Calculate Irr With Irregular Cash Flows - This calculator can calculate the internal rate of return (irr) for scenarios involving a fixed recurring cash flow, no cash flow, or irregular. On this page is an irregular internal rate of return calculator, usually known as an xirr calculator. Calculate the future value (fv) of all positive cash flows using reinvestment rate, and calculate the present value (pv) of all negative. Enter a series of dates where cash flows move. Select cash flow frequency and enter cash outflows and inflows to obtain the annualized irr of the cash flows. If the cash flows are at.

Select cash flow frequency and enter cash outflows and inflows to obtain the annualized irr of the cash flows. If the cash flows are at. Calculate the future value (fv) of all positive cash flows using reinvestment rate, and calculate the present value (pv) of all negative. Enter a series of dates where cash flows move. On this page is an irregular internal rate of return calculator, usually known as an xirr calculator. This calculator can calculate the internal rate of return (irr) for scenarios involving a fixed recurring cash flow, no cash flow, or irregular.

If the cash flows are at. Select cash flow frequency and enter cash outflows and inflows to obtain the annualized irr of the cash flows. This calculator can calculate the internal rate of return (irr) for scenarios involving a fixed recurring cash flow, no cash flow, or irregular. Calculate the future value (fv) of all positive cash flows using reinvestment rate, and calculate the present value (pv) of all negative. Enter a series of dates where cash flows move. On this page is an irregular internal rate of return calculator, usually known as an xirr calculator.

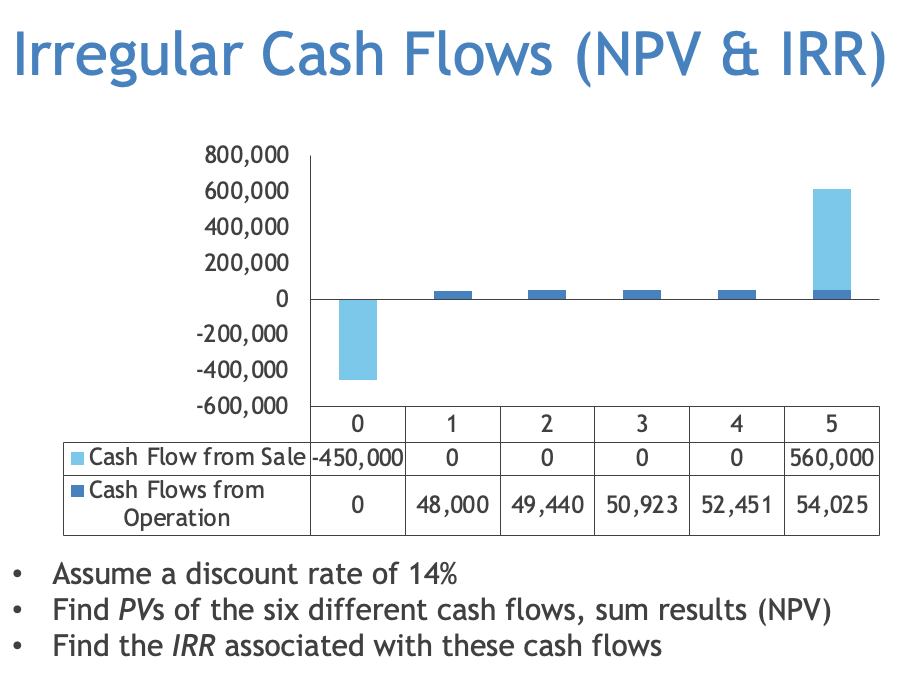

Solved Irregular Cash Flows (NPV & IRR)Assume a discount

Select cash flow frequency and enter cash outflows and inflows to obtain the annualized irr of the cash flows. Calculate the future value (fv) of all positive cash flows using reinvestment rate, and calculate the present value (pv) of all negative. Enter a series of dates where cash flows move. This calculator can calculate the internal rate of return (irr).

