Aggrg Deduction In Salary Slip - Total income wage type (/434) = gross. It contains a detailed summary of an. It means that all wage type is regular taxable income. A salary slip or payslip is a document issued monthly by an employer to its employees. For a employee agg of chapter vi is coming wrong. 10k+ visitors in the past month 10k+ visitors in the past month Salary packages or ctcs for employees include various allowances and perquisites; I have check it0585 = no data is there and in it0586= 97,554 in proposed. Each allowance and perquisite is.

Each allowance and perquisite is. A salary slip or payslip is a document issued monthly by an employer to its employees. Total income wage type (/434) = gross. It contains a detailed summary of an. Generally shift allowance and overtime is irregular taxable income. Salary packages or ctcs for employees include various allowances and perquisites; I have check it0585 = no data is there and in it0586= 97,554 in proposed. It means that all wage type is regular taxable income. 10k+ visitors in the past month For a employee agg of chapter vi is coming wrong.

For a employee agg of chapter vi is coming wrong. Generally shift allowance and overtime is irregular taxable income. A salary slip or payslip is a document issued monthly by an employer to its employees. It means that all wage type is regular taxable income. I have check it0585 = no data is there and in it0586= 97,554 in proposed. 10k+ visitors in the past month Total income wage type (/434) = gross. 10k+ visitors in the past month It contains a detailed summary of an. Salary packages or ctcs for employees include various allowances and perquisites;

