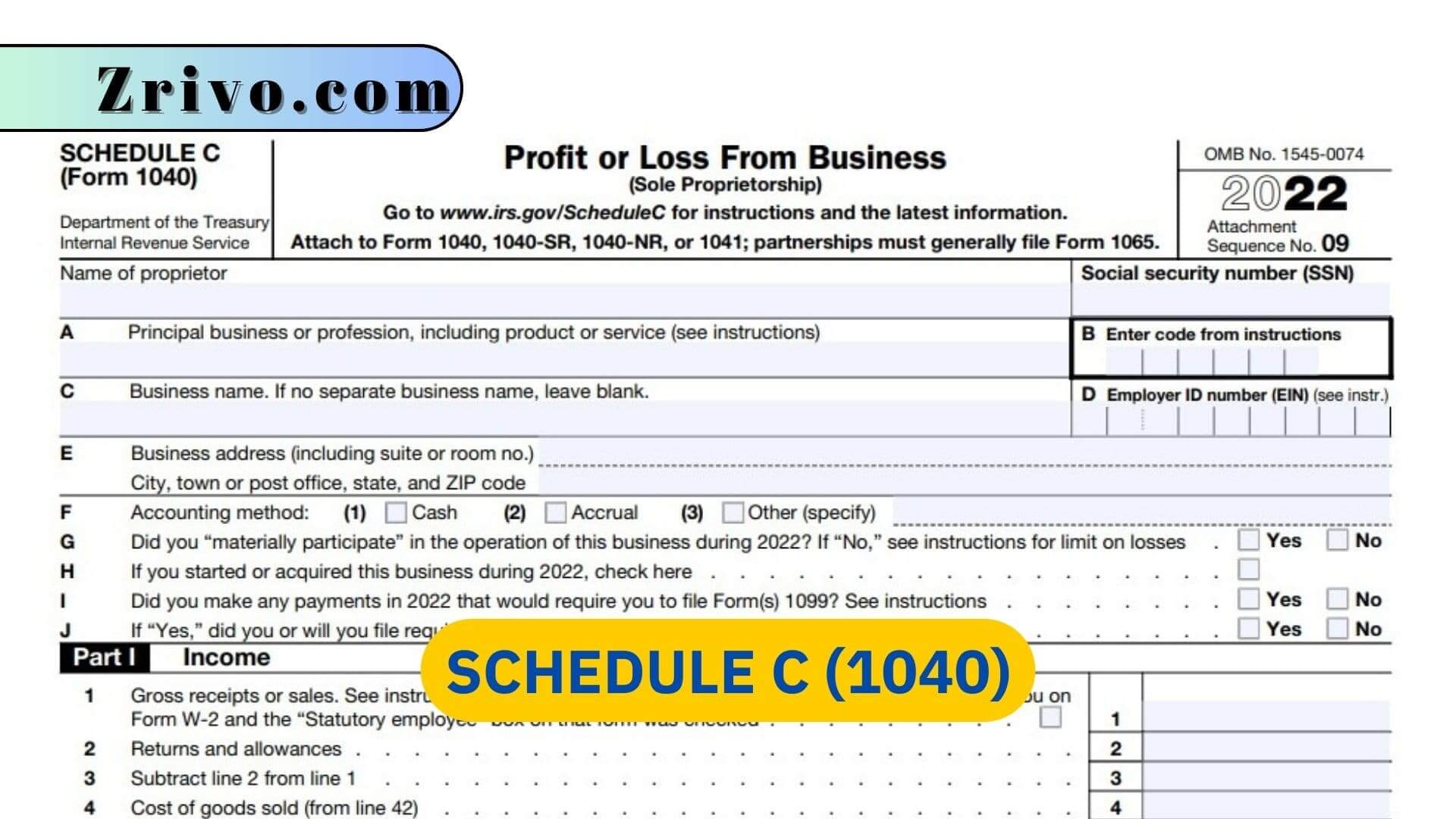

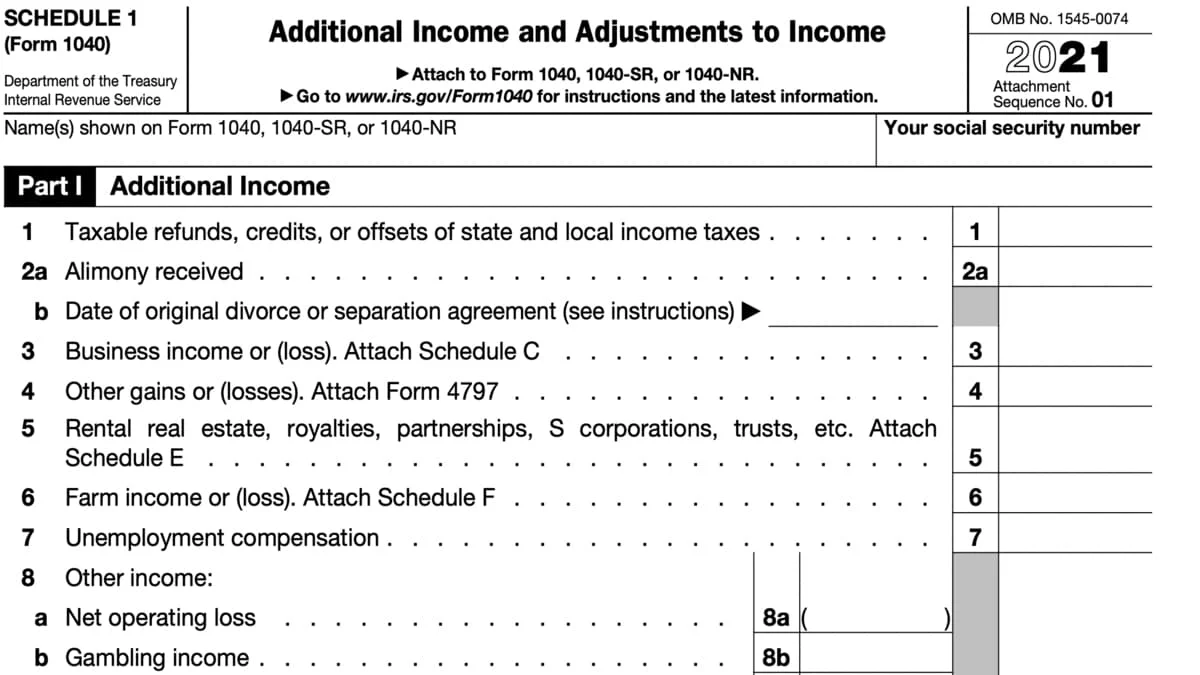

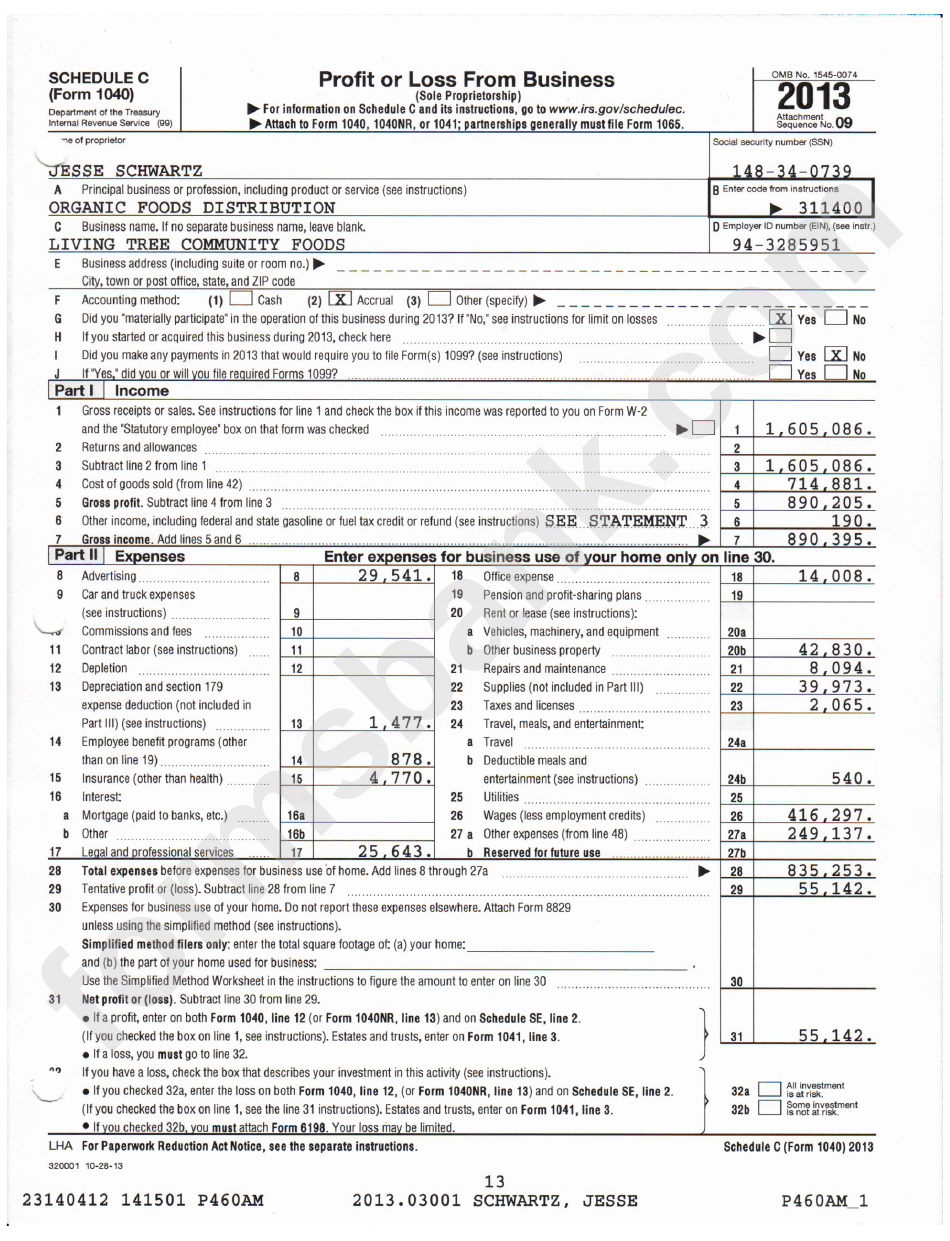

2023 1040 Schedule C Fillable Form - (dueño único de un negocio) adjunte al. 127 rows review a list of current tax year free file fillable forms and their limitations. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. If no separate business name, leave blank. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps.

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. 127 rows review a list of current tax year free file fillable forms and their limitations. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. If no separate business name, leave blank. (dueño único de un negocio) adjunte al. This essential form also helps.

Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. (dueño único de un negocio) adjunte al. If no separate business name, leave blank. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. 127 rows review a list of current tax year free file fillable forms and their limitations.

Schedule C (Form 1040) 2023 Instructions

This essential form also helps. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. 127 rows review a list of current tax year free file fillable forms.

Schedule C (1040) 2023 2024

Go to www.irs.gov/schedulec for instructions and the latest information. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. If no separate business name, leave blank. This essential form also helps.

Printable Schedule C 2023

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. Schedule c (form 1040) is used to report income or.

Irs 2024 Form 1040 Schedule C Tasha Fredelia

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. This essential form also helps. (dueño único de un negocio) adjunte al. If no separate business name, leave blank.

Download Fillable Schedule C Form

Go to www.irs.gov/schedulec for instructions and the latest information. 127 rows review a list of current tax year free file fillable forms and their limitations. If no separate business name, leave blank. This essential form also helps. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

Schedule C Expenses Worksheet 2023

(dueño único de un negocio) adjunte al. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. If no separate business name, leave blank. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. Go to www.irs.gov/schedulec for instructions and the latest information.