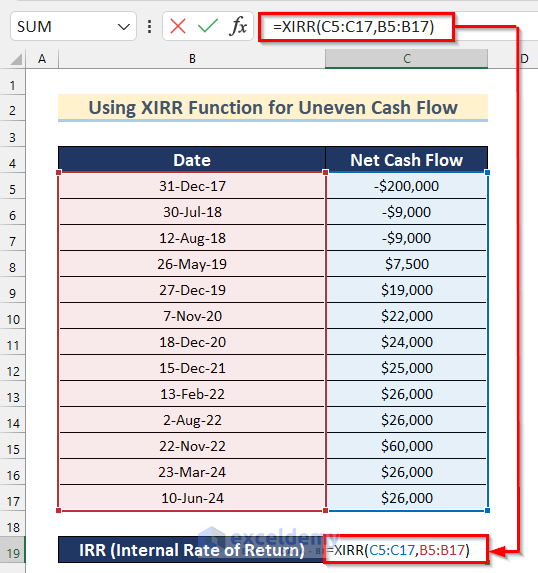

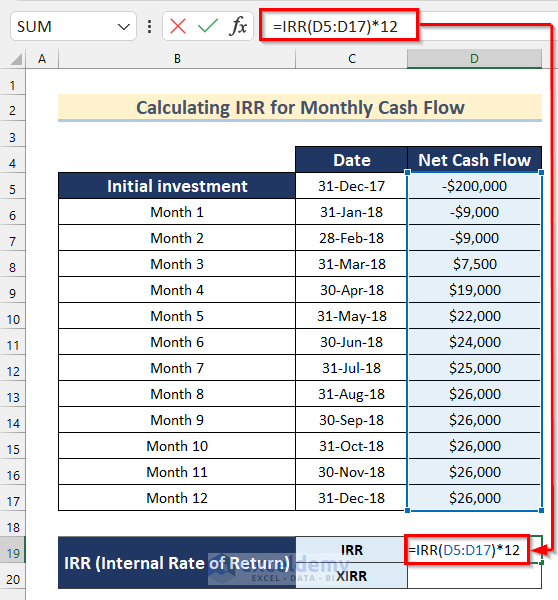

How to Calculate IRR (Internal Rate of Return) in Excel (8 Ways)

Calculate the future value (fv) of all positive cash flows using reinvestment rate, and calculate the present value (pv) of all negative. On this page is an irregular internal rate of return calculator, usually known as an xirr calculator. This calculator can calculate the internal rate of return (irr) for scenarios involving a fixed recurring cash flow, no cash flow,.

CAPITAL BUDGETING DECISIONS ppt video online download

Select cash flow frequency and enter cash outflows and inflows to obtain the annualized irr of the cash flows. On this page is an irregular internal rate of return calculator, usually known as an xirr calculator. If the cash flows are at. Enter a series of dates where cash flows move. This calculator can calculate the internal rate of return.

The Ultimate Guide To Calculating IRR Using A Financial Calculator

On this page is an irregular internal rate of return calculator, usually known as an xirr calculator. If the cash flows are at. Select cash flow frequency and enter cash outflows and inflows to obtain the annualized irr of the cash flows. Enter a series of dates where cash flows move. This calculator can calculate the internal rate of return.

Plantilla Excel Calculadora Irr

Enter a series of dates where cash flows move. If the cash flows are at. On this page is an irregular internal rate of return calculator, usually known as an xirr calculator. Select cash flow frequency and enter cash outflows and inflows to obtain the annualized irr of the cash flows. Calculate the future value (fv) of all positive cash.