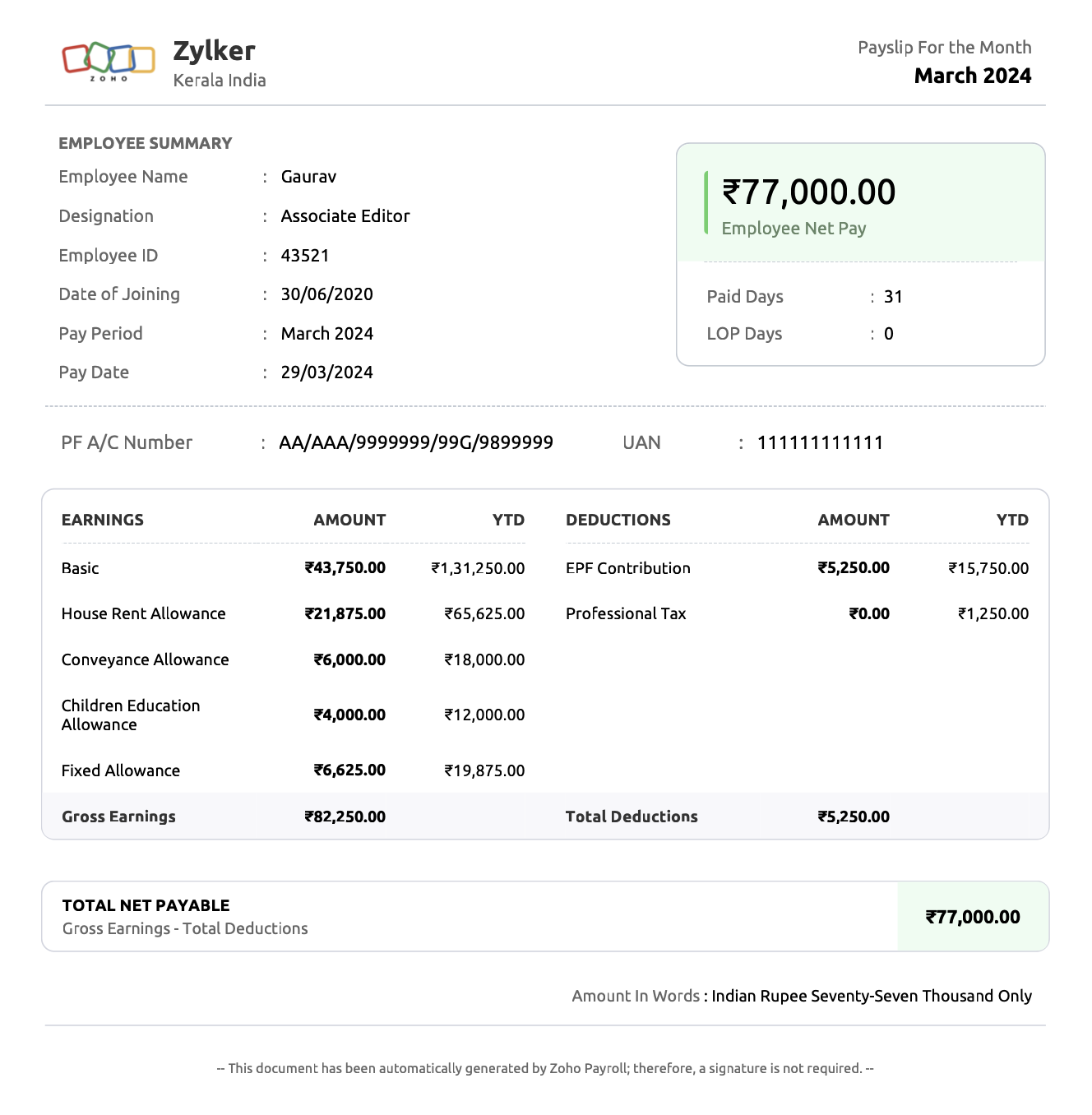

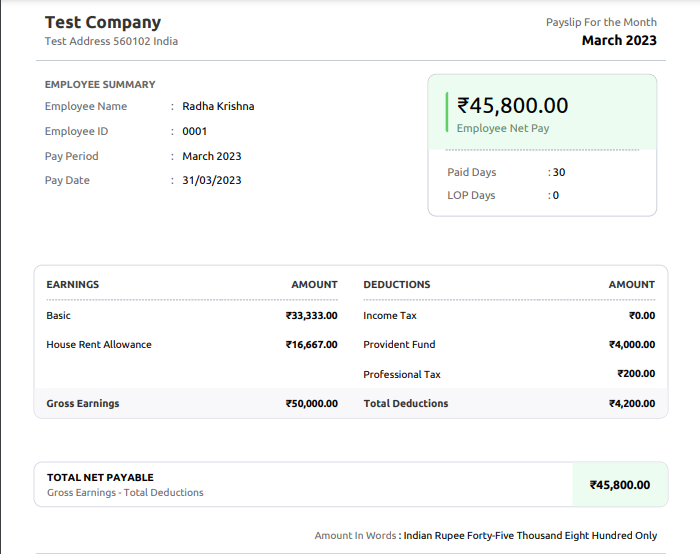

Analysis of Salary slip

Salary packages or ctcs for employees include various allowances and perquisites; Generally shift allowance and overtime is irregular taxable income. It means that all wage type is regular taxable income. I have check it0585 = no data is there and in it0586= 97,554 in proposed. Total income wage type (/434) = gross.

What is salary slip or payslip? Format & components Zoho Payroll

For a employee agg of chapter vi is coming wrong. Salary packages or ctcs for employees include various allowances and perquisites; Total income wage type (/434) = gross. Each allowance and perquisite is. Generally shift allowance and overtime is irregular taxable income.

Employee Salary Slip What is Earnings & Deductions?

I have check it0585 = no data is there and in it0586= 97,554 in proposed. As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. It contains a detailed summary of an. A salary slip or payslip is a document issued monthly by an employer to its employees. Generally shift allowance.

Salary Slip PDF Tax Deduction Taxes

10k+ visitors in the past month A salary slip or payslip is a document issued monthly by an employer to its employees. Salary packages or ctcs for employees include various allowances and perquisites; Total income wage type (/434) = gross. I have check it0585 = no data is there and in it0586= 97,554 in proposed.

What is Salary Slip Components of Salary Slip, Format & Payslip Breakdown

I have check it0585 = no data is there and in it0586= 97,554 in proposed. Salary packages or ctcs for employees include various allowances and perquisites; Each allowance and perquisite is. For a employee agg of chapter vi is coming wrong. Total income wage type (/434) = gross.

Salary Slip कैसे बनायें

A salary slip or payslip is a document issued monthly by an employer to its employees. Each allowance and perquisite is. For a employee agg of chapter vi is coming wrong. Total income wage type (/434) = gross. 10k+ visitors in the past month

Salary Slip PDF Paycheck Tax Deduction

I have check it0585 = no data is there and in it0586= 97,554 in proposed. As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. It means that all wage type is regular taxable income. Each allowance and perquisite is. Total income wage type (/434) = gross.

Editable salary slip format in excel tokera

It contains a detailed summary of an. A salary slip or payslip is a document issued monthly by an employer to its employees. Salary packages or ctcs for employees include various allowances and perquisites; I have check it0585 = no data is there and in it0586= 97,554 in proposed. Total income wage type (/434) = gross.

Salary Slip Meaning, Format and Components

A salary slip or payslip is a document issued monthly by an employer to its employees. Salary packages or ctcs for employees include various allowances and perquisites; For a employee agg of chapter vi is coming wrong. I have check it0585 = no data is there and in it0586= 97,554 in proposed. 10k+ visitors in the past month

Payslip Templates Excel

Salary packages or ctcs for employees include various allowances and perquisites; As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. 10k+ visitors in the past month Each allowance and perquisite is. It contains a detailed summary of an.

Each Allowance And Perquisite Is.

Salary packages or ctcs for employees include various allowances and perquisites; It contains a detailed summary of an. It means that all wage type is regular taxable income. For a employee agg of chapter vi is coming wrong.

A Salary Slip Or Payslip Is A Document Issued Monthly By An Employer To Its Employees.

I have check it0585 = no data is there and in it0586= 97,554 in proposed. 10k+ visitors in the past month Total income wage type (/434) = gross. As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00.

10K+ Visitors In The Past Month

Generally shift allowance and overtime is irregular taxable income.