2023 Form IRS Instructions 1040 Schedule C Fill Online, Printable

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. 127 rows review a list of current tax year free file fillable forms and their limitations. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. (dueño único.

Printable 1040 Schedule C

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. The 2023 form 1040 schedule c is.

Printable Schedule C 2023

If no separate business name, leave blank. This essential form also helps. Go to www.irs.gov/schedulec for instructions and the latest information. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. Schedule c (form 1040) is used to report income or loss from a.

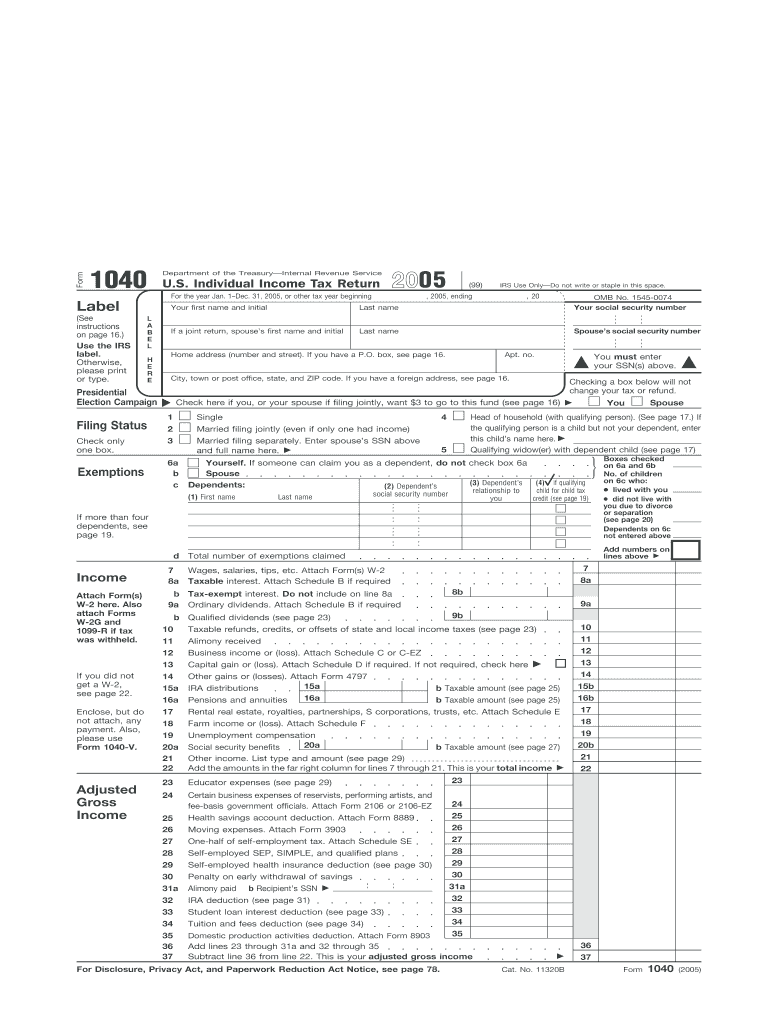

1040 form 2023 Fill out & sign online DocHub

Go to www.irs.gov/schedulec for instructions and the latest information. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Visite www.irs.gov/schedulecsp.

Schedule C (Form 1040) Is Used To Report Income Or Loss From A Business Operated As A Sole Proprietorship.

If no separate business name, leave blank. Visite www.irs.gov/schedulecsp para obtener las instrucciones y la información más reciente. This essential form also helps. Go to www.irs.gov/schedulec for instructions and the latest information.

(Dueño Único De Un Negocio) Adjunte Al.

127 rows review a list of current tax year free file fillable forms and their limitations. The 2023 form 1040 schedule c is a supplemental form used in conjunction with the form 1040 to report the profit or loss from a sole. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)