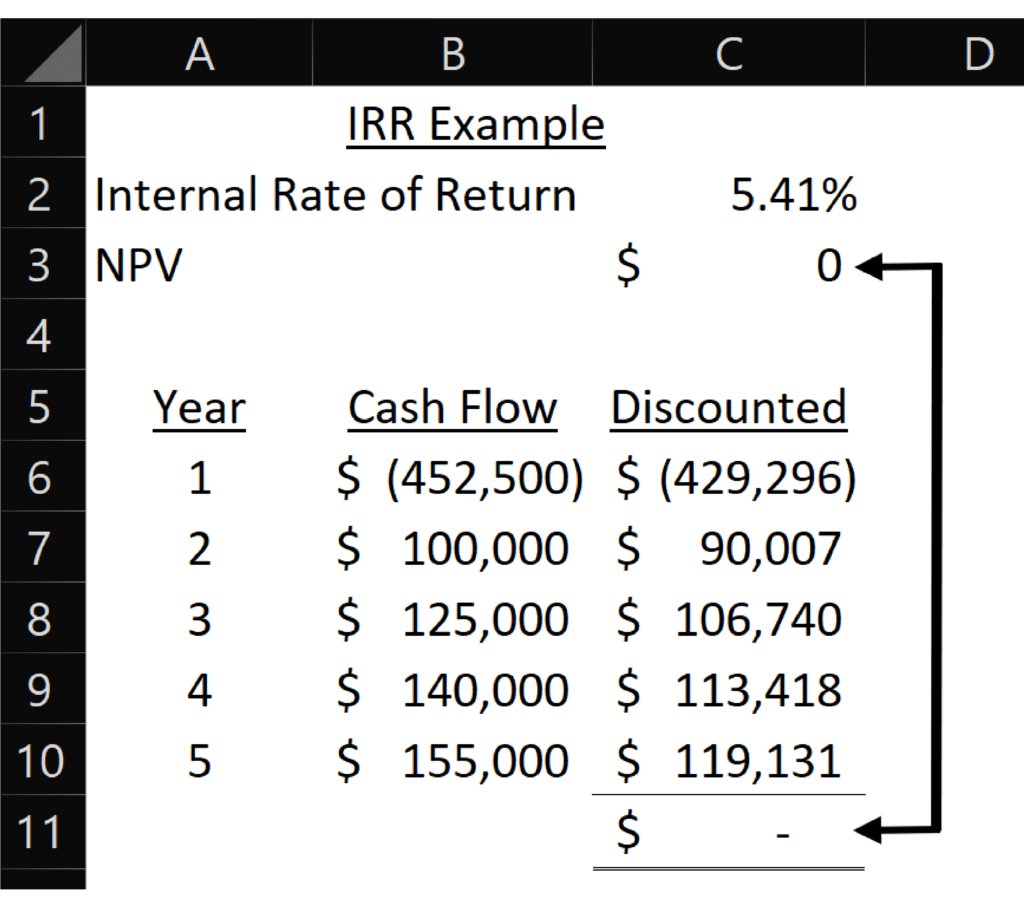

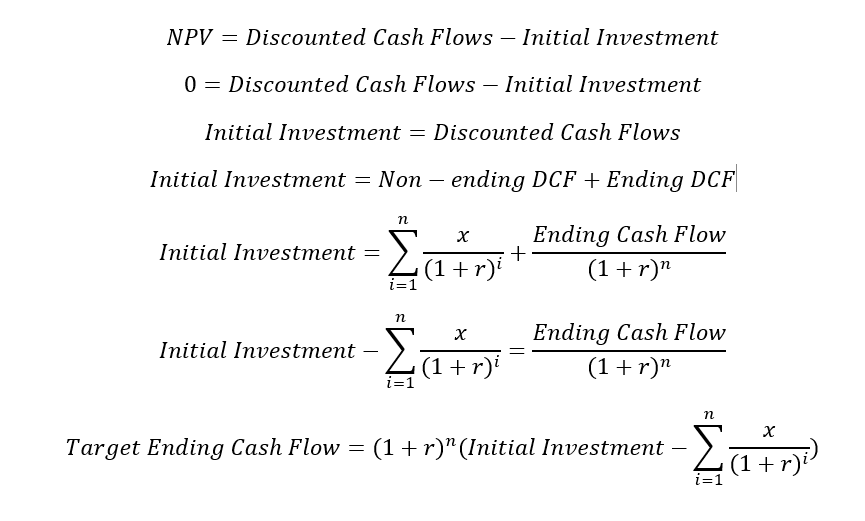

Back into IRR with uneven cash flows, not using goal seek? Wall

If the cash flows are at. Calculate the future value (fv) of all positive cash flows using reinvestment rate, and calculate the present value (pv) of all negative. On this page is an irregular internal rate of return calculator, usually known as an xirr calculator. Select cash flow frequency and enter cash outflows and inflows to obtain the annualized irr.

How to Calculate IRR (Internal Rate of Return) in Excel (8 Ways)

Enter a series of dates where cash flows move. This calculator can calculate the internal rate of return (irr) for scenarios involving a fixed recurring cash flow, no cash flow, or irregular. On this page is an irregular internal rate of return calculator, usually known as an xirr calculator. If the cash flows are at. Select cash flow frequency and.

How to Calculate IRR in Excel for Monthly Cash Flow (4 Ways)

On this page is an irregular internal rate of return calculator, usually known as an xirr calculator. Calculate the future value (fv) of all positive cash flows using reinvestment rate, and calculate the present value (pv) of all negative. Enter a series of dates where cash flows move. This calculator can calculate the internal rate of return (irr) for scenarios.

Mastering IRR Excel Functions How to Calculate the Internal Rate of

Select cash flow frequency and enter cash outflows and inflows to obtain the annualized irr of the cash flows. Calculate the future value (fv) of all positive cash flows using reinvestment rate, and calculate the present value (pv) of all negative. If the cash flows are at. Enter a series of dates where cash flows move. This calculator can calculate.

Chapter 9 The Time Value of Money. ppt download

If the cash flows are at. Calculate the future value (fv) of all positive cash flows using reinvestment rate, and calculate the present value (pv) of all negative. Select cash flow frequency and enter cash outflows and inflows to obtain the annualized irr of the cash flows. On this page is an irregular internal rate of return calculator, usually known.

This Calculator Can Calculate The Internal Rate Of Return (Irr) For Scenarios Involving A Fixed Recurring Cash Flow, No Cash Flow, Or Irregular.

Enter a series of dates where cash flows move. If the cash flows are at. On this page is an irregular internal rate of return calculator, usually known as an xirr calculator. Calculate the future value (fv) of all positive cash flows using reinvestment rate, and calculate the present value (pv) of all negative.

+with+uneven+cash+flows.jpg)