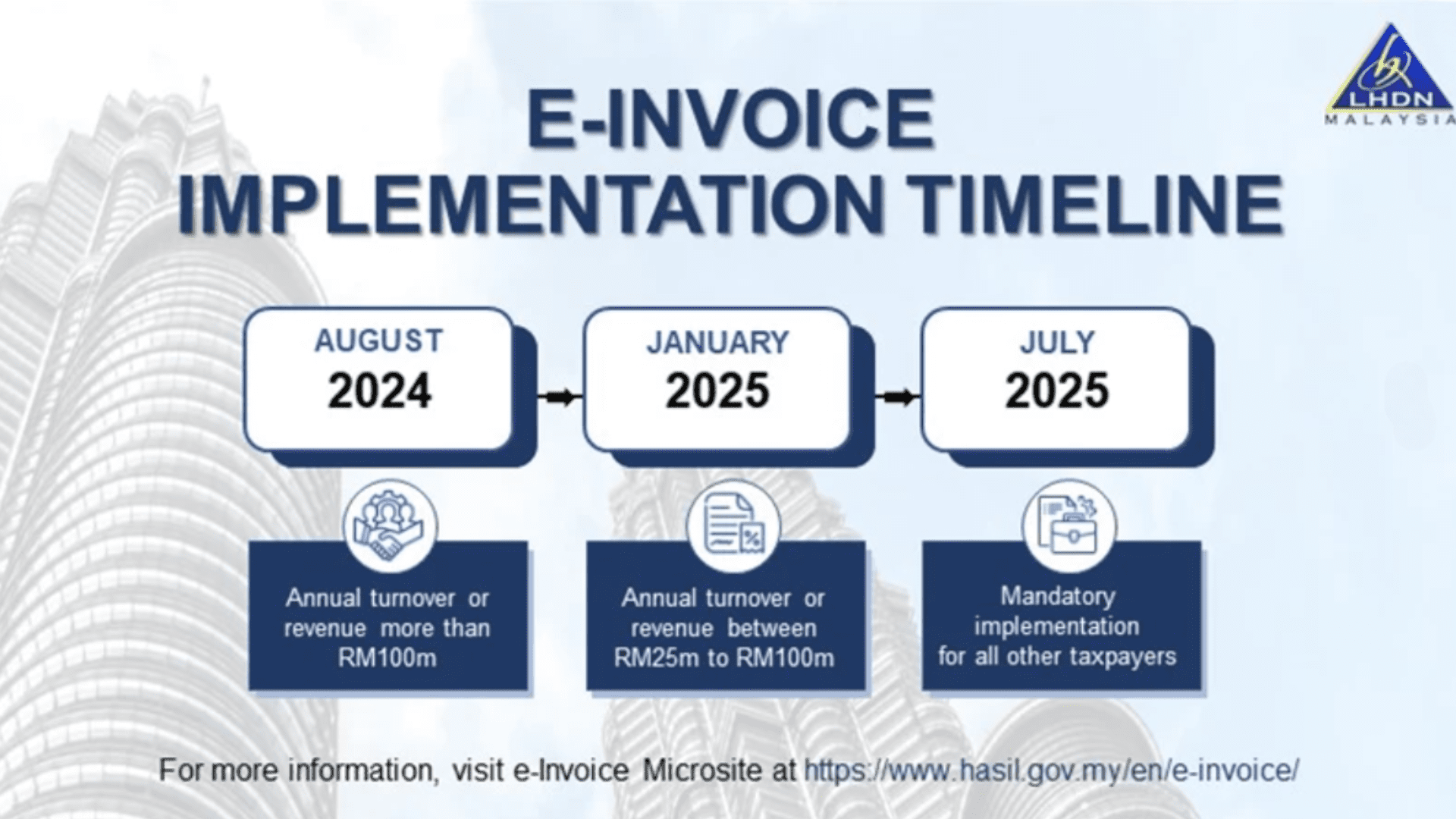

E Invoicing Malaysia Implementation Date - Lhdn has introduced a phased implementation plan based on annual. This guide explains the phased implementation timeline, starting august 2024. For new businesses or operations commencing from 2023 to 2025 with an annual turnover or revenue of at least rm500,000, the. Annual sales between rm150k to rm500k, the implementation date will be postponed to 1st january 2026. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

Lhdn has introduced a phased implementation plan based on annual. For new businesses or operations commencing from 2023 to 2025 with an annual turnover or revenue of at least rm500,000, the. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Annual sales between rm150k to rm500k, the implementation date will be postponed to 1st january 2026. This guide explains the phased implementation timeline, starting august 2024.

Lhdn has introduced a phased implementation plan based on annual. For new businesses or operations commencing from 2023 to 2025 with an annual turnover or revenue of at least rm500,000, the. This guide explains the phased implementation timeline, starting august 2024. Annual sales between rm150k to rm500k, the implementation date will be postponed to 1st january 2026. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

Navigating EInvoice Regulations IRB Malaysia's 2023 Guidelines

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. For new businesses or operations commencing from 2023 to 2025 with an annual turnover or revenue of at least rm500,000, the. Lhdn has introduced a phased implementation plan based on annual. Annual sales between rm150k to rm500k, the implementation date will.

