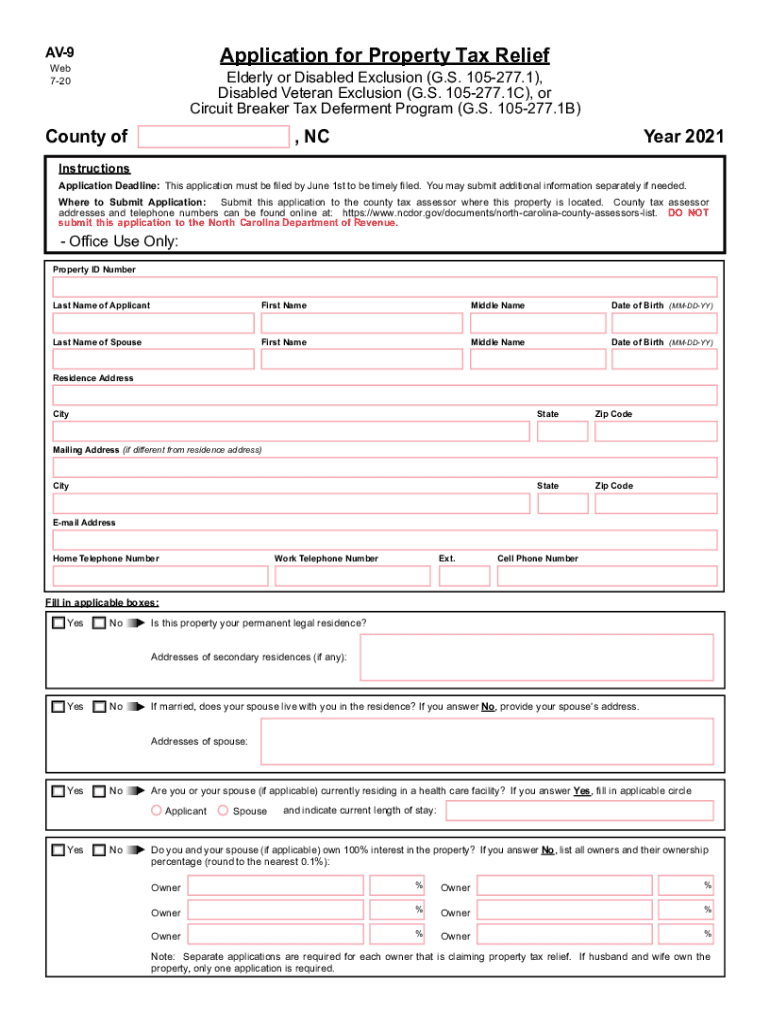

Fillable Online Property Tax Relief Form Fax Email Print pdfFiller

State law provides 2 tax benefit programs for senior citizens and persons with disabilities. In washington, individuals who meet certain eligibility requirements may receive a reduction of property taxes. They include property tax exemptions and property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Click here.

King County Senior Property Tax Exemption 2025 Karen K. Ater

They include property tax exemptions and property. Please be sure to pay your property tax bill on time even if you’ve already applied. Click here to apply online, or apply by mail, download 2025 paper application and instructions. We recommend applying online for faster. If you are approved, you will receive a refund for any.

King County Senior Property Tax Exemption 2025 Britt L. Yokley

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Click here to apply online, or apply by mail, download 2025 paper application and instructions. If you are approved, you will receive a refund for any. In washington, individuals who meet certain eligibility requirements may receive a reduction.

Senior Discount Property Tax King County at Ida Barrera blog

They include property tax exemptions and property. Please be sure to pay your property tax bill on time even if you’ve already applied. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Click here to apply online, or apply by mail, download 2025 paper application and instructions..

King County Senior Property Tax Exemption 2024 Vina Aloisia

Click here to apply online, or apply by mail, download 2025 paper application and instructions. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. In washington, individuals who meet certain eligibility requirements may receive a reduction of property taxes. They include property tax exemptions and property. Please.

Property Tax King 2025

In washington, individuals who meet certain eligibility requirements may receive a reduction of property taxes. They include property tax exemptions and property. We recommend applying online for faster. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. If you are approved, you will receive a refund for any.

They Include Property Tax Exemptions And Property.

Please be sure to pay your property tax bill on time even if you’ve already applied. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. If you are approved, you will receive a refund for any. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or.

We Recommend Applying Online For Faster.

Click here to apply online, or apply by mail, download 2025 paper application and instructions. In washington, individuals who meet certain eligibility requirements may receive a reduction of property taxes.