National EInvoicing Initiative My Software Solutions

This guide explains the phased implementation timeline, starting august 2024. For new businesses or operations commencing from 2023 to 2025 with an annual turnover or revenue of at least rm500,000, the. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Annual sales between rm150k to rm500k, the implementation date will.

2024 LHDN EInvoicing Malaysia How it impact your business

This guide explains the phased implementation timeline, starting august 2024. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. For new businesses or operations commencing from 2023 to 2025 with an annual turnover or revenue of at least rm500,000, the. Lhdn has introduced a phased implementation plan based on annual..

Pelaksanaan eInvois di Malaysia Apa maksudnya

Lhdn has introduced a phased implementation plan based on annual. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. For new businesses or operations commencing from 2023 to 2025 with an annual turnover or revenue of at least rm500,000, the. Annual sales between rm150k to rm500k, the implementation date will.

Implementation of EInvoicing Malaysia IVAOTR

This guide explains the phased implementation timeline, starting august 2024. For new businesses or operations commencing from 2023 to 2025 with an annual turnover or revenue of at least rm500,000, the. Lhdn has introduced a phased implementation plan based on annual. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026..

National EInvoicing MDEC

Lhdn has introduced a phased implementation plan based on annual. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Annual sales between rm150k to rm500k, the implementation date will be postponed to 1st january 2026. This guide explains the phased implementation timeline, starting august 2024. For new businesses or operations.

Adapting to EInvoicing A New Era for Malaysian Businesses SiteGiant

This guide explains the phased implementation timeline, starting august 2024. Lhdn has introduced a phased implementation plan based on annual. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. For new businesses or operations commencing from 2023 to 2025 with an annual turnover or revenue of at least rm500,000, the..

Malaysia E Invoicing 2024 Magda Roselle

Lhdn has introduced a phased implementation plan based on annual. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. For new businesses or operations commencing from 2023 to 2025 with an annual turnover or revenue of at least rm500,000, the. This guide explains the phased implementation timeline, starting august 2024..

Malaysia LHDN eInvoice Guidelines 50 QnA L & Co Accountants

Lhdn has introduced a phased implementation plan based on annual. Annual sales between rm150k to rm500k, the implementation date will be postponed to 1st january 2026. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. This guide explains the phased implementation timeline, starting august 2024. For new businesses or operations.

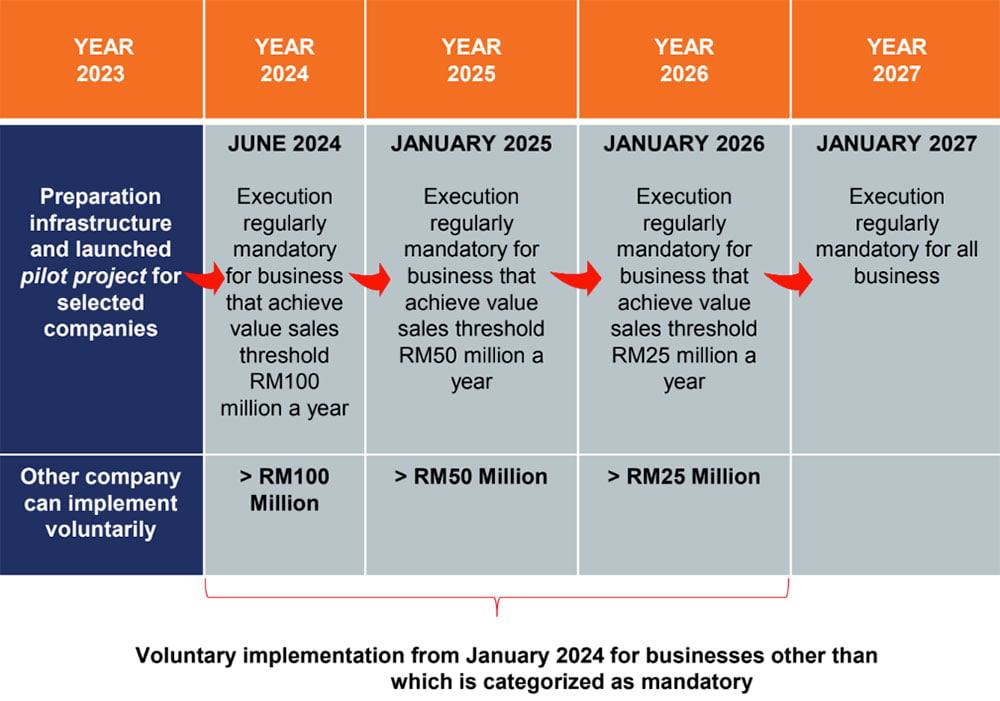

Mandatory eInvoicing System Starting From June 2024 ShineWing TY TEOH

Annual sales between rm150k to rm500k, the implementation date will be postponed to 1st january 2026. This guide explains the phased implementation timeline, starting august 2024. Lhdn has introduced a phased implementation plan based on annual. For new businesses or operations commencing from 2023 to 2025 with an annual turnover or revenue of at least rm500,000, the. Implementation for those.

Annual Sales Between Rm150K To Rm500K, The Implementation Date Will Be Postponed To 1St January 2026.

For new businesses or operations commencing from 2023 to 2025 with an annual turnover or revenue of at least rm500,000, the. This guide explains the phased implementation timeline, starting august 2024. Lhdn has introduced a phased implementation plan based on annual